Answered step by step

Verified Expert Solution

Question

1 Approved Answer

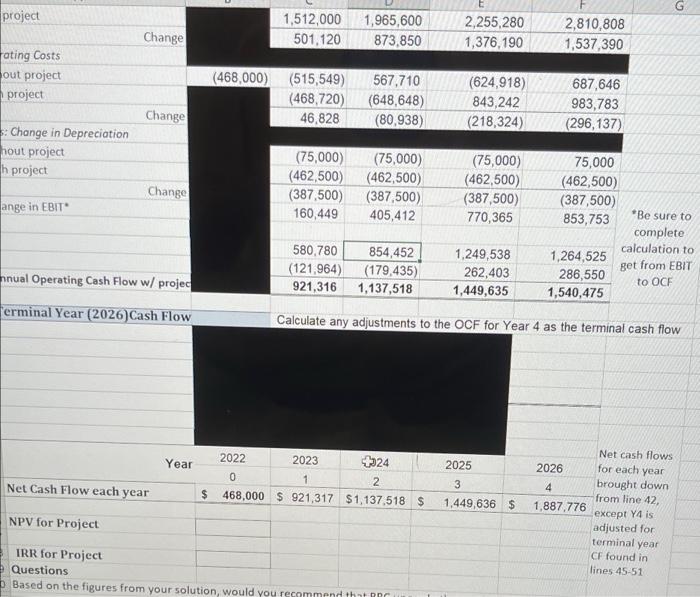

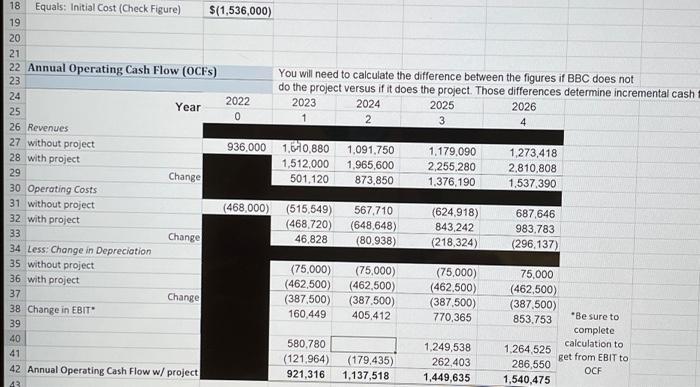

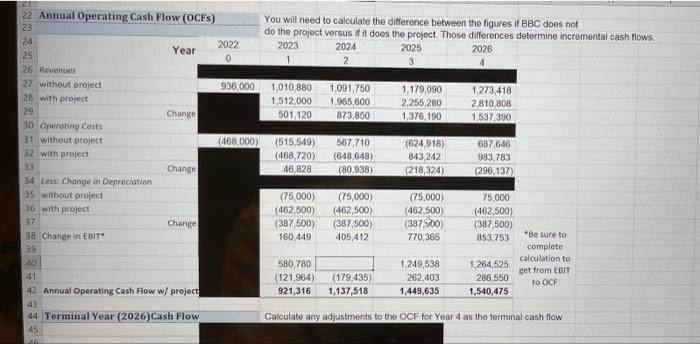

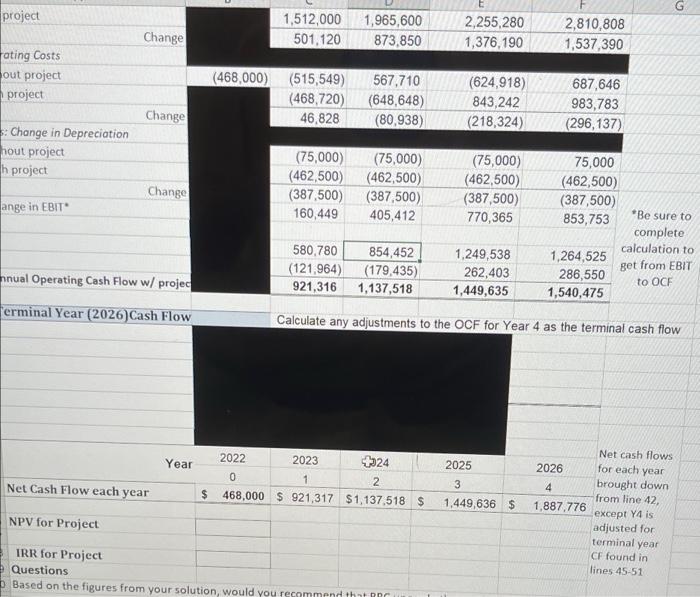

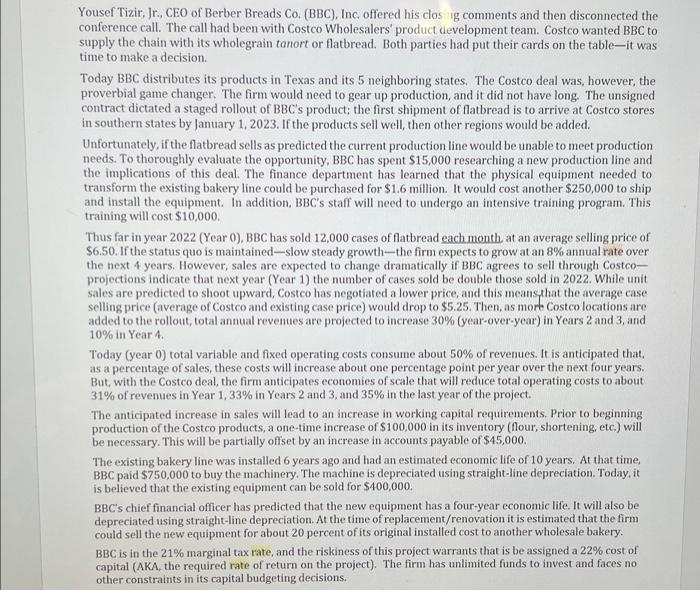

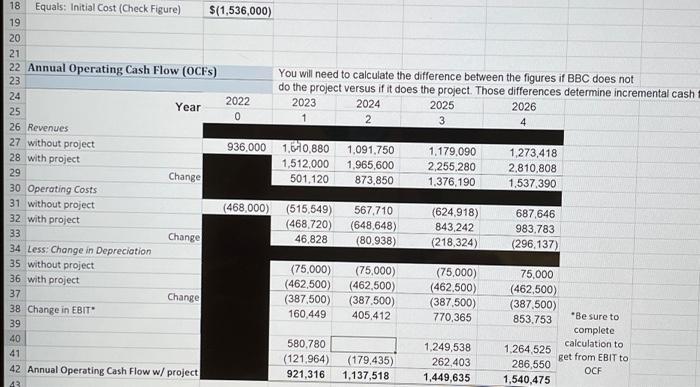

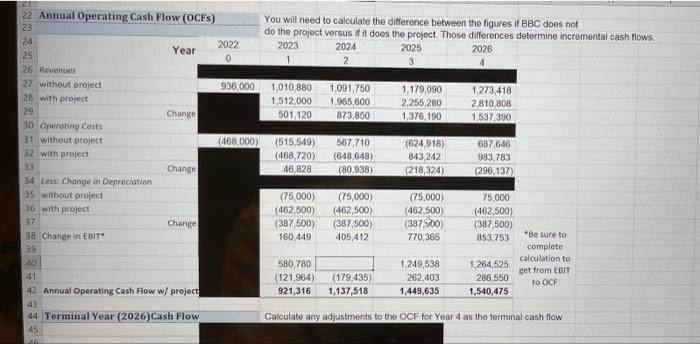

the Initial cost for the project is $1,536,000, what is the NPV and IRR? discount rate 22% i think G project 1,512,000 501,120 Change 1,965,600

the Initial cost for the project is $1,536,000, what is the NPV and IRR?

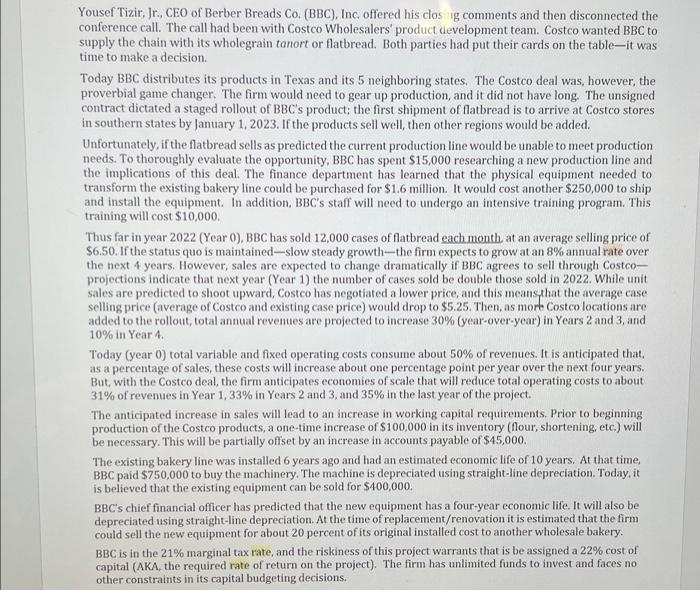

discount rate 22% i think G project 1,512,000 501,120 Change 1,965,600 873,850 2,255,280 1,376,190 2,810,808 1,537,390 ating Costs out project project (468,000) (515,549) (468,720) 46,828 567,710 (648,648) (80,938) (624,918) 843 242 (218,324) 687,646 983,783 (296,137) Change s: Change in Depreciation nout project h project Change (75,000) (462,500) (387,500) 160,449 (75,000) (462,500) (387,500) 405,412 (75,000) (462,500) (387,500) 770,365 ange in EBIT 75,000 (462,500) (387,500) 853,753 Be sure to complete calculation to 1,264,525 get from EBIT 286,550 to OCF 1,540,475 580 780 (121,964) 921,316 nnual Operating Cash Flow w/ projec 854,452 (179,435) 1,137,518 1,249,538 262,403 1,449,635 erminal Year (2026)Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow Year 2022 2023 324 0 1 2 468,000 $ 921,317 $1,137,518 $ Net Cash Flow each year 2025 3 1,449,636 $ $ Net cash flows 2026 for each year 4 brought down from line 42 1.887.776 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project IRR for Project Questions Based on the figures from your solution, would you recommend that ABC Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc offered his clos g comments and then disconnected the conference call. The call had been with Costco Wholesalers' product development team. Costco wanted BBC to supply the chain with its wholegrain tanort or flatbread. Both parties had put their cards on the table--it was time to make a decision. Today BBC distributes its products in Texas and its 5 neighboring states. The Costco deal was, however, the proverbial game changer. The firm would need to gear up production, and it did not have long. The unsigned contract dictated a staged rollout of BBC's product; the first shipment of flatbread is to arrive at Costco stores in southern states by January 1, 2023. If the products sell well, then other regions would be added. Unfortunately, if the flatbread sells as predicted the current production line would be unable to meet production needs. To thoroughly evaluate the opportunity, BBC has spent $15,000 researching a new production line and the implications of this deal. The finance department has learned that the physical equipment needed to transform the existing bakery line could be purchased for $1.6 million. It would cost another $250,000 to ship and install the equipment. In addition, BBC's staff will need to undergo an intensive training program. This training will cost $10,000, Thus far in year 2022 (Year O), BBC has sold 12,000 cases of flatbread each month at an average selling price of $6.50. If the status quo is maintained-slow steady growth-the firm expects to grow at an 8% annual rate over the next 4 years. However, sales are expected to change dramatically if BBC agrees to sell through Costco- projections indicate that next year (Year 1) the number of cases sold be double those sold in 2022. While unit sales are predicted to shoot upward, Costco has negotiated a lower price, and this means that the average case selling price (average of Costco and existing case price) would drop to $5.25. Then, as more Costco locations are added to the rollout, total annual revenues are projected to increase 30% (year-over-year) in Years 2 and 3, and 10% in Year 4. Today (year 0) total variable and fixed operating costs consume about 50% of revenues. It is anticipated that as a percentage of sales, these costs will increase about one percentage point per year over the next four years. But with the Costco deal, the firm anticipates economies of scale that will reduce total operating costs to about 31% of revenues in Year 1,33% in Years 2 and 3, and 35% in the last year of the project, The anticipated increase in sales will lead to an increase in working capital requirements. Prior to beginning production of the Costco products, a one-time increase of $100,000 in its inventory (flour, shortening, etc.) will be necessary. This will be partially offset by an increase in accounts payable of $45,000. The existing bakery line was installed 6 years ago and had an estimated economic life of 10 years. At that time, BBC paid $750,000 to buy the machinery. The machine is depreciated using straight-line depreciation. Today, it is believed that the existing equipment can be sold for $400,000. BBC's chief financial officer has predicted that the new equipment has a four-year economic life. It will also be depreciated using straight-line depreciation. At the time of replacement/renovation it is estimated that the firm could sell the new equipment for about 20 percent of its original installed cost to another wholesale bakery. BBC is in the 21% marginal tax rate, and the riskiness of this project warrants that is be assigned a 22% cost of capital (AKA, the required rate of return on the project). The firm has unlimited funds to invest and faces no other constraints in its capital budgeting decisions. 18 Equals: Initial Cost (Check Figure) $(1,536,000) 19 20 21 22 Annual Operating Cash Flow (OCFS) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash 24 2022 Year 2023 2024 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936.000 1.60,880 1.091.750 1.179,090 1.273,418 28 with project 1,512.000 1,965,600 2,255,280 2.810,808 29 Change 501,120 873,850 1,376,190 1.537.390 30 Operating costs 31 without project (468.000) (515,549) 567.710 (624.918) 687.646 32 with project (468.720) (648,648) 843,242 983.783 33 Change 46,828 (80.938) (218,324) (296,137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75.000 36 with project (462,500) (462,500) (462.500) (462,500) 37 Change (387,500) (387.500) (387,500) (387,500) 38 Change in EBIT 160.449 405,412 770,365 853,753 "Be sure to 39 complete 40 calculation to 580.780 1.249,538 1,264,525 get from EBIT to 41 (121,964) (179,435) 262,403 286,550 OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 22 Annual Operating Cash Flow (OCF) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash flows 24 2022 2023 2024 Year 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936,000 1,010,880 1,091,750 1,179,090 1,273,418 26 with project 1,512.000 1,955,600 2,255,280 2,810 808 29 Change 501,120 873,850 1,376,190 1,537,390 30 Operating costs 31 without project (468,000) (515,549) 567 710 (624,918) 687646 32 with project (468,720) (648,648) 843,242 983,783 33 Change 46,828 (80,938) (218,324) (296, 137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75,000 36 with project (462,500) (462,500) (462,500) (462,500) 37 Chance (387,500) (387,500) (387,00) (387,500) 38 Change in EBIT "Be sure to 160.449 405,412 770,365 853 753 39 complete calculation to 30 530 780 1 249,538 1,264,525 get from EBIT 41 (121.964) (179,435) 262,403 286,550 to OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 45 G project 1,512,000 501,120 Change 1,965,600 873,850 2,255,280 1,376,190 2,810,808 1,537,390 ating Costs out project project (468,000) (515,549) (468,720) 46,828 567,710 (648,648) (80,938) (624,918) 843 242 (218,324) 687,646 983,783 (296,137) Change s: Change in Depreciation nout project h project Change (75,000) (462,500) (387,500) 160,449 (75,000) (462,500) (387,500) 405,412 (75,000) (462,500) (387,500) 770,365 ange in EBIT 75,000 (462,500) (387,500) 853,753 Be sure to complete calculation to 1,264,525 get from EBIT 286,550 to OCF 1,540,475 580 780 (121,964) 921,316 nnual Operating Cash Flow w/ projec 854,452 (179,435) 1,137,518 1,249,538 262,403 1,449,635 erminal Year (2026)Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow Year 2022 2023 324 0 1 2 468,000 $ 921,317 $1,137,518 $ Net Cash Flow each year 2025 3 1,449,636 $ $ Net cash flows 2026 for each year 4 brought down from line 42 1.887.776 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project IRR for Project Questions Based on the figures from your solution, would you recommend that ABC Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc offered his clos g comments and then disconnected the conference call. The call had been with Costco Wholesalers' product development team. Costco wanted BBC to supply the chain with its wholegrain tanort or flatbread. Both parties had put their cards on the table--it was time to make a decision. Today BBC distributes its products in Texas and its 5 neighboring states. The Costco deal was, however, the proverbial game changer. The firm would need to gear up production, and it did not have long. The unsigned contract dictated a staged rollout of BBC's product; the first shipment of flatbread is to arrive at Costco stores in southern states by January 1, 2023. If the products sell well, then other regions would be added. Unfortunately, if the flatbread sells as predicted the current production line would be unable to meet production needs. To thoroughly evaluate the opportunity, BBC has spent $15,000 researching a new production line and the implications of this deal. The finance department has learned that the physical equipment needed to transform the existing bakery line could be purchased for $1.6 million. It would cost another $250,000 to ship and install the equipment. In addition, BBC's staff will need to undergo an intensive training program. This training will cost $10,000, Thus far in year 2022 (Year O), BBC has sold 12,000 cases of flatbread each month at an average selling price of $6.50. If the status quo is maintained-slow steady growth-the firm expects to grow at an 8% annual rate over the next 4 years. However, sales are expected to change dramatically if BBC agrees to sell through Costco- projections indicate that next year (Year 1) the number of cases sold be double those sold in 2022. While unit sales are predicted to shoot upward, Costco has negotiated a lower price, and this means that the average case selling price (average of Costco and existing case price) would drop to $5.25. Then, as more Costco locations are added to the rollout, total annual revenues are projected to increase 30% (year-over-year) in Years 2 and 3, and 10% in Year 4. Today (year 0) total variable and fixed operating costs consume about 50% of revenues. It is anticipated that as a percentage of sales, these costs will increase about one percentage point per year over the next four years. But with the Costco deal, the firm anticipates economies of scale that will reduce total operating costs to about 31% of revenues in Year 1,33% in Years 2 and 3, and 35% in the last year of the project, The anticipated increase in sales will lead to an increase in working capital requirements. Prior to beginning production of the Costco products, a one-time increase of $100,000 in its inventory (flour, shortening, etc.) will be necessary. This will be partially offset by an increase in accounts payable of $45,000. The existing bakery line was installed 6 years ago and had an estimated economic life of 10 years. At that time, BBC paid $750,000 to buy the machinery. The machine is depreciated using straight-line depreciation. Today, it is believed that the existing equipment can be sold for $400,000. BBC's chief financial officer has predicted that the new equipment has a four-year economic life. It will also be depreciated using straight-line depreciation. At the time of replacement/renovation it is estimated that the firm could sell the new equipment for about 20 percent of its original installed cost to another wholesale bakery. BBC is in the 21% marginal tax rate, and the riskiness of this project warrants that is be assigned a 22% cost of capital (AKA, the required rate of return on the project). The firm has unlimited funds to invest and faces no other constraints in its capital budgeting decisions. 18 Equals: Initial Cost (Check Figure) $(1,536,000) 19 20 21 22 Annual Operating Cash Flow (OCFS) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash 24 2022 Year 2023 2024 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936.000 1.60,880 1.091.750 1.179,090 1.273,418 28 with project 1,512.000 1,965,600 2,255,280 2.810,808 29 Change 501,120 873,850 1,376,190 1.537.390 30 Operating costs 31 without project (468.000) (515,549) 567.710 (624.918) 687.646 32 with project (468.720) (648,648) 843,242 983.783 33 Change 46,828 (80.938) (218,324) (296,137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75.000 36 with project (462,500) (462,500) (462.500) (462,500) 37 Change (387,500) (387.500) (387,500) (387,500) 38 Change in EBIT 160.449 405,412 770,365 853,753 "Be sure to 39 complete 40 calculation to 580.780 1.249,538 1,264,525 get from EBIT to 41 (121,964) (179,435) 262,403 286,550 OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 22 Annual Operating Cash Flow (OCF) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash flows 24 2022 2023 2024 Year 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936,000 1,010,880 1,091,750 1,179,090 1,273,418 26 with project 1,512.000 1,955,600 2,255,280 2,810 808 29 Change 501,120 873,850 1,376,190 1,537,390 30 Operating costs 31 without project (468,000) (515,549) 567 710 (624,918) 687646 32 with project (468,720) (648,648) 843,242 983,783 33 Change 46,828 (80,938) (218,324) (296, 137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75,000 36 with project (462,500) (462,500) (462,500) (462,500) 37 Chance (387,500) (387,500) (387,00) (387,500) 38 Change in EBIT "Be sure to 160.449 405,412 770,365 853 753 39 complete calculation to 30 530 780 1 249,538 1,264,525 get from EBIT 41 (121.964) (179,435) 262,403 286,550 to OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 45

discount rate 22% i think G project 1,512,000 501,120 Change 1,965,600 873,850 2,255,280 1,376,190 2,810,808 1,537,390 ating Costs out project project (468,000) (515,549) (468,720) 46,828 567,710 (648,648) (80,938) (624,918) 843 242 (218,324) 687,646 983,783 (296,137) Change s: Change in Depreciation nout project h project Change (75,000) (462,500) (387,500) 160,449 (75,000) (462,500) (387,500) 405,412 (75,000) (462,500) (387,500) 770,365 ange in EBIT 75,000 (462,500) (387,500) 853,753 Be sure to complete calculation to 1,264,525 get from EBIT 286,550 to OCF 1,540,475 580 780 (121,964) 921,316 nnual Operating Cash Flow w/ projec 854,452 (179,435) 1,137,518 1,249,538 262,403 1,449,635 erminal Year (2026)Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow Year 2022 2023 324 0 1 2 468,000 $ 921,317 $1,137,518 $ Net Cash Flow each year 2025 3 1,449,636 $ $ Net cash flows 2026 for each year 4 brought down from line 42 1.887.776 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project IRR for Project Questions Based on the figures from your solution, would you recommend that ABC Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc offered his clos g comments and then disconnected the conference call. The call had been with Costco Wholesalers' product development team. Costco wanted BBC to supply the chain with its wholegrain tanort or flatbread. Both parties had put their cards on the table--it was time to make a decision. Today BBC distributes its products in Texas and its 5 neighboring states. The Costco deal was, however, the proverbial game changer. The firm would need to gear up production, and it did not have long. The unsigned contract dictated a staged rollout of BBC's product; the first shipment of flatbread is to arrive at Costco stores in southern states by January 1, 2023. If the products sell well, then other regions would be added. Unfortunately, if the flatbread sells as predicted the current production line would be unable to meet production needs. To thoroughly evaluate the opportunity, BBC has spent $15,000 researching a new production line and the implications of this deal. The finance department has learned that the physical equipment needed to transform the existing bakery line could be purchased for $1.6 million. It would cost another $250,000 to ship and install the equipment. In addition, BBC's staff will need to undergo an intensive training program. This training will cost $10,000, Thus far in year 2022 (Year O), BBC has sold 12,000 cases of flatbread each month at an average selling price of $6.50. If the status quo is maintained-slow steady growth-the firm expects to grow at an 8% annual rate over the next 4 years. However, sales are expected to change dramatically if BBC agrees to sell through Costco- projections indicate that next year (Year 1) the number of cases sold be double those sold in 2022. While unit sales are predicted to shoot upward, Costco has negotiated a lower price, and this means that the average case selling price (average of Costco and existing case price) would drop to $5.25. Then, as more Costco locations are added to the rollout, total annual revenues are projected to increase 30% (year-over-year) in Years 2 and 3, and 10% in Year 4. Today (year 0) total variable and fixed operating costs consume about 50% of revenues. It is anticipated that as a percentage of sales, these costs will increase about one percentage point per year over the next four years. But with the Costco deal, the firm anticipates economies of scale that will reduce total operating costs to about 31% of revenues in Year 1,33% in Years 2 and 3, and 35% in the last year of the project, The anticipated increase in sales will lead to an increase in working capital requirements. Prior to beginning production of the Costco products, a one-time increase of $100,000 in its inventory (flour, shortening, etc.) will be necessary. This will be partially offset by an increase in accounts payable of $45,000. The existing bakery line was installed 6 years ago and had an estimated economic life of 10 years. At that time, BBC paid $750,000 to buy the machinery. The machine is depreciated using straight-line depreciation. Today, it is believed that the existing equipment can be sold for $400,000. BBC's chief financial officer has predicted that the new equipment has a four-year economic life. It will also be depreciated using straight-line depreciation. At the time of replacement/renovation it is estimated that the firm could sell the new equipment for about 20 percent of its original installed cost to another wholesale bakery. BBC is in the 21% marginal tax rate, and the riskiness of this project warrants that is be assigned a 22% cost of capital (AKA, the required rate of return on the project). The firm has unlimited funds to invest and faces no other constraints in its capital budgeting decisions. 18 Equals: Initial Cost (Check Figure) $(1,536,000) 19 20 21 22 Annual Operating Cash Flow (OCFS) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash 24 2022 Year 2023 2024 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936.000 1.60,880 1.091.750 1.179,090 1.273,418 28 with project 1,512.000 1,965,600 2,255,280 2.810,808 29 Change 501,120 873,850 1,376,190 1.537.390 30 Operating costs 31 without project (468.000) (515,549) 567.710 (624.918) 687.646 32 with project (468.720) (648,648) 843,242 983.783 33 Change 46,828 (80.938) (218,324) (296,137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75.000 36 with project (462,500) (462,500) (462.500) (462,500) 37 Change (387,500) (387.500) (387,500) (387,500) 38 Change in EBIT 160.449 405,412 770,365 853,753 "Be sure to 39 complete 40 calculation to 580.780 1.249,538 1,264,525 get from EBIT to 41 (121,964) (179,435) 262,403 286,550 OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 22 Annual Operating Cash Flow (OCF) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash flows 24 2022 2023 2024 Year 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936,000 1,010,880 1,091,750 1,179,090 1,273,418 26 with project 1,512.000 1,955,600 2,255,280 2,810 808 29 Change 501,120 873,850 1,376,190 1,537,390 30 Operating costs 31 without project (468,000) (515,549) 567 710 (624,918) 687646 32 with project (468,720) (648,648) 843,242 983,783 33 Change 46,828 (80,938) (218,324) (296, 137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75,000 36 with project (462,500) (462,500) (462,500) (462,500) 37 Chance (387,500) (387,500) (387,00) (387,500) 38 Change in EBIT "Be sure to 160.449 405,412 770,365 853 753 39 complete calculation to 30 530 780 1 249,538 1,264,525 get from EBIT 41 (121.964) (179,435) 262,403 286,550 to OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 45 G project 1,512,000 501,120 Change 1,965,600 873,850 2,255,280 1,376,190 2,810,808 1,537,390 ating Costs out project project (468,000) (515,549) (468,720) 46,828 567,710 (648,648) (80,938) (624,918) 843 242 (218,324) 687,646 983,783 (296,137) Change s: Change in Depreciation nout project h project Change (75,000) (462,500) (387,500) 160,449 (75,000) (462,500) (387,500) 405,412 (75,000) (462,500) (387,500) 770,365 ange in EBIT 75,000 (462,500) (387,500) 853,753 Be sure to complete calculation to 1,264,525 get from EBIT 286,550 to OCF 1,540,475 580 780 (121,964) 921,316 nnual Operating Cash Flow w/ projec 854,452 (179,435) 1,137,518 1,249,538 262,403 1,449,635 erminal Year (2026)Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow Year 2022 2023 324 0 1 2 468,000 $ 921,317 $1,137,518 $ Net Cash Flow each year 2025 3 1,449,636 $ $ Net cash flows 2026 for each year 4 brought down from line 42 1.887.776 except Y4 is adjusted for terminal year CF found in lines 45-51 NPV for Project IRR for Project Questions Based on the figures from your solution, would you recommend that ABC Yousef Tizir, Jr., CEO of Berber Breads Co. (BBC), Inc offered his clos g comments and then disconnected the conference call. The call had been with Costco Wholesalers' product development team. Costco wanted BBC to supply the chain with its wholegrain tanort or flatbread. Both parties had put their cards on the table--it was time to make a decision. Today BBC distributes its products in Texas and its 5 neighboring states. The Costco deal was, however, the proverbial game changer. The firm would need to gear up production, and it did not have long. The unsigned contract dictated a staged rollout of BBC's product; the first shipment of flatbread is to arrive at Costco stores in southern states by January 1, 2023. If the products sell well, then other regions would be added. Unfortunately, if the flatbread sells as predicted the current production line would be unable to meet production needs. To thoroughly evaluate the opportunity, BBC has spent $15,000 researching a new production line and the implications of this deal. The finance department has learned that the physical equipment needed to transform the existing bakery line could be purchased for $1.6 million. It would cost another $250,000 to ship and install the equipment. In addition, BBC's staff will need to undergo an intensive training program. This training will cost $10,000, Thus far in year 2022 (Year O), BBC has sold 12,000 cases of flatbread each month at an average selling price of $6.50. If the status quo is maintained-slow steady growth-the firm expects to grow at an 8% annual rate over the next 4 years. However, sales are expected to change dramatically if BBC agrees to sell through Costco- projections indicate that next year (Year 1) the number of cases sold be double those sold in 2022. While unit sales are predicted to shoot upward, Costco has negotiated a lower price, and this means that the average case selling price (average of Costco and existing case price) would drop to $5.25. Then, as more Costco locations are added to the rollout, total annual revenues are projected to increase 30% (year-over-year) in Years 2 and 3, and 10% in Year 4. Today (year 0) total variable and fixed operating costs consume about 50% of revenues. It is anticipated that as a percentage of sales, these costs will increase about one percentage point per year over the next four years. But with the Costco deal, the firm anticipates economies of scale that will reduce total operating costs to about 31% of revenues in Year 1,33% in Years 2 and 3, and 35% in the last year of the project, The anticipated increase in sales will lead to an increase in working capital requirements. Prior to beginning production of the Costco products, a one-time increase of $100,000 in its inventory (flour, shortening, etc.) will be necessary. This will be partially offset by an increase in accounts payable of $45,000. The existing bakery line was installed 6 years ago and had an estimated economic life of 10 years. At that time, BBC paid $750,000 to buy the machinery. The machine is depreciated using straight-line depreciation. Today, it is believed that the existing equipment can be sold for $400,000. BBC's chief financial officer has predicted that the new equipment has a four-year economic life. It will also be depreciated using straight-line depreciation. At the time of replacement/renovation it is estimated that the firm could sell the new equipment for about 20 percent of its original installed cost to another wholesale bakery. BBC is in the 21% marginal tax rate, and the riskiness of this project warrants that is be assigned a 22% cost of capital (AKA, the required rate of return on the project). The firm has unlimited funds to invest and faces no other constraints in its capital budgeting decisions. 18 Equals: Initial Cost (Check Figure) $(1,536,000) 19 20 21 22 Annual Operating Cash Flow (OCFS) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash 24 2022 Year 2023 2024 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936.000 1.60,880 1.091.750 1.179,090 1.273,418 28 with project 1,512.000 1,965,600 2,255,280 2.810,808 29 Change 501,120 873,850 1,376,190 1.537.390 30 Operating costs 31 without project (468.000) (515,549) 567.710 (624.918) 687.646 32 with project (468.720) (648,648) 843,242 983.783 33 Change 46,828 (80.938) (218,324) (296,137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75.000 36 with project (462,500) (462,500) (462.500) (462,500) 37 Change (387,500) (387.500) (387,500) (387,500) 38 Change in EBIT 160.449 405,412 770,365 853,753 "Be sure to 39 complete 40 calculation to 580.780 1.249,538 1,264,525 get from EBIT to 41 (121,964) (179,435) 262,403 286,550 OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 22 Annual Operating Cash Flow (OCF) You will need to calculate the difference between the figures if BBC does not 23 do the project versus if it does the project. Those differences determine incremental cash flows 24 2022 2023 2024 Year 2025 2026 25 0 1 2 3 4 26 Revenues 27 without project 936,000 1,010,880 1,091,750 1,179,090 1,273,418 26 with project 1,512.000 1,955,600 2,255,280 2,810 808 29 Change 501,120 873,850 1,376,190 1,537,390 30 Operating costs 31 without project (468,000) (515,549) 567 710 (624,918) 687646 32 with project (468,720) (648,648) 843,242 983,783 33 Change 46,828 (80,938) (218,324) (296, 137) 34 Less: Change in Depreciation 35 without project (75,000) (75,000) (75,000) 75,000 36 with project (462,500) (462,500) (462,500) (462,500) 37 Chance (387,500) (387,500) (387,00) (387,500) 38 Change in EBIT "Be sure to 160.449 405,412 770,365 853 753 39 complete calculation to 30 530 780 1 249,538 1,264,525 get from EBIT 41 (121.964) (179,435) 262,403 286,550 to OCF 42 Annual Operating Cash Flow w/ project 921,316 1,137,518 1,449,635 1,540,475 43 44 Terminal Year (2026) Cash Flow Calculate any adjustments to the OCF for Year 4 as the terminal cash flow 45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started