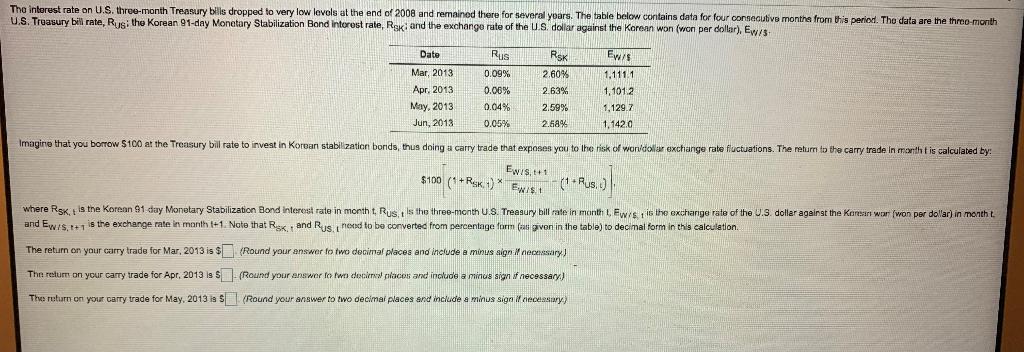

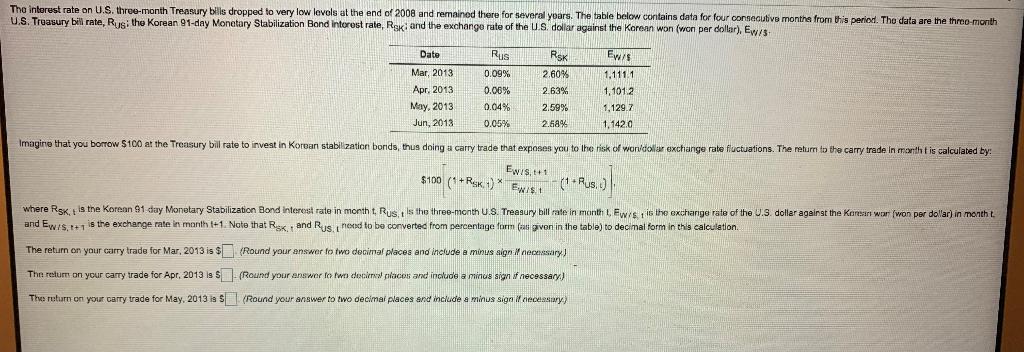

The interest rate an U.S. three-month Treasury bills dropped to very low levels at the end of 2008 and remained there for several years. The table below contains data for four consecutive months from this period. The data are the three month U.S. Treasury bill rate, Rusi the Korean 91-day Monetary Stabilization Bond interost rate, Rski and the exchange rate of the US dollar against the Korean won (won per dollar), Ew/s 0.09% Date Rus RSK EWS Mar, 2013 2.60% 1.1111 Apr. 2013 0.00% 2.63% 1,1012 May, 2013 0.04% 2.59% 1,129,7 Jun, 2013 0.05% 2.58% 1.142.0 Imagine that you borrow $100 at the Treasury bill rate to invest in Korean stabilization bonds, thus doing a carry trade that exposes you to the risk of wordoiar exchange rate fluctuations. The return to the carry trade in monthtis calculated by: EWIS, +++ $100 (*+RK) Ewist where Rsk, is the Korean 91 day Monetary Stabilization Bond Interest rate in month t. Rus, is the three-month US Treasury bill rate in month Lewis is the exchange rate of the U.S. dollar against the Karin war won per dollar) in month and Ewis, + 1 is the exchange rate in month (+1. Note that Rex. and Rus need to be converted from percentage formas aven in the table) to decimal form in this calculation . ) - The return on your carry trade for Mar, 2013 is $(Round your answer to two decimal places and include a minus sign wiry) The return on your carry trade for Apr. 2013 is $- found your answer to two docieras palaces and include a minus sign if necessary) The return on your carty trade for May, 2013 $ $ (Round your answer to two decimal places and include a minus sign if necessary) The interest rate an U.S. three-month Treasury bills dropped to very low levels at the end of 2008 and remained there for several years. The table below contains data for four consecutive months from this period. The data are the three month U.S. Treasury bill rate, Rusi the Korean 91-day Monetary Stabilization Bond interost rate, Rski and the exchange rate of the US dollar against the Korean won (won per dollar), Ew/s 0.09% Date Rus RSK EWS Mar, 2013 2.60% 1.1111 Apr. 2013 0.00% 2.63% 1,1012 May, 2013 0.04% 2.59% 1,129,7 Jun, 2013 0.05% 2.58% 1.142.0 Imagine that you borrow $100 at the Treasury bill rate to invest in Korean stabilization bonds, thus doing a carry trade that exposes you to the risk of wordoiar exchange rate fluctuations. The return to the carry trade in monthtis calculated by: EWIS, +++ $100 (*+RK) Ewist where Rsk, is the Korean 91 day Monetary Stabilization Bond Interest rate in month t. Rus, is the three-month US Treasury bill rate in month Lewis is the exchange rate of the U.S. dollar against the Karin war won per dollar) in month and Ewis, + 1 is the exchange rate in month (+1. Note that Rex. and Rus need to be converted from percentage formas aven in the table) to decimal form in this calculation . ) - The return on your carry trade for Mar, 2013 is $(Round your answer to two decimal places and include a minus sign wiry) The return on your carry trade for Apr. 2013 is $- found your answer to two docieras palaces and include a minus sign if necessary) The return on your carty trade for May, 2013 $ $ (Round your answer to two decimal places and include a minus sign if necessary)