Question

The Indigo Company accumulates the following adjustment data at December 31. 1. Revenue of $1,342 collected in advance has been recognized. 2. Salaries of $624

The Indigo Company accumulates the following adjustment data at December 31.

1. Revenue of $1,342 collected in advance has been recognized.

2. Salaries of $624 are unpaid.

3. Prepaid rent totaling $424 has expired.

4. Supplies of $561 have been used.

5. Revenue recognized but unbilled totals $630.

6. Utility expenses of $384 are unpaid.

7. Interest of $310 has accrued on a note payable.

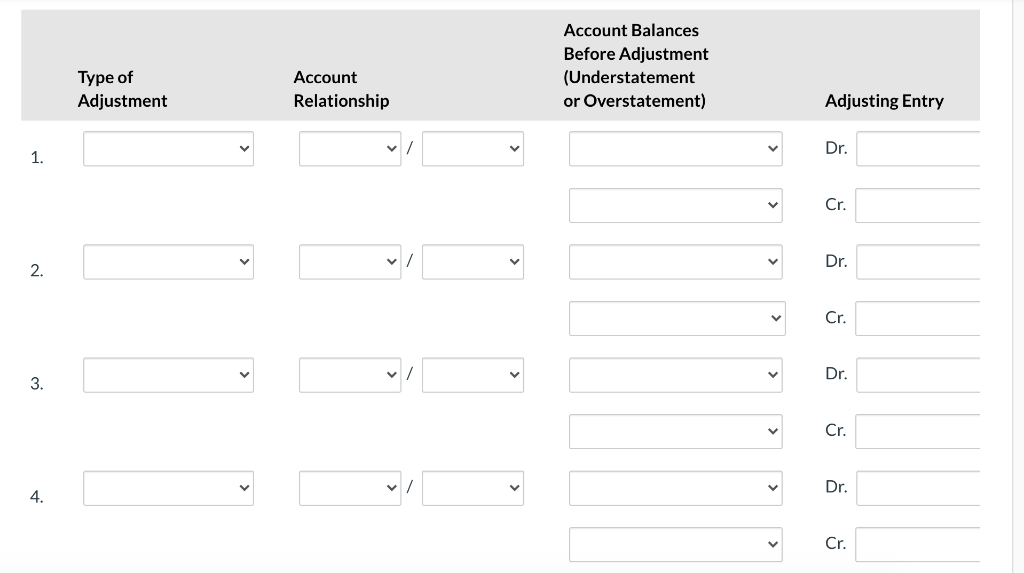

For each of the above items indicate:

| 1. | The type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accrued expense). | |

| 2. | The account relationship (asset/liability, liability/revenue, etc.). | |

| 3. | The status of account balances before adjustment (understatement or overstatement). | |

| 4. | The adjusting entry. |

Prepare your answer in the tabular form. (For account relationship and understatement or overstatement, list Revenue or Expense before Asset or Liability. If an amount reduces the Net Income then enter using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started