Answered step by step

Verified Expert Solution

Question

1 Approved Answer

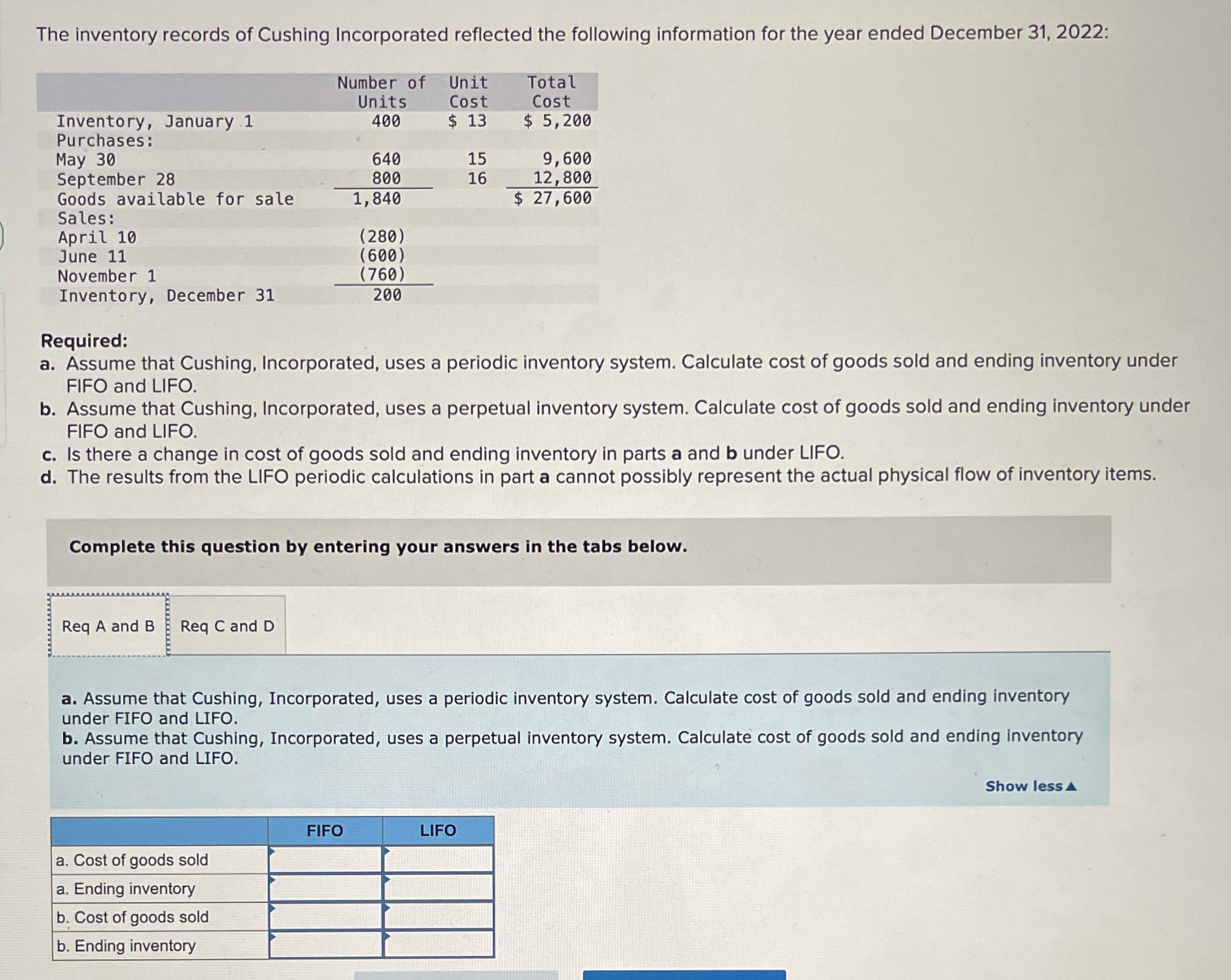

The inventory records of Cushing Incorporated reflected the following information for the year ended December 31, 2022: Number of Unit Total Units Cost Cost

The inventory records of Cushing Incorporated reflected the following information for the year ended December 31, 2022: Number of Unit Total Units Cost Cost Inventory, January 1 400 $ 13 Purchases: May 30 640 15 September 28 800 16 Goods available for sale 1,840 $5,200 9,600 12,800 $ 27,600 Sales: April 10 (280) June 11 (600) November 1 (760) Inventory, December 31 200 Required: a. Assume that Cushing, Incorporated, uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. b. Assume that Cushing, Incorporated, uses a perpetual inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. c. Is there a change in cost of goods sold and ending inventory in parts a and b under LIFO. d. The results from the LIFO periodic calculations in part a cannot possibly represent the actual physical flow of inventory items. Complete this question by entering your answers in the tabs below. Req A and B Req C and D a. Assume that Cushing, Incorporated, uses a periodic inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. b. Assume that Cushing, Incorporated, uses a perpetual inventory system. Calculate cost of goods sold and ending inventory under FIFO and LIFO. FIFO LIFO a. Cost of goods sold a. Ending inventory b. Cost of goods sold b. Ending inventory Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started