Question

The interest rate or discount rate that will equate the observed market value of a bond to the present value of all its future

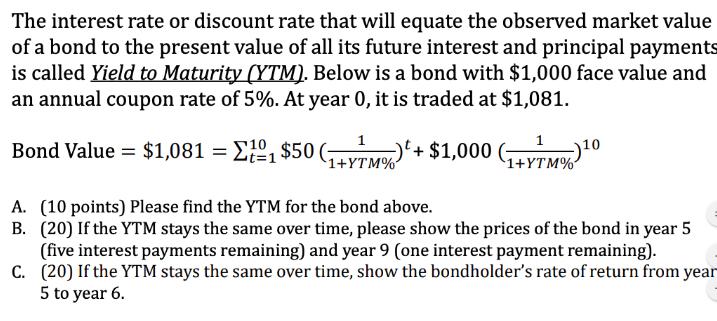

The interest rate or discount rate that will equate the observed market value of a bond to the present value of all its future interest and principal payments is called Yield to Maturity (YTM). Below is a bond with $1,000 face value and an annual coupon rate of 5%. At year 0, it is traded at $1,081. Bond Value = $1,081 = E, $50 s10 )'+ $1,000 1+YTM% 1+YTM% A. (10 points) Please find the YTM for the bond above. B. (20) If the YTM stays the same over time, please show the prices of the bond in year 5 (five interest payments remaining) and year 9 (one interest payment remaining). C. (20) If the YTM stays the same over time, show the bondholder's rate of return from year 5 to year 6.

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Money, Banking, Financial Markets and Institutions

Authors: Michael Brandl

1st edition

538748575, 9781305855885 , 978-0538748575

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App