Briefly explain whether each of The following statements is true or false. 1. In the IS-LM model, if investment spending becomes less sensitive to

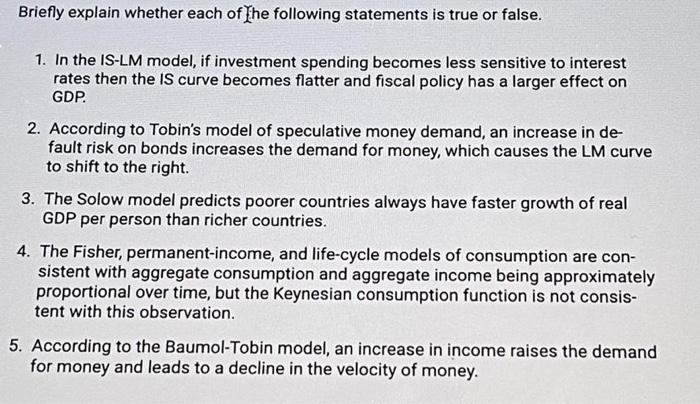

Briefly explain whether each of The following statements is true or false. 1. In the IS-LM model, if investment spending becomes less sensitive to interest rates then the IS curve becomes flatter and fiscal policy has a larger effect on GDP. 2. According to Tobin's model of speculative money demand, an increase in de- fault risk on bonds increases the demand for money, which causes the LM curve to shift to the right. 3. The Solow model predicts poorer countries always have faster growth of real GDP per person than richer countries. 4. The Fisher, permanent-income, and life-cycle models of consumption are con- sistent with aggregate consumption and aggregate income being approximately proportional over time, but the Keynesian consumption function is not consis- tent with this observation. 5. According to the Baumol-Tobin model, an increase in income raises the demand for money and leads to a decline in the velocity of money.

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 False If investment spending becomes less sensitive to interest rates then the IS curve becomes steeper and fiscal policy has a larger effect on GDP The relationship among interest rates re...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started