Question

The incorporators of Beta Corporation would like to make a counter offer to an angel investor. The latter is offering P4,000,000 for a 50%

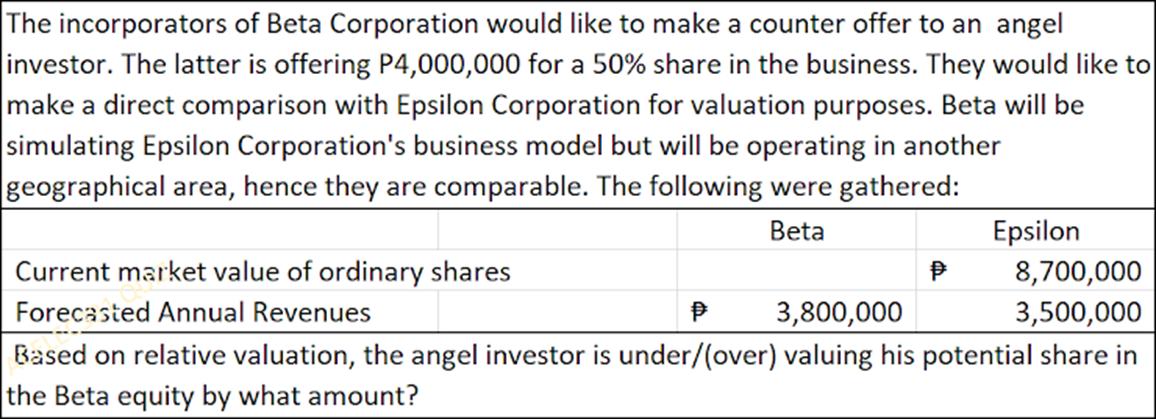

The incorporators of Beta Corporation would like to make a counter offer to an angel investor. The latter is offering P4,000,000 for a 50% share in the business. They would like to make a direct comparison with Epsilon Corporation for valuation purposes. Beta will be simulating Epsilon Corporation's business model but will be operating in another geographical area, hence they are comparable. The following were gathered: Beta Epsilon 8,700,000 3,800,000 3,500,000 Based on relative valuation, the angel investor is under/(over) valuing his potential share in the Beta equity by what amount? Current market value of ordinary shares Forecasted Annual Revenues P

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount by which the angel investor is underover valuing his potential share in Beta ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App