Answered step by step

Verified Expert Solution

Question

1 Approved Answer

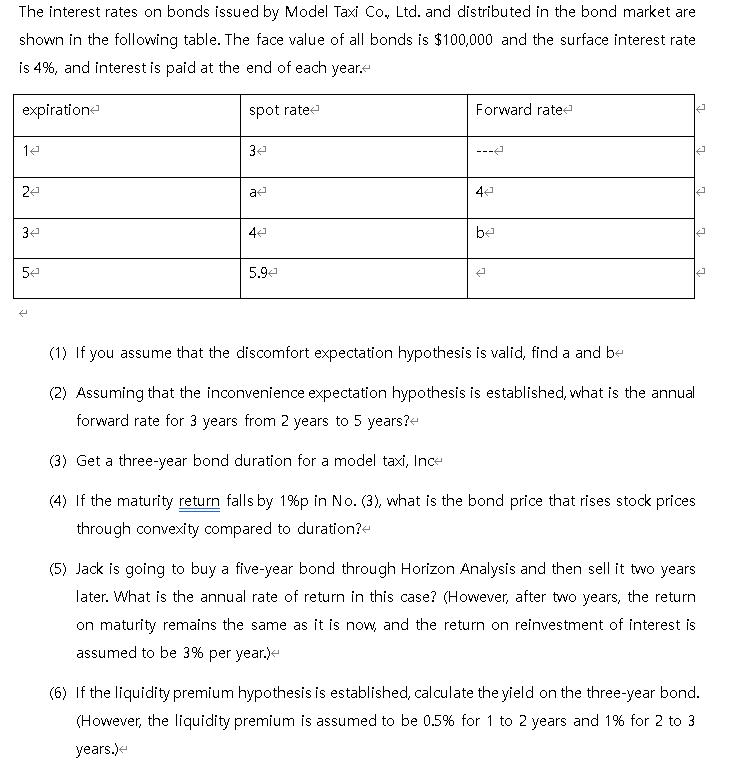

The interest rates on bonds issued by Model Taxi Co., Ltd. and distributed in the bond market are shown in the following table. The

The interest rates on bonds issued by Model Taxi Co., Ltd. and distributed in the bond market are shown in the following table. The face value of all bonds is $100,000 and the surface interest rate is 4%, and interest is paid at the end of each year. < expiration 14 24 34 54 spot rated 34 a 44 5.94 Forward rate < --- 4 be 7 7 (1) If you assume that the discomfort expectation hypothesis is valid, find a and be (2) Assuming that the inconvenience expectation hypothesis is established, what is the annual forward rate for 3 years from 2 years to 5 years? (3) Get a three-year bond duration for a model taxi, Ince (4) If the maturity return falls by 1% p in No. (3), what is the bond price that rises stock prices through convexity compared to duration? (5) Jack is going to buy a five-year bond through Horizon Analysis and then sell it two years later. What is the annual rate of return in this case? (However, after two years, the return on maturity remains the same as it is now, and the return on reinvestment of interest is assumed to be 3% per year.) < (6) If the liquidity premium hypothesis is established, calculate the yield on the three-year bond. (However, the liquidity premium is assumed to be 0.5% for 1 to 2 years and 1% for 2 to 3 years.)

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Heres a revised version of the responses based on the information provided 1 Discomfort Expectation Hypothesis Under the assumption that the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started