Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The intrinsic value of a companys stock, also known as its fundamental value, refers to the stocks true value based on accurate risk and return

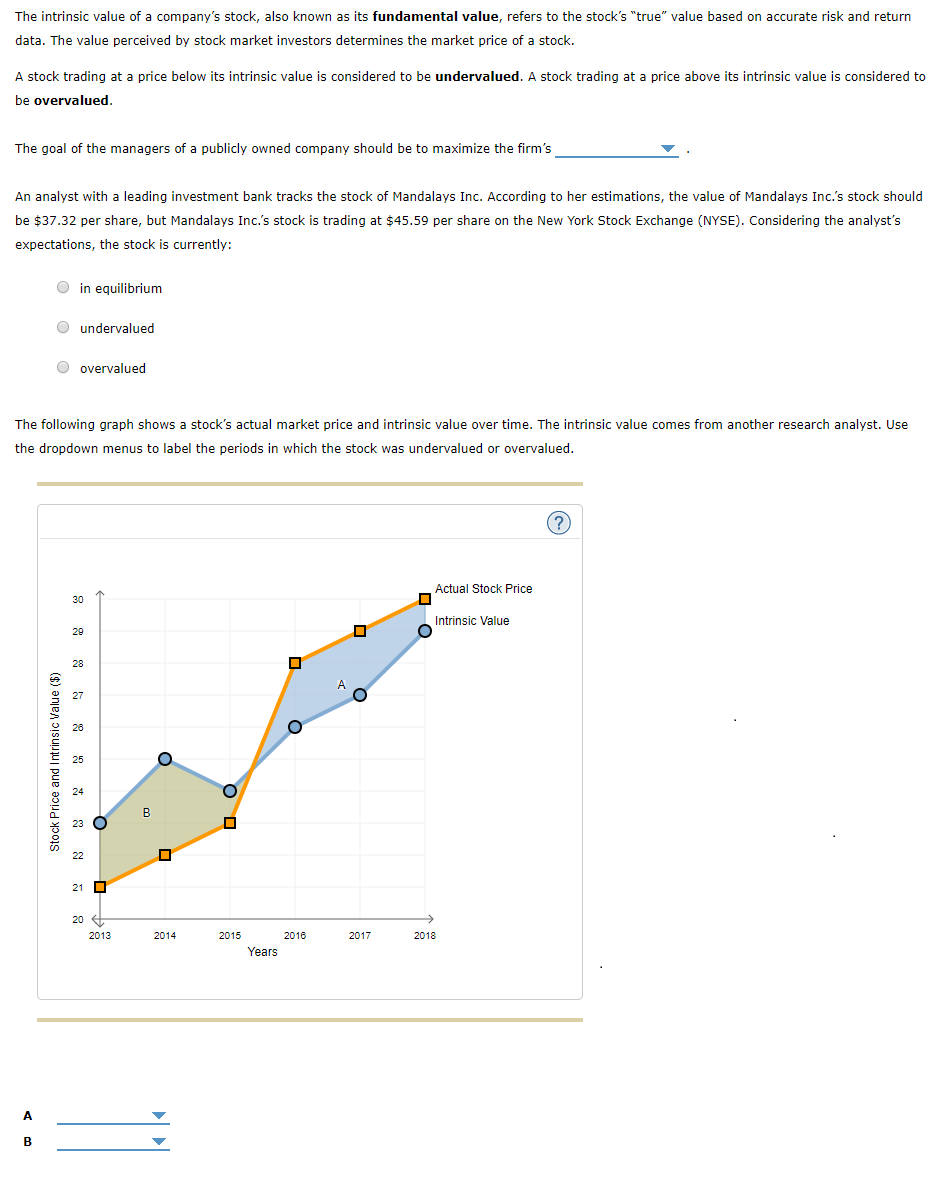

The intrinsic value of a companys stock, also known as its fundamental value, refers to the stocks true value based on accurate risk and return data. The value perceived by stock market investors determines the market price of a stock.A stock trading at a price below its intrinsic value is considered to be undervalued. A stock trading at a price above its intrinsic value is considered to be overvalued.The goal of the managers of a publicly owned company should be to maximize the firmsAn analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.s stock should be $ per share, but Mandalays Inc.s stock is trading at $ per share on the New York Stock Exchange NYSE Considering the analysts expectations, the stock is currently:overvaluedundervaluedin equilibriumThe following graph shows a stocks actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropdown menus to label the periods in which the stock was undervalued or overvalued.Created with Raphal Stock Price and Intrinsic Value $YearsIntrinsic ValueActual Stock PriceBAArea: AB

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started