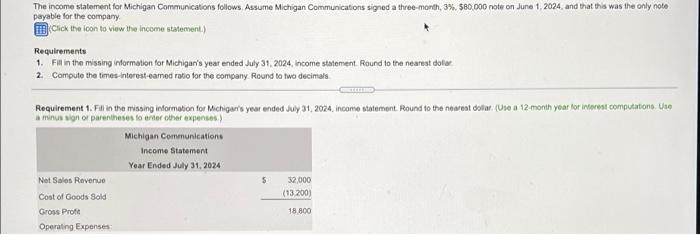

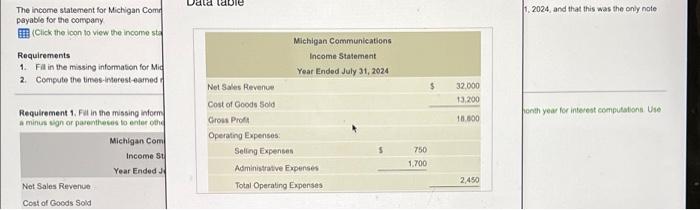

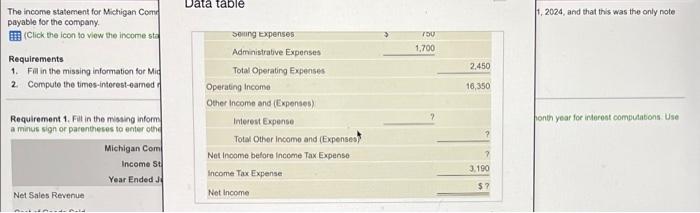

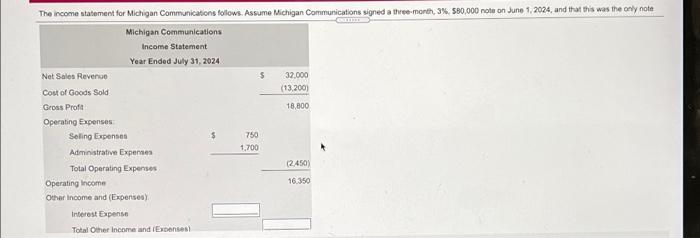

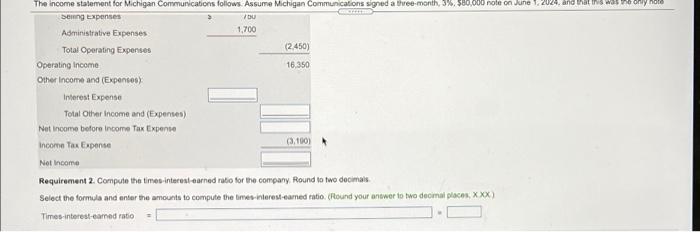

The income statement for Michigan Communications follows Assume Michigan Communications signed a three-month, 3% $80,000 note on June 1, 2024, and that this was the only note payable for the company Click the icon to view the income statement) Requirements 1. Fill in the missing information for Michigan's year ended July 31, 2024. Income statement. Round to the nearest dollar 2. Compute the times-intorest-eamed ratio for the company Round to two decimals Requirement 1. Fill in the missing information for Michigan's year ended Juy 31, 2024. Income statement Pound to the nearest dolar:/Use a 12 month year for infocat computations. Use a minus sign of parentheses tortor other expenses) Michigan Communications Income Statement Year Ended July 31, 2024 Net Sales Revenue 32.000 Cost of Goods Sold (13200) Gross Prote Operating Expenses 5 18 800 Dald labie 11.2024 and that this was the only note The income statement for Michigan Comd payable for the company Click the icon to view the income sta Requirements 1. Fill in the missing information for Mid 2 Computo the times-Interest earned $ 32.000 13,200 Michigan Communications Income Statement Year Ended July 31, 2024 Net Sales Revenue Cost of Goods Sold Grous Prof Operating Expenses Seling Expenses Administrative Expenses Total Operating Expenses onth year for interest computations Use Requirement 1. Fit in the missing inform a minus signor parentheses to enter the Michigan Com Income si Year Ended Net Sales Revenue Cost of Goods Sold 18.800 750 1.700 2,450 Data table 1.2024, and that this was the only note The income statement for Michigan Com payable for the company (Click the icon to view the income sta 70 1,700 2,450 Requirements 1. Fill in the missing information for Mid 2 Compute the times-intorest-camed 16,350 Song Expenses Administrative Expenses Total Operating Expenses Operating Income Other Income and (Expenses Interest Expense Total Other Income and (Expenses Net Income before Income Tax Expense Income Tax Expense Net Income onth year for interest computations Use Requirement 1. Fit in the missing inform a minus sign or parentheses to enter the Michigan Com Income St Year Ended Net Sales Revenue 2 2 3.190 $? The income statement for Michigan Communications follows. Assume Michigan Communications signed a three month, 3%, 580.000 note on June 1.2024, and that this was the only note Michigan Communications Income Statement Year Ended July 31, 2024 Net Sales Revenue $ 32.000 Cost of Goods Sold (13.2003 Gross Profit 18,800 Operating Expenses Seling Expenses $ 750 1,700 Administrative Expenses Total Operating Expenses (2450) Operating Income 16.350 Other Income and (Expenses Interest Expense Total Other Income and wants The income statement for Michigan Communications follows. Assume Michigan Communications signed a three month, 3%, $80,000 note on June 12029. and that was only noce Sening Expenses 00 1,700 Administrative Expenses Total Operating Expenses (2.450) Operating Income 16,350 Other Income and (Expensen Interest Expense Total Other Income and (Expenses) Not Income before Income Tax Experte Income Tax Expense 0.100) Not Income Requirement 2. Compute the times interest earned ratio for the company Round to two decimals Select the formula and enter the amounts to compute the time interest-camed ratio. (Round your answer to two deomal places, XXX Times-interest-amad ratio =