The information for Bland Media Company at the end of the fiscal year, June 30, 20X8 are listed in this spreadsheet . Additional information:

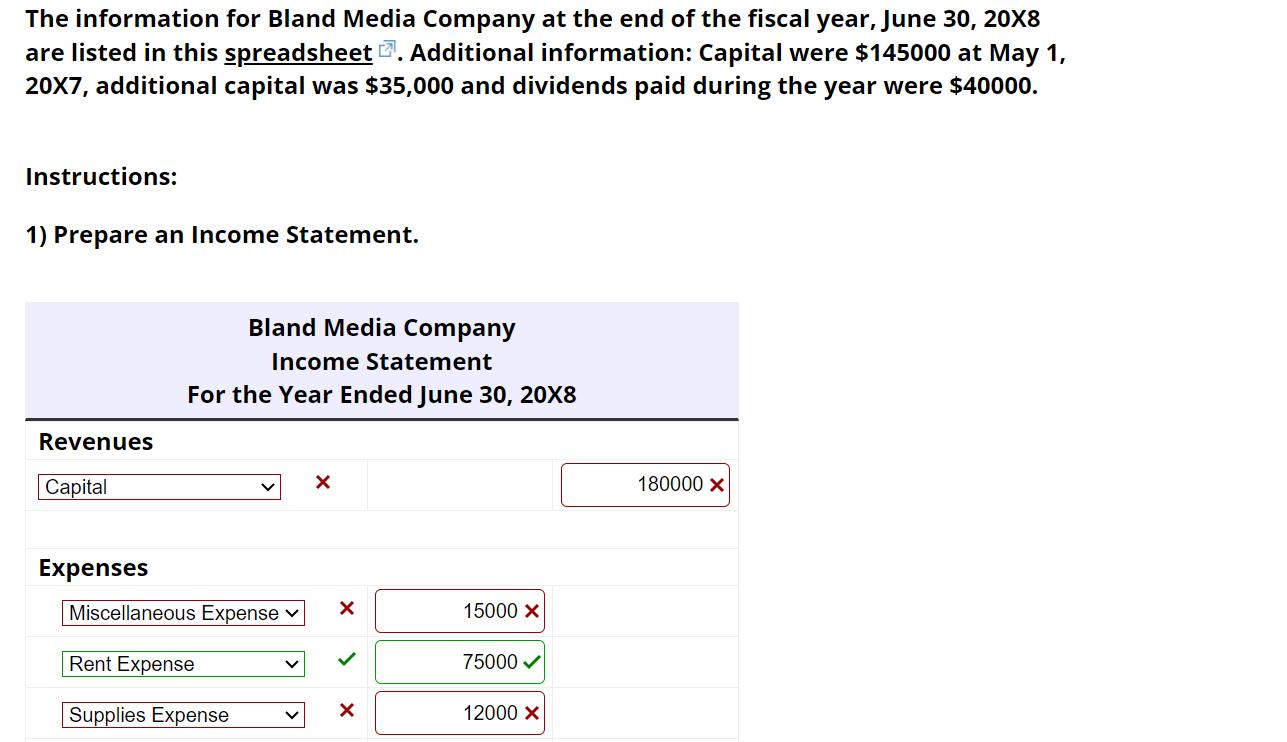

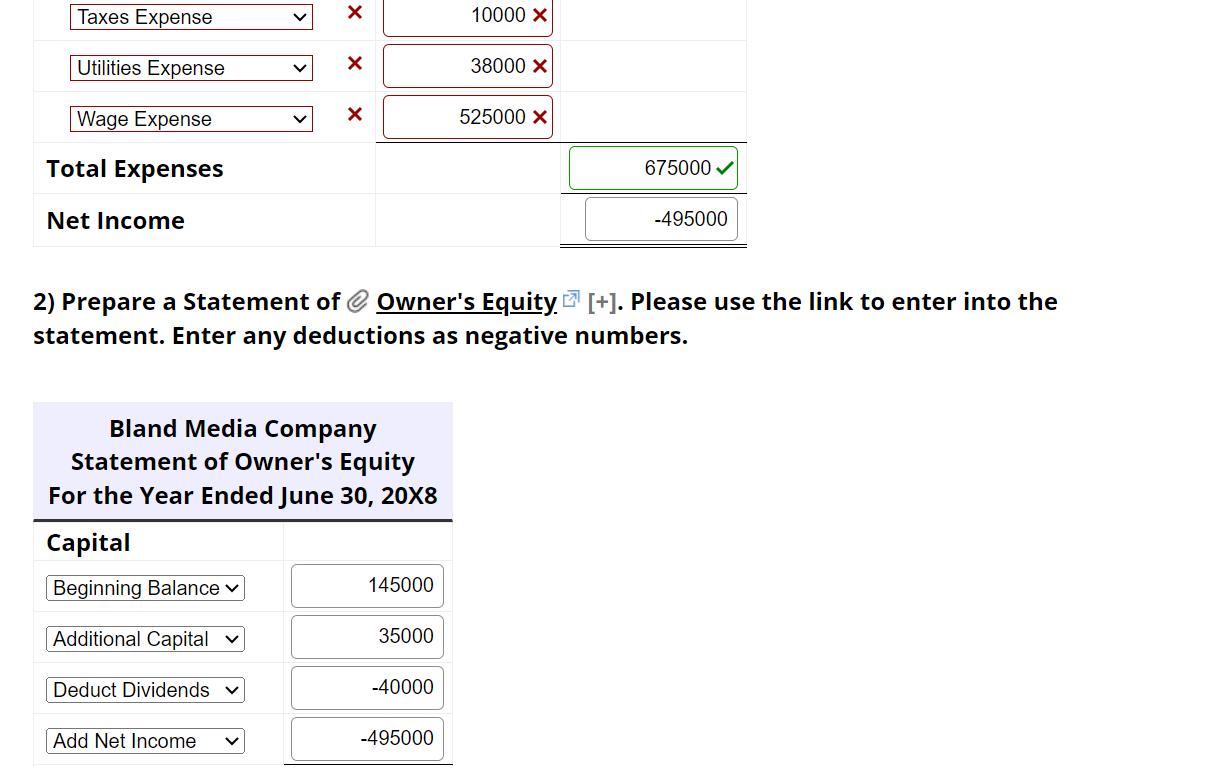

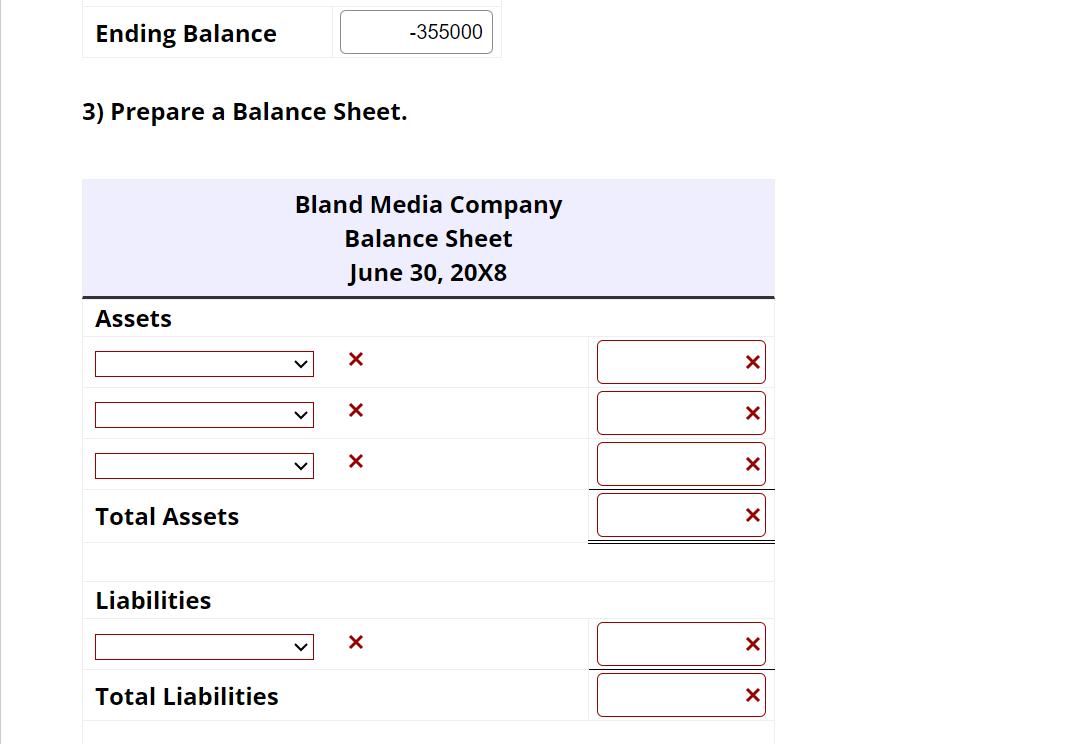

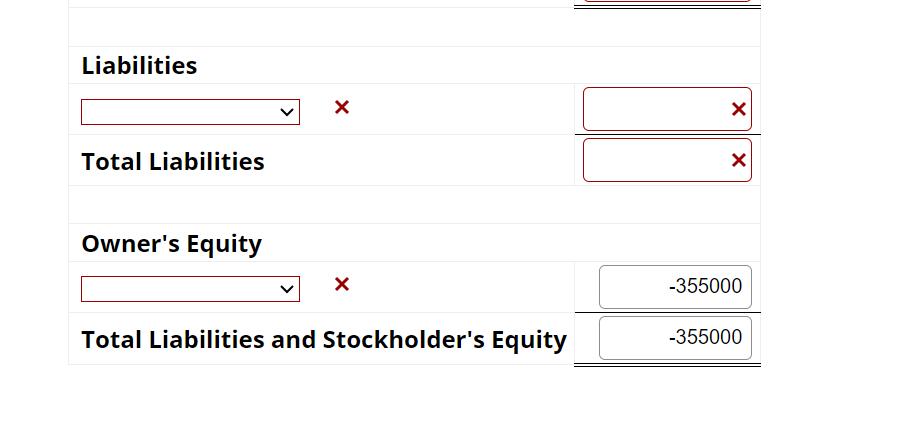

The information for Bland Media Company at the end of the fiscal year, June 30, 20X8 are listed in this spreadsheet . Additional information: Capital were $145000 at May 1, 20X7, additional capital was $35,000 and dividends paid during the year were $40000. Instructions: 1) Prepare an Income Statement. Revenues Bland Media Company Income Statement For the Year Ended June 30, 20X8 Capital Expenses Miscellaneous Expense 15000 X Rent Expense 75000 Supplies Expense 12000 X 180000 X Taxes Expense X 10000 X Utilities Expense 38000 X Wage Expense 525000 X Total Expenses 675000 Net Income -495000 2) Prepare a Statement of Owner's Equity [+]. Please use the link to enter into the statement. Enter any deductions as negative numbers. Bland Media Company Statement of Owner's Equity For the Year Ended June 30, 20X8 Capital Beginning Balance 145000 Additional Capital 35000 Deduct Dividends -40000 Add Net Income -495000 Ending Balance 3) Prepare a Balance Sheet. -355000 Bland Media Company Balance Sheet June 30, 20X8 Assets X Total Assets Liabilities Total Liabilities X Liabilities Total Liabilities Owner's Equity Total Liabilities and Stockholder's Equity -355000 -355000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Bland Media Company Income Statement For the Year Ended June 30 20X8 Revenues 180000 Expe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started