Question

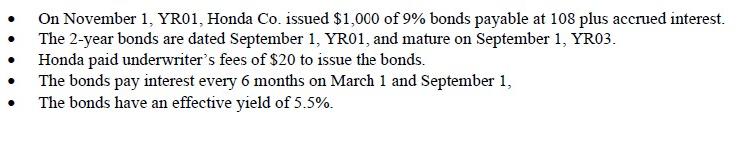

. On November 1, YR01, Honda Co. issued $1,000 of 9% bonds payable at 108 plus accrued interest. The 2-year bonds are dated September

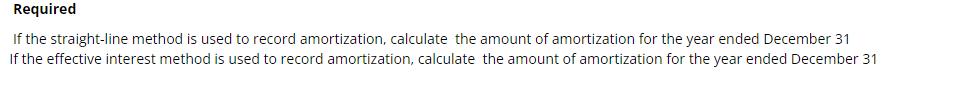

. On November 1, YR01, Honda Co. issued $1,000 of 9% bonds payable at 108 plus accrued interest. The 2-year bonds are dated September 1, YR01, and mature on September 1, YR03. Honda paid underwriter's fees of $20 to issue the bonds. The bonds pay interest every 6 months on March 1 and September 1, The bonds have an effective yield of 5.5%. Required If the straight-line method is used to record amortization, calculate the amount of amortization for the year ended December 31 If the effective interest method is used to record amortization, calculate the amount of amortization for the year ended December 31

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of amortization for the year ended December 31 using the straightline method ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App