Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The insurance firm has two objectives. It wants to earn at least 11% per year, and it wishes to immunize its liabilities. It has

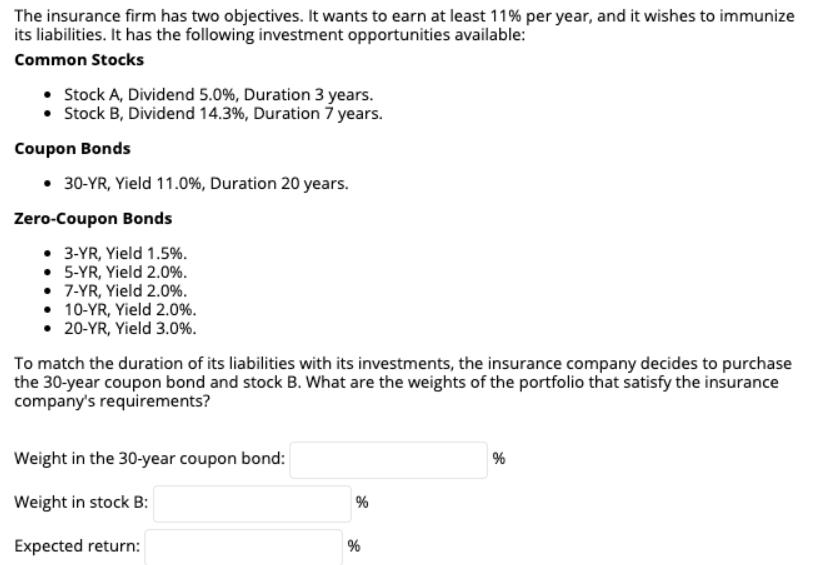

The insurance firm has two objectives. It wants to earn at least 11% per year, and it wishes to immunize its liabilities. It has the following investment opportunities available: Common Stocks Stock A, Dividend 5.0%, Duration 3 years. Stock B, Dividend 14.3%, Duration 7 years. Coupon Bonds 30-YR, Yield 11.0%, Duration 20 years. Zero-Coupon Bonds 3-YR, Yield 1.5%. 5-YR, Yield 2.0%. 7-YR, Yield 2.0%. 10-YR, Yield 2.0%. 20-YR, Yield 3.0%. To match the duration of its liabilities with its investments, the insurance company decides to purchase the 30-year coupon bond and stock B. What are the weights of the portfolio that satisfy the insurance company's requirements? Weight in the 30-year coupon bond: Weight in stock B: Expected return: % % %

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To satisfy the insurance companys requirements we need to find the weights of the 30year coupon bond and stock B in the portfolio Let x Weight in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started