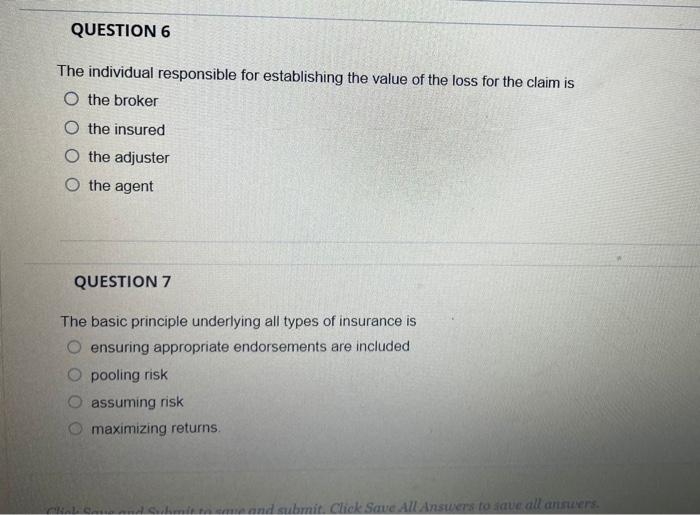

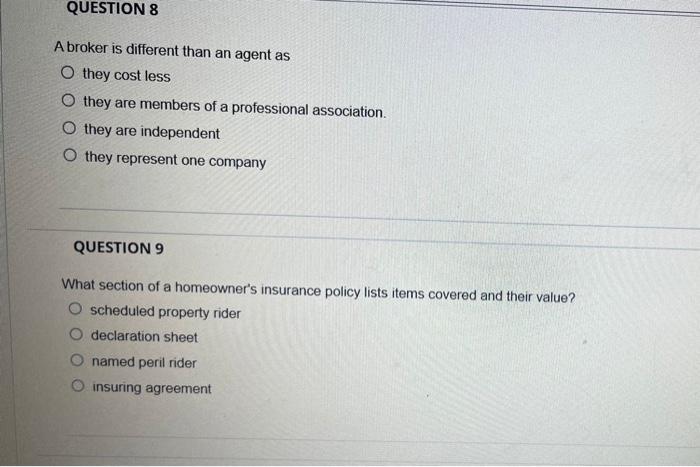

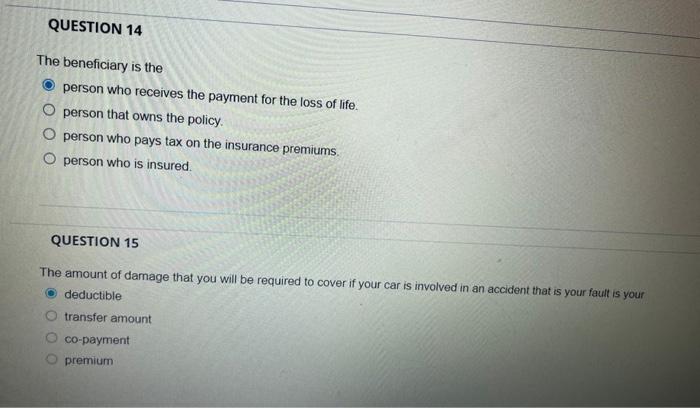

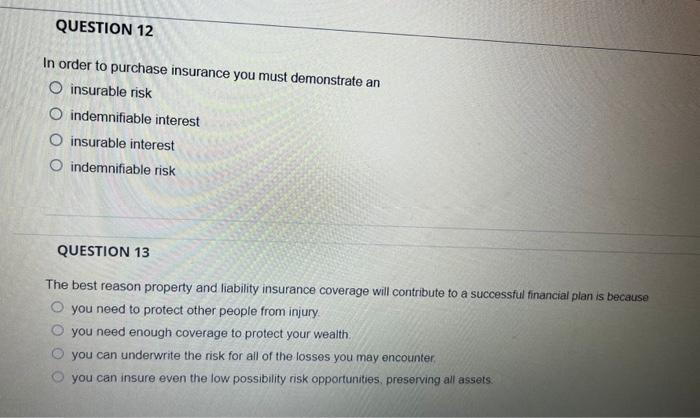

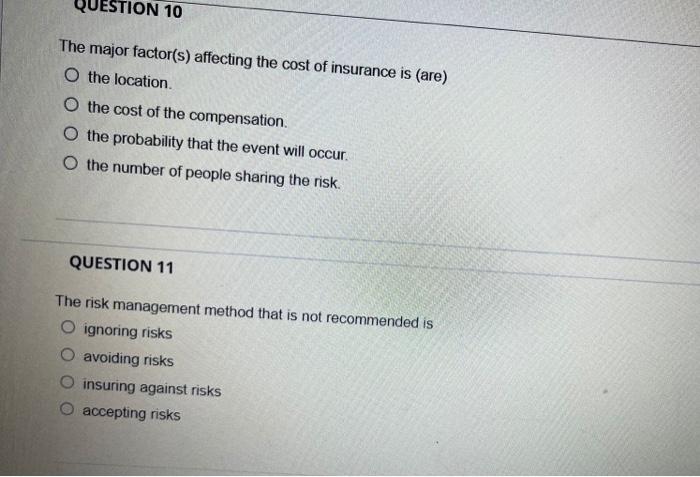

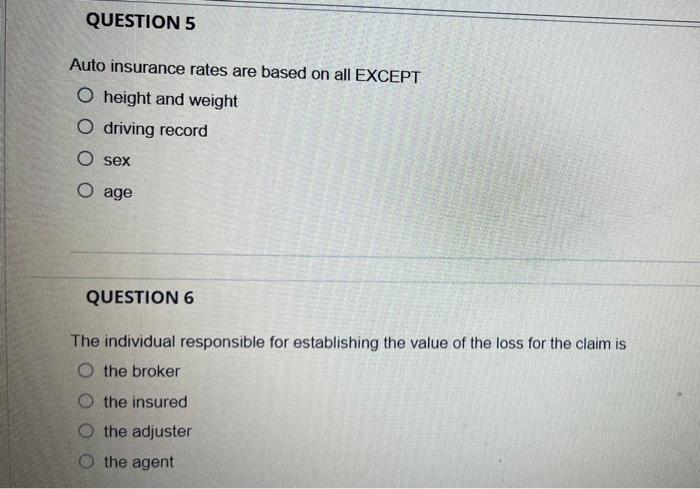

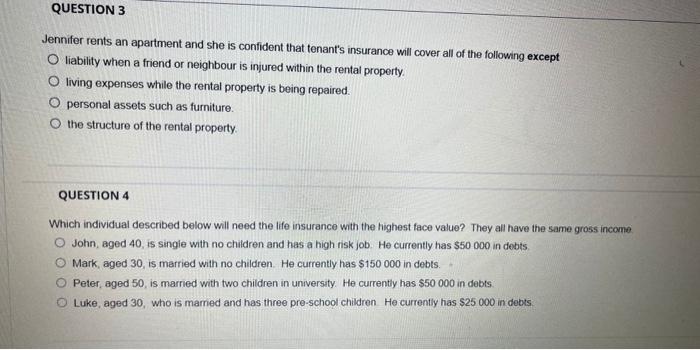

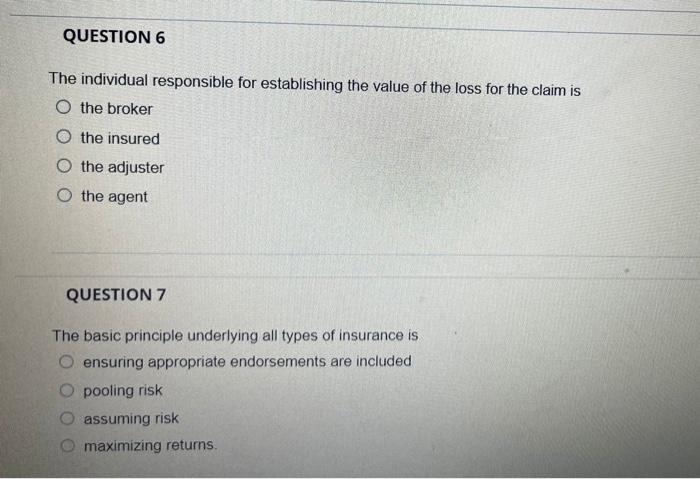

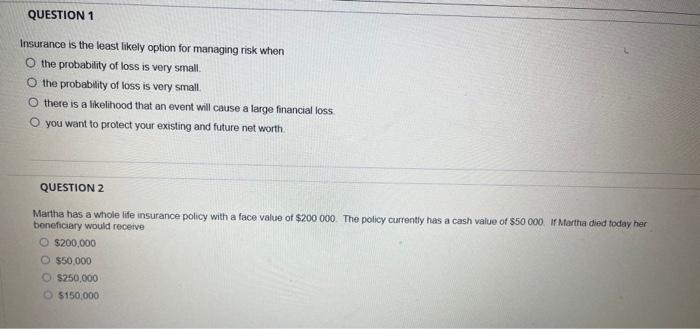

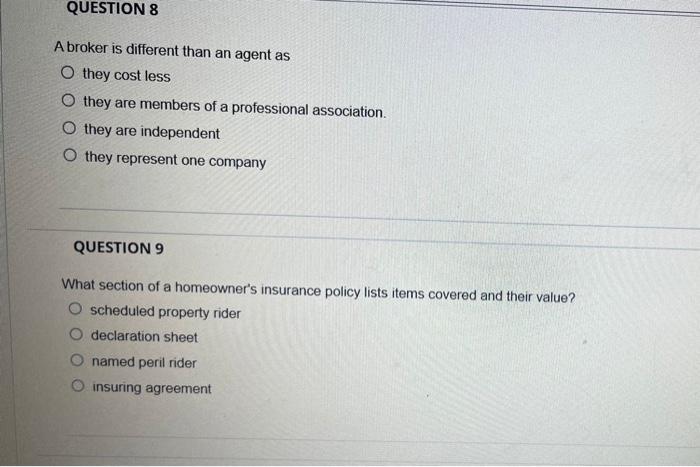

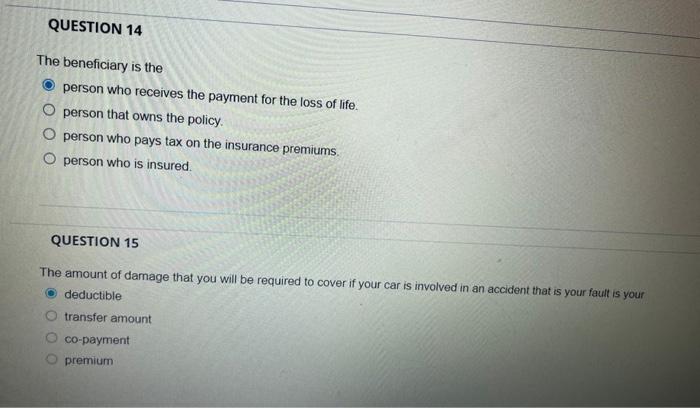

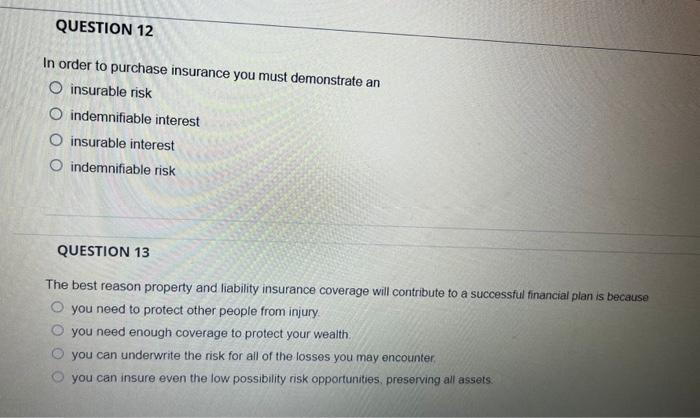

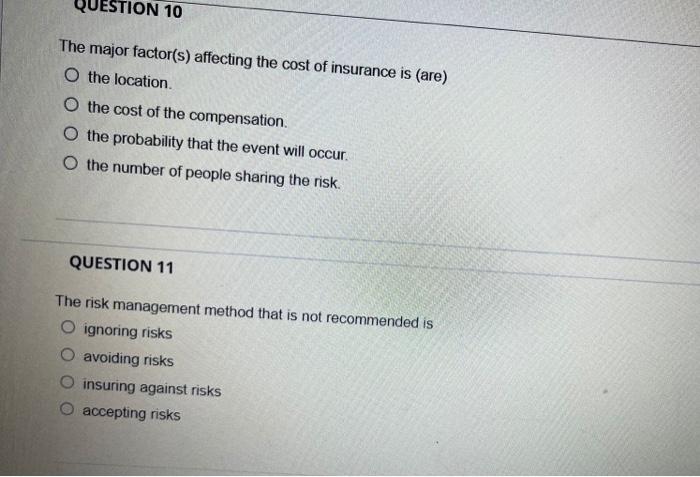

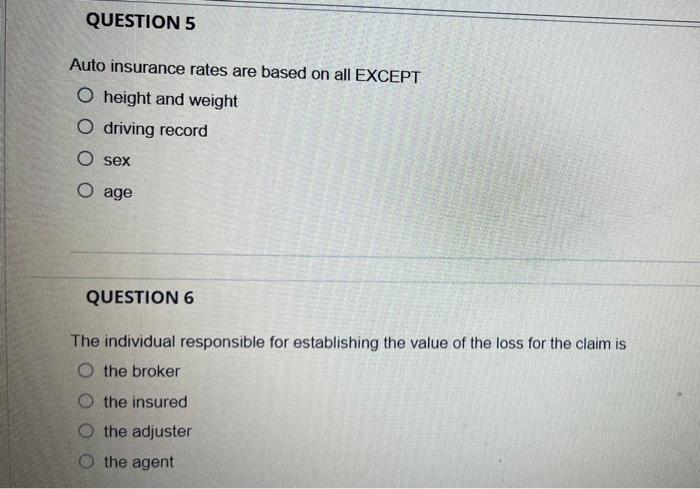

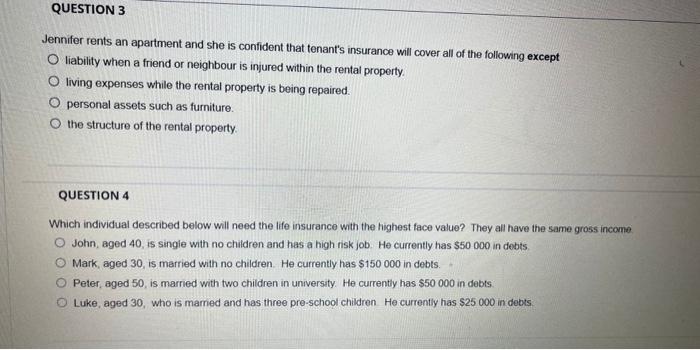

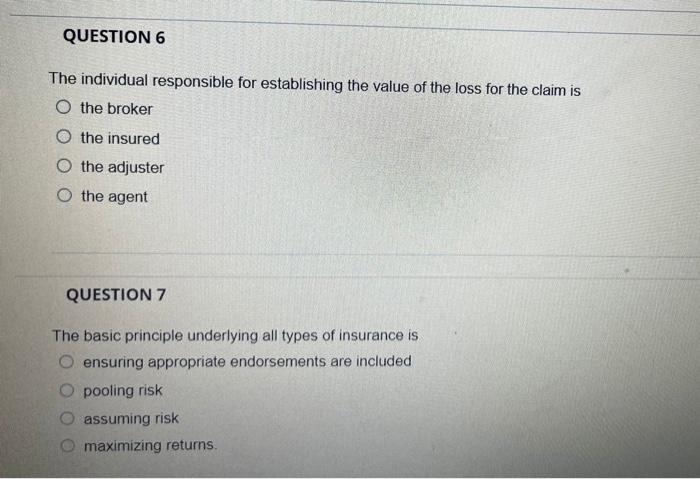

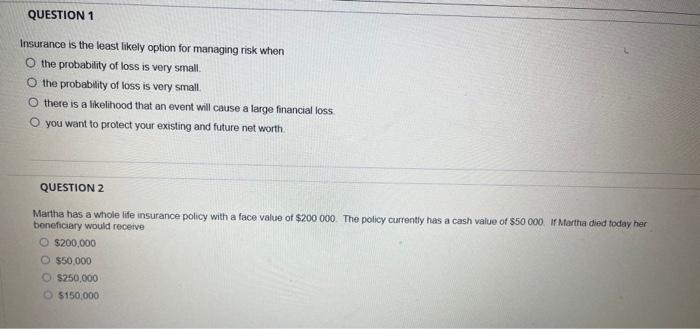

The individual responsible for establishing the value of the loss for the claim is the broker the insured the adjuster the agent QUESTION 7 The basic principle underlying all types of insurance is ensuring appropriate endorsements are included pooling risk assuming risk maximizing returns. A broker is different than an agent as they cost less they are members of a professional association. they are independent they represent one company QUESTION 9 What section of a homeowner's insurance policy lists items covered and their value? scheduled property rider declaration sheet named peril rider insuring agreement The beneficiary is the person who receives the payment for the loss of life. person that owns the policy. person who pays tax on the insurance premiums. person who is insured. QUESTION 15 The amount of damage that you will be required to cover if your car is involved in an accident that is your fault is your deductible transfer amount co-payment premium In order to purchase insurance you must demonstrate an insurable risk indemnifiable interest insurable interest indemnifiable risk QUESTION 13 The best reason property and liability insurance coverage will contribute to a successful financial plan is because you need to protect other people from injury. you need enough coverage to protect your wealth. you can underwrite the risk for all of the losses you may encounter. you can insure even the low possibility risk opportunities, preserving all assets. The major factor(s) affecting the cost of insurance is (are) the location. the cost of the compensation. the probability that the event will occur. the number of people sharing the risk. QUESTION 11 The risk management method that is not recommended is ignoring risks avoiding risks insuring against risks accepting risks Auto insurance rates are based on all EXCEPT height and weight driving record sex age QUESTION 6 The individual responsible for establishing the value of the loss for the claim is the broker the insured the adjuster the agent Jennifer rents an apartment and she is confident that tenant's insurance will cover all of the following except liability when a friend or neighbour is injured within the rental property. living expenses while the rental property is being repaired. personal assets such as furniture. the structure of the rental property. QUESTION 4 Which individual described below will need the life insurance with the highest face value? They all have the same gross income John, aged 40, is single with no children and has a high risk job. He currently has $50000 in debts Mark, aged 30 , is married with no children. He currently has $150000 in debts. Peter, aged 50 , is married with two children in university. He currently has $50000 in debts. Luke, aged 30, who is mamed and has three pre-school children. He currently has $25000 in debts. The individual responsible for establishing the value of the loss for the claim is the broker the insured the adjuster the agent QUESTION 7 The basic principle underlying all types of insurance is ensuring appropriate endorsements are included pooling risk assuming risk maximizing returns. Insurance is the least likely option for managing risk when the probability of loss is very small. the probablity of loss is very small. there is a likelihood that an event will cause a large financial loss you want to protect your existing and future net worth. QUESTION 2 Martha has a whole life insurance policy with a face value of $200000. The policy currently has a cash value of $50000. If Martha died today her beneficiary would receive $200,000 $50,000 $250,000 $150,000