Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The invesment should or should not be made as the B/C ratio is Greater than, lower than or equal to 1? A local municipality is

The invesment should or should not be made as the B/C ratio is Greater than, lower than or equal to 1?

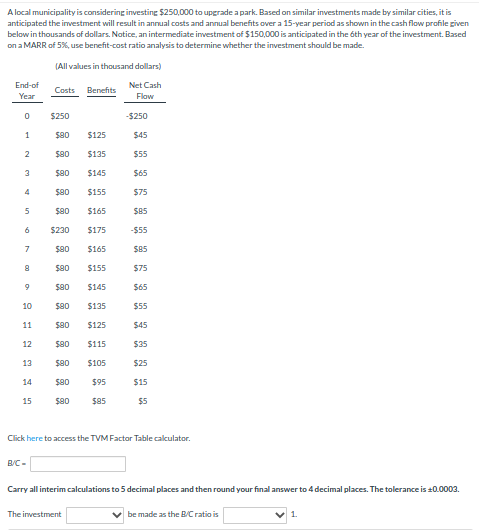

A local municipality is considering investine $250,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the irvestment will result in annual costs and annual benefits over a 15 -year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $150,000 is anticipated in the 6th year of the irwestment. Based on a MARR of 5%, use benefit-cost ratio analysis to determine whether the investment should be made. (All values in thousand dollars) Click here to access the TVM Factor Table cakulator. BCC= Carry all interim calculations to 5 decimal places and then round your final answer to 4 decimal places. The tolerance is 0.0003. The irwestment be made as the B/C ratio is 1. A local municipality is considering investine $250,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the irvestment will result in annual costs and annual benefits over a 15 -year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $150,000 is anticipated in the 6th year of the irwestment. Based on a MARR of 5%, use benefit-cost ratio analysis to determine whether the investment should be made. (All values in thousand dollars) Click here to access the TVM Factor Table cakulator. BCC= Carry all interim calculations to 5 decimal places and then round your final answer to 4 decimal places. The tolerance is 0.0003. The irwestment be made as the B/C ratio is 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started