Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The introduction of GST has thrown open a huge opportunity for the tax consultancy business and Jacob Kurian is one of those professionals actively considering

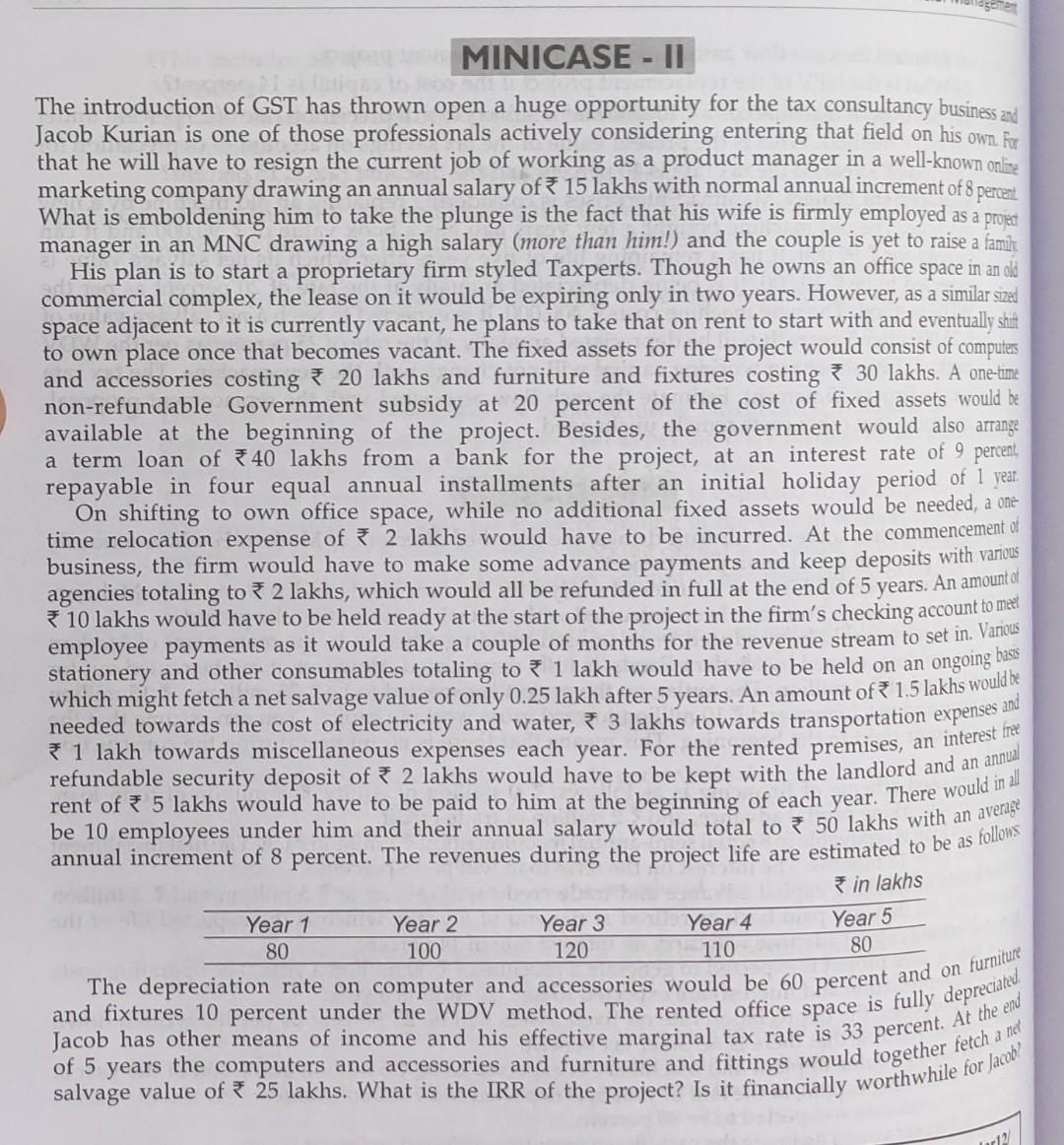

The introduction of GST has thrown open a huge opportunity for the tax consultancy business and Jacob Kurian is one of those professionals actively considering entering that field on his own. For that he will have to resign the current job of working as a product manager in a well-known online marketing company drawing an annual salary of 15 lakhs with normal annual increment of 8 perment What is emboldening him to take the plunge is the fact that his wife is firmly employed as a projet manager in an MNC drawing a high salary (more than him!) and the couple is yet to raise a faml. His plan is to start a proprietary firm styled Taxperts. Though he owns an office space in an did commercial complex, the lease on it would be expiring only in two years. However, as a similar sized space adjacent to it is currently vacant, he plans to take that on rent to start with and eventually shit to own place once that becomes vacant. The fixed assets for the project would consist of computer and accessories costing 20 lakhs and furniture and fixtures costing 30 lakhs. A one-tme non-refundable Government subsidy at 20 percent of the cost of fixed assets would be available at the beginning of the project. Besides, the government would also arrange a term loan of 40 lakhs from a bank for the project, at an interest rate of 9 percent repayable in four equal annual installments after an initial holiday period of 1 year On shifting to own office space, while no additional fixed assets would be needed, a one time relocation expense of 2 lakhs would have to be incurred. At the commencement of business, the firm would have to make some advance payments and keep deposits with various agencies totaling to 2 lakhs, which would all be refunded in full at the end of 5 years. An amountlol 10 lakhs would have to be held ready at the start of the project in the firm's checking account to met employee payments as it would take a couple of months for the revenue stream to set in. Varios stationery and other consumables totaling to 1 lakh would have to be held on an ongoing bass which might fetch a net salvage value of only 0.25 lakh after 5 years. An amount of 1.5 lakhs would he needed towards the cost of electricity and water, 3 lakhs towards transportation expenses and 1 lakh towards miscellaneous expenses each year. For the rented premises, an interest frit refundable security deposit of 2 lakhs would have to be kept with the landlord and an rent of 5 lakhs would have to be paid to him at the beginning of each year. There would in 2 be 10 employees under him and their annual salary would total to 50 lakhs with an average annual increment of 8 percent. The revenues during the project life are estimated to be as follows in lakhs The depreciation rate on computer and accessories would be 60 percent a and fixtures 10 percent under the WDV method. The rented office space is fully salvage value of 25 lakhs. What is the IRR of the project? Is it financially worthw

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started