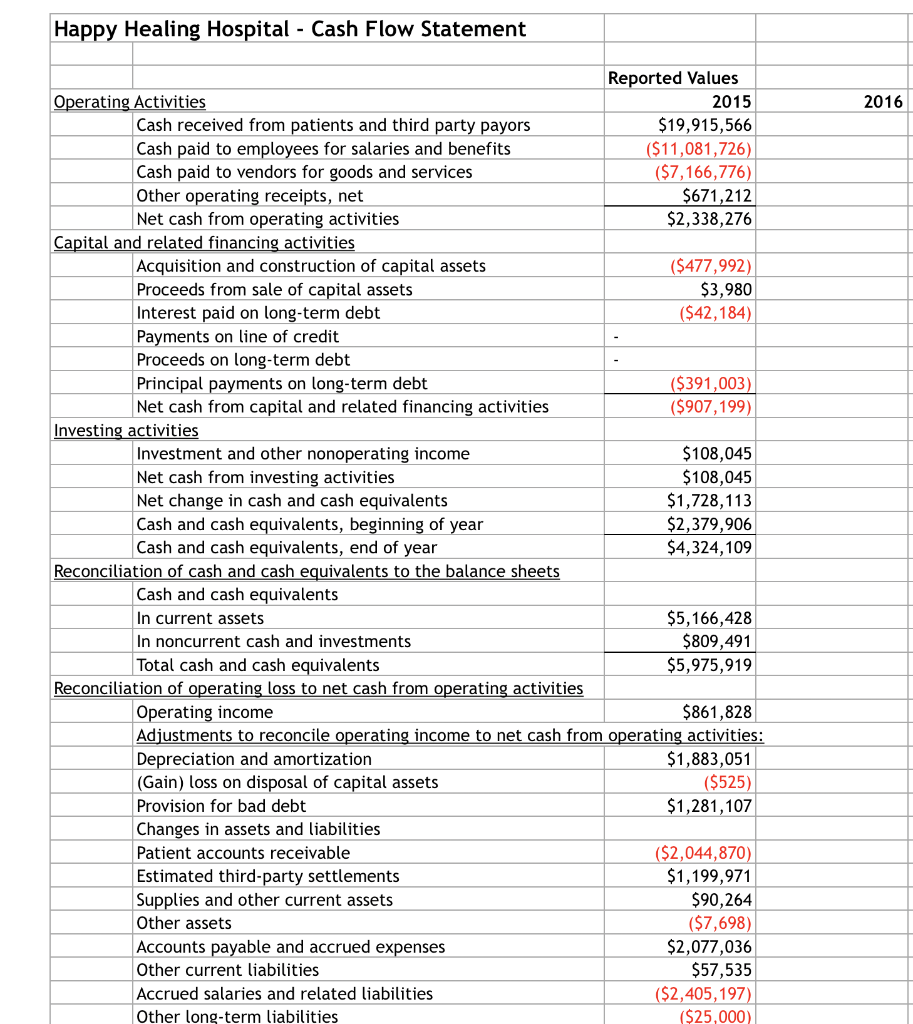

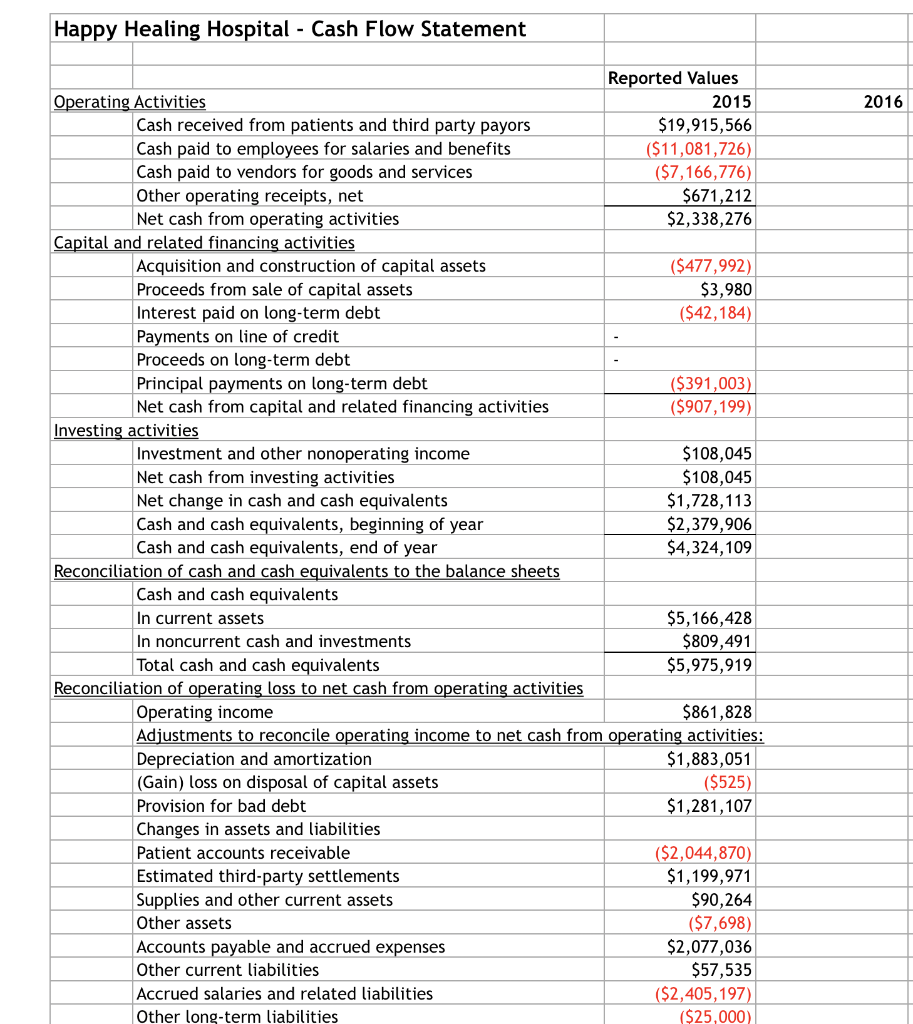

The information for 2016 has been collected from various sources within the healthcare organization and is listed in the attached document. It is not nice and neat. The entries are not lined up very well and maybe a little out of order for your report but the information you need to create this statement is all listed. It is up to you to create the statement and make it presentable.

- add a column next to 2015 and label it 2016 for side-by-side comparison.

- enter the information below in the appropriate cell.

- create formulas to total each section as was done for 2015.

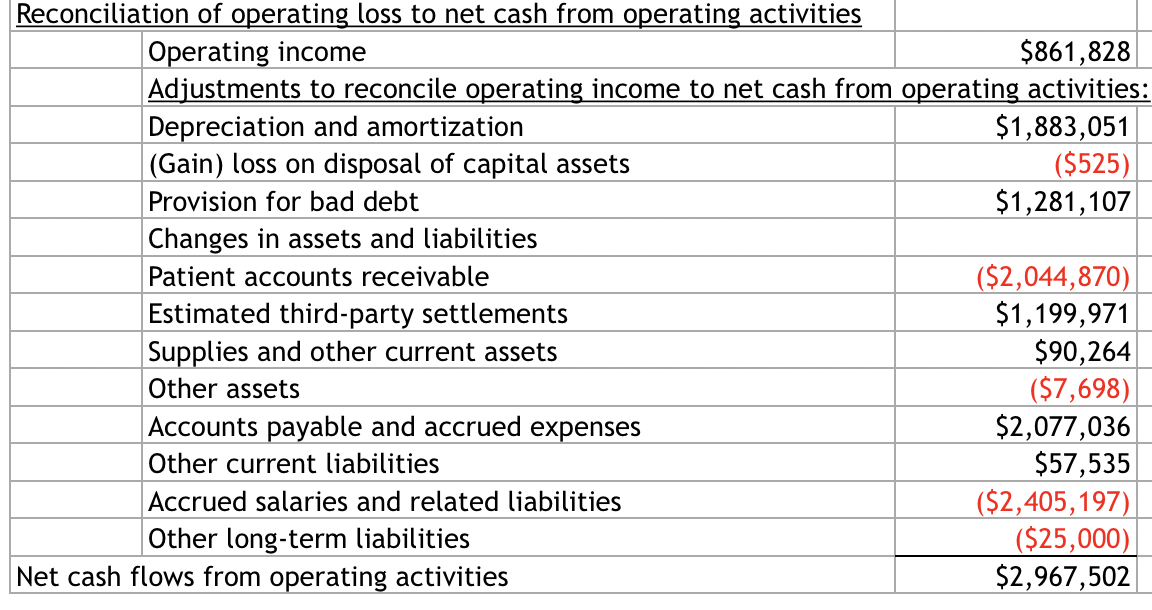

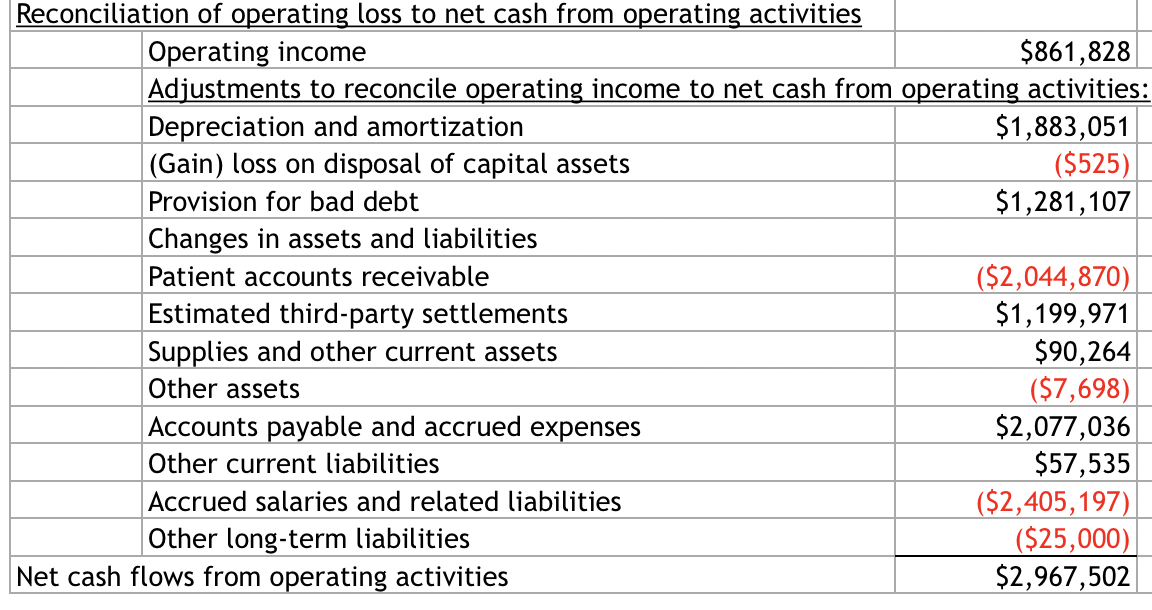

Happy Healing Hospital - Cash Flow Statement Reported Values Operating Activities 2015 $19,915,566 ($11,081,726) Cash received from patients and third party payors Cash paid to employees for salaries and benefits Cash paid to vendors for goods and services Other operating receipts, net ($7,166,776) $671,212 $2,338,276 Net cash from operating activities Capital and related financing activities ($477,992) Acquisition and construction of capital assets Proceeds from sale of capital assets $3,980 Interest paid on long-term debt ($42,184) Payments on line of credit Proceeds on long-term debt Principal payments on long-term debt ($391,003) Net cash from capital and related financing activities ($907,199) Investing activities Investment and other nonoperating income $108,045 Net cash from investing activities $108,045 Net change in cash and cash equivalents $1,728,113 $2,379,906 Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year $4,324,109 Reconciliation of cash and cash equivalents to the balance sheets Cash and cash equivalents In current assets $5,166,428 In noncurrent cash and investments $809,491 Total cash and cash equivalents $5,975,919 Reconciliation of operating loss to net cash from operating activities Operating income $861,828 Adjustments to reconcile operating income to net cash from operating activities: Depreciation and amortization $1,883,051 (Gain) loss on disposal of capital assets ($525) Provision for bad debt $1,281,107 Changes in assets and liabilities Patient accounts receivable ($2,044,870) Estimated third-party settlements $1,199,971 $90,264 Supplies and other current assets Other assets ($7,698) Accounts payable and accrued expenses $2,077,036 Other current liabilities $57,535 Accrued salaries and related liabilities ($2,405,197) Other long-term liabilities ($25,000) 2016 Reconciliation of operating loss to net cash from operating activities Operating income $861,828 Adjustments to reconcile operating income to net cash from operating activities: Depreciation and amortization $1,883,051 (Gain) loss on disposal of capital assets ($525) Provision for bad debt $1,281,107 Changes in assets and liabilities Patient accounts receivable ($2,044,870) $1,199,971 Estimated third-party settlements Supplies and other current assets Other assets $90,264 ($7,698) Accounts payable and accrued expenses $2,077,036 Other current liabilities $57,535 ($2,405,197) Accrued salaries and related liabilities Other long-term liabilities ($25,000) $2,967,502 Net cash flows from operating activities Happy Healing Hospital - Cash Flow Statement Reported Values Operating Activities 2015 $19,915,566 ($11,081,726) Cash received from patients and third party payors Cash paid to employees for salaries and benefits Cash paid to vendors for goods and services Other operating receipts, net ($7,166,776) $671,212 $2,338,276 Net cash from operating activities Capital and related financing activities ($477,992) Acquisition and construction of capital assets Proceeds from sale of capital assets $3,980 Interest paid on long-term debt ($42,184) Payments on line of credit Proceeds on long-term debt Principal payments on long-term debt ($391,003) Net cash from capital and related financing activities ($907,199) Investing activities Investment and other nonoperating income $108,045 Net cash from investing activities $108,045 Net change in cash and cash equivalents $1,728,113 $2,379,906 Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year $4,324,109 Reconciliation of cash and cash equivalents to the balance sheets Cash and cash equivalents In current assets $5,166,428 In noncurrent cash and investments $809,491 Total cash and cash equivalents $5,975,919 Reconciliation of operating loss to net cash from operating activities Operating income $861,828 Adjustments to reconcile operating income to net cash from operating activities: Depreciation and amortization $1,883,051 (Gain) loss on disposal of capital assets ($525) Provision for bad debt $1,281,107 Changes in assets and liabilities Patient accounts receivable ($2,044,870) Estimated third-party settlements $1,199,971 $90,264 Supplies and other current assets Other assets ($7,698) Accounts payable and accrued expenses $2,077,036 Other current liabilities $57,535 Accrued salaries and related liabilities ($2,405,197) Other long-term liabilities ($25,000) 2016 Reconciliation of operating loss to net cash from operating activities Operating income $861,828 Adjustments to reconcile operating income to net cash from operating activities: Depreciation and amortization $1,883,051 (Gain) loss on disposal of capital assets ($525) Provision for bad debt $1,281,107 Changes in assets and liabilities Patient accounts receivable ($2,044,870) $1,199,971 Estimated third-party settlements Supplies and other current assets Other assets $90,264 ($7,698) Accounts payable and accrued expenses $2,077,036 Other current liabilities $57,535 ($2,405,197) Accrued salaries and related liabilities Other long-term liabilities ($25,000) $2,967,502 Net cash flows from operating activities