Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The individual financial statements for Paisley, Inc. and Skyler Corp. for the year ending December 31, 2019 are provided in the worksheet below. Paisley

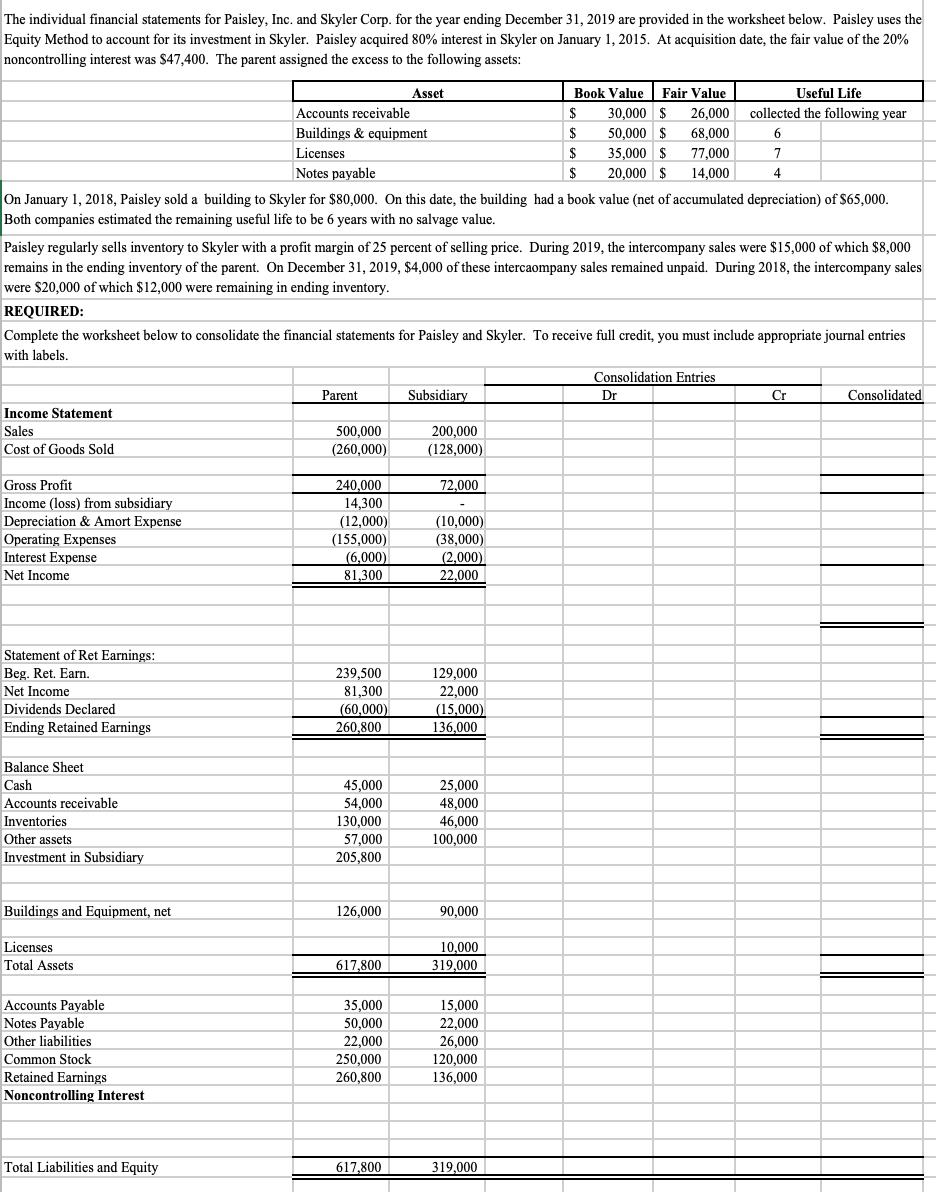

The individual financial statements for Paisley, Inc. and Skyler Corp. for the year ending December 31, 2019 are provided in the worksheet below. Paisley uses the Equity Method to account for its investment in Skyler. Paisley acquired 80% interest in Skyler on January 1, 2015. At acquisition date, the fair value of the 20% noncontrolling interest was $47,400. The parent assigned the excess to the following assets: Asset Book Value Fair Value Useful Life Accounts receivable $ 30,000 $ 26,000 collected the following year Buildings & equipment 24 50,000 $ 68,000 Licenses $ 35,000 $ 77,000 Notes payable 2$ 20,000 $ 14,000 On January 1, 2018, Paisley sold a building to Skyler for $80,000. On this date, the building had a book value (net of accumulated depreciation) of S65,000. Both companies estimated the remaining useful life to be 6 years with no salvage value. Paisley regularly sells inventory to Skyler with a profit margin of 25 percent of selling price. During 2019, the intercompany sales were $15,000 of which $8,000 remains in the ending inventory of the parent. On December 31, 2019, $4,000 of these intercaompany sales remained unpaid. During 2018, the intercompany sales were $20,000 of which $12,000 were remaining in ending inventory. REQUIRED: Complete the worksheet below to consolidate the financial statements for Paisley and Skyler. To receive full credit, you must include appropriate journal entries with labels. Consolidation Entries Parent Subsidiary Dr Cr Consolidated Income Statement 500,000 (260,000) 200,000 (128,000) Sales Cost of Goods Sold Gross Profit 240,000 72,000 Income (loss) from subsidiary 14,300 Depreciation & Amort Expense (10,000) (38,000) (12,000) Operating Expenses Interest Expense Net Income (155,000) (6,000) 81,300 (2,000) 22,000 Statement of Ret Earnings: Beg. Ret. Earn. 239,500 81,300 (60,000) 129,000 22,000 (15,000) Net Income Dividends Declared Ending Retained Earnings 260,800 136,000 Balance Sheet Cash Accounts receivable Inventories Other assets 25,000 48,000 46,000 100,000 45,000 54,000 130,000 57,000 205,800 Investment in Subsidiary Buildings and Equipment, net 126,000 90,000 Licenses 10,000 Total Assets 617,800 319,000 Accounts Payable 35,000 15,000 22,000 26,000 120,000 136,000 Notes Payable 50,000 22,000 250,000 260,800 Other liabilities Common Stock Retained Earnings Noncontrolling Interest Total Liabilities and Equity 617.800 319,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Consideration transferred for common and preferred stock 560000 Skylers book value 450000 Excess fai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60d02c4503b25_215678.pdf

180 KBs PDF File

60d02c4503b25_215678.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started