Answered step by step

Verified Expert Solution

Question

1 Approved Answer

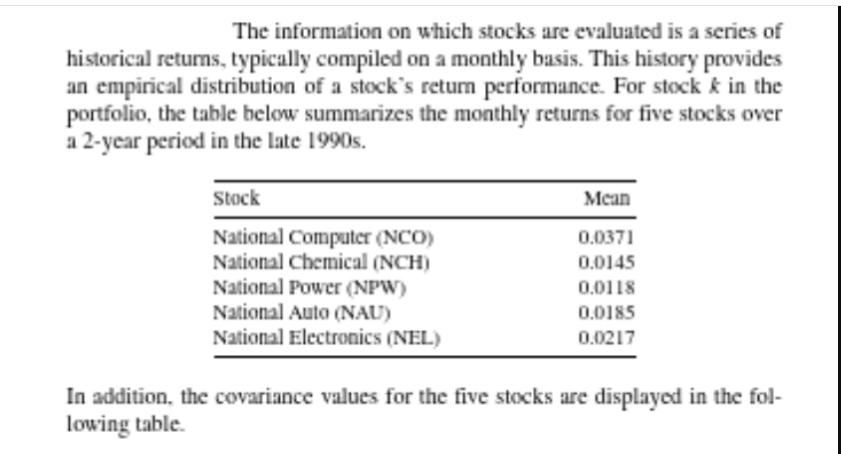

The information on which stocks are evaluated is a series of historical returns, typically compiled on a monthly basis. This history provides an empirical

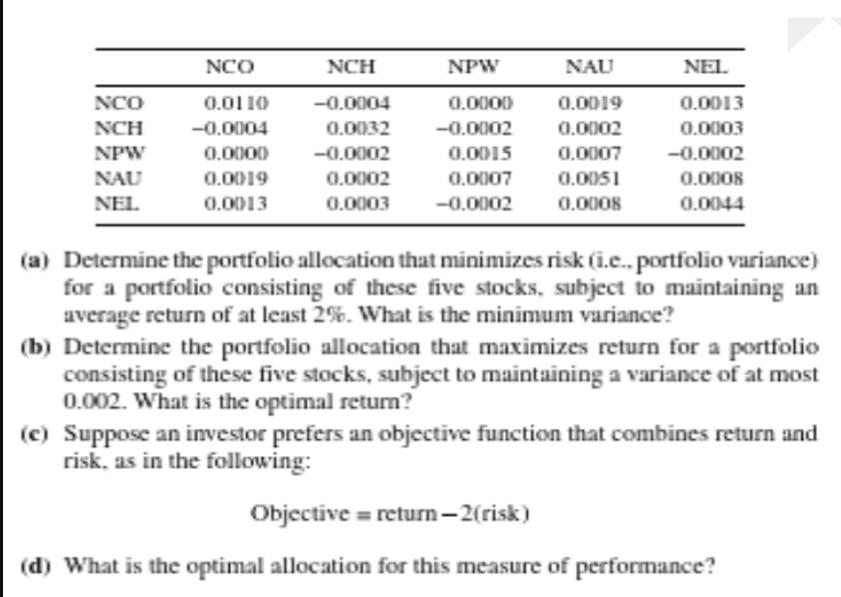

The information on which stocks are evaluated is a series of historical returns, typically compiled on a monthly basis. This history provides an empirical distribution of a stock's return performance. For stock & in the portfolio, the table below summarizes the monthly returns for five stocks over a 2-year period in the late 1990s. Stock National Computer (NCO) National Chemical (NCH) National Power (NPW) National Auto (NAU) National Electronics (NEL) Mean 0.0371 0.0145 0.0118 0.0185 0.0217 In addition, the covariance values for the five stocks are displayed in the fol- lowing table. NCO NCO 0.0110 NCH -0.0004 NPW 0.0000 NAU NEL 0.0019 0.0013 NCH -0.0004 0.0032 -0.0002 0.0002 0.0003 NPW NAU 0.0000 0.0019 -0.0002 0.0002 0.0015 0.0007 0.0007 -0.0002 0.0051 0.0008 NEL 0.0013 0.0003 -0.0002 0.0008 0.0044 (a) Determine the portfolio allocation that minimizes risk (i.c.. portfolio variance) for a portfolio consisting of these five stocks, subject to maintaining an average return of at least 2%. What is the minimum variance? (b) Determine the portfolio allocation that maximizes return for a portfolio consisting of these five stocks, subject to maintaining a variance of at most 0.002. What is the optimal return? (c) Suppose an investor prefers an objective function that combines return and risk, as in the following: Objective = return-2 (risk) (d) What is the optimal allocation for this measure of performance?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To minimize portfolio variance subject to average return constraint Let x1 x2 x3 x4 x5 be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started