Answered step by step

Verified Expert Solution

Question

1 Approved Answer

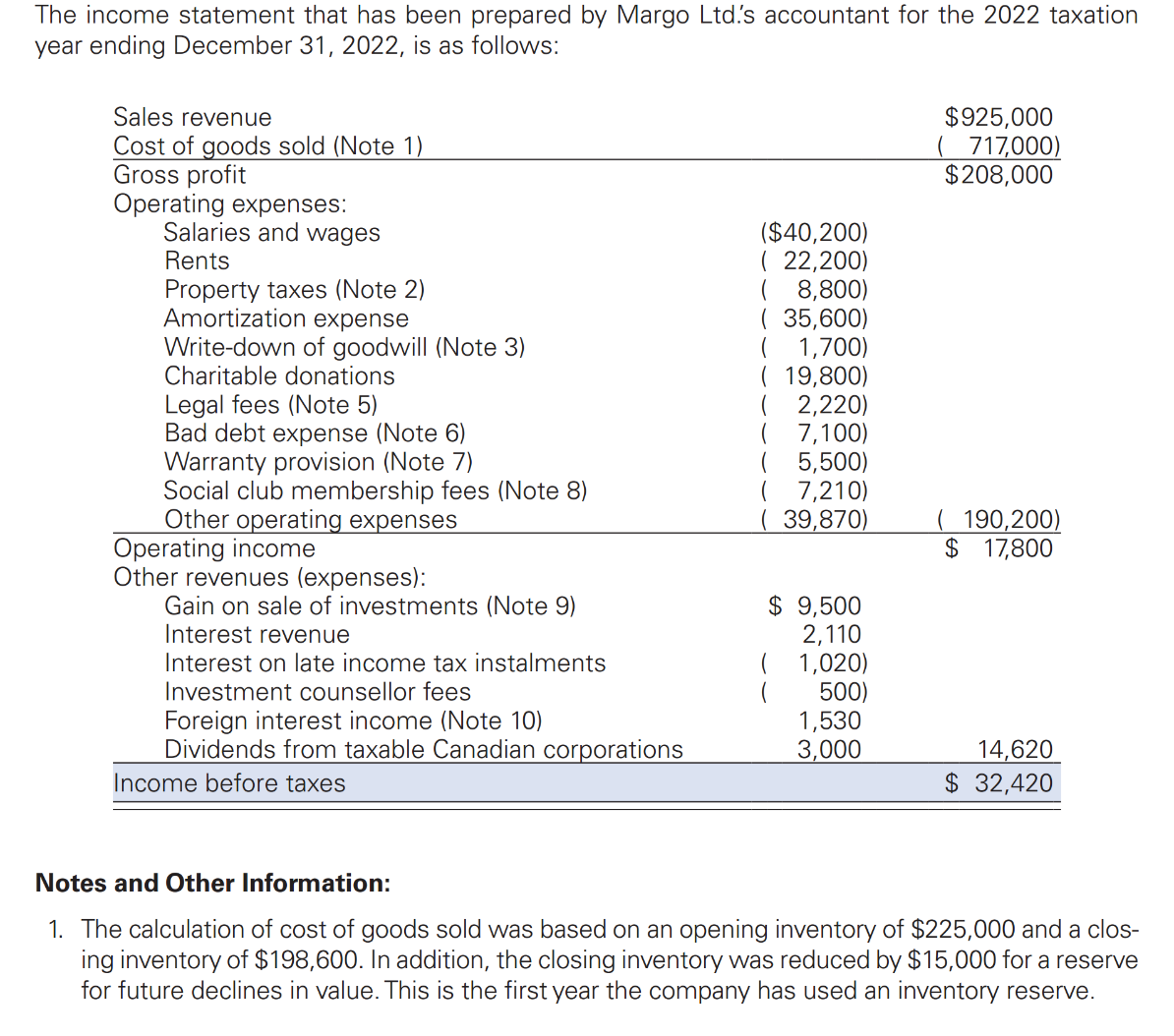

The income statement that has been prepared by Margo Ltd.'s accountant for the 2022 taxation year ending December 31, 2022, is as follows: Sales

The income statement that has been prepared by Margo Ltd.'s accountant for the 2022 taxation year ending December 31, 2022, is as follows: Sales revenue Cost of goods sold (Note 1) Gross profit Operating expenses: Salaries and wages Rents $925,000 ( 717,000) $208,000 ($40,200) ( 22,200) Property taxes (Note 2) ( 8,800) Amortization expense ( 35,600) Write-down of goodwill (Note 3) ( 1,700) Charitable donations Legal fees (Note 5) ( 19,800) ( 2,220) Bad debt expense (Note 6) ( 7,100) Warranty provision (Note 7) ( 5,500) Social club membership fees (Note 8) ( 7,210) Other operating expenses ( 39,870) Operating income ( 190,200) $ 17,800 Other revenues (expenses): Gain on sale of investments (Note 9) $ 9,500 Interest revenue 2,110 Interest on late income tax instalments ( 1,020) Investment counsellor fees 500) Foreign interest income (Note 10) Dividends from taxable Canadian corporations Income before taxes 1,530 3,000 14,620 $ 32,420 Notes and Other Information: 1. The calculation of cost of goods sold was based on an opening inventory of $225,000 and a clos- ing inventory of $198,600. In addition, the closing inventory was reduced by $15,000 for a reserve for future declines in value. This is the first year the company has used an inventory reserve.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Taxable Income Calculation for Margo Ltd Adjustments to Income Add back nondeductible expenses Socia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dcccce4074_962026.pdf

180 KBs PDF File

663dcccce4074_962026.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started