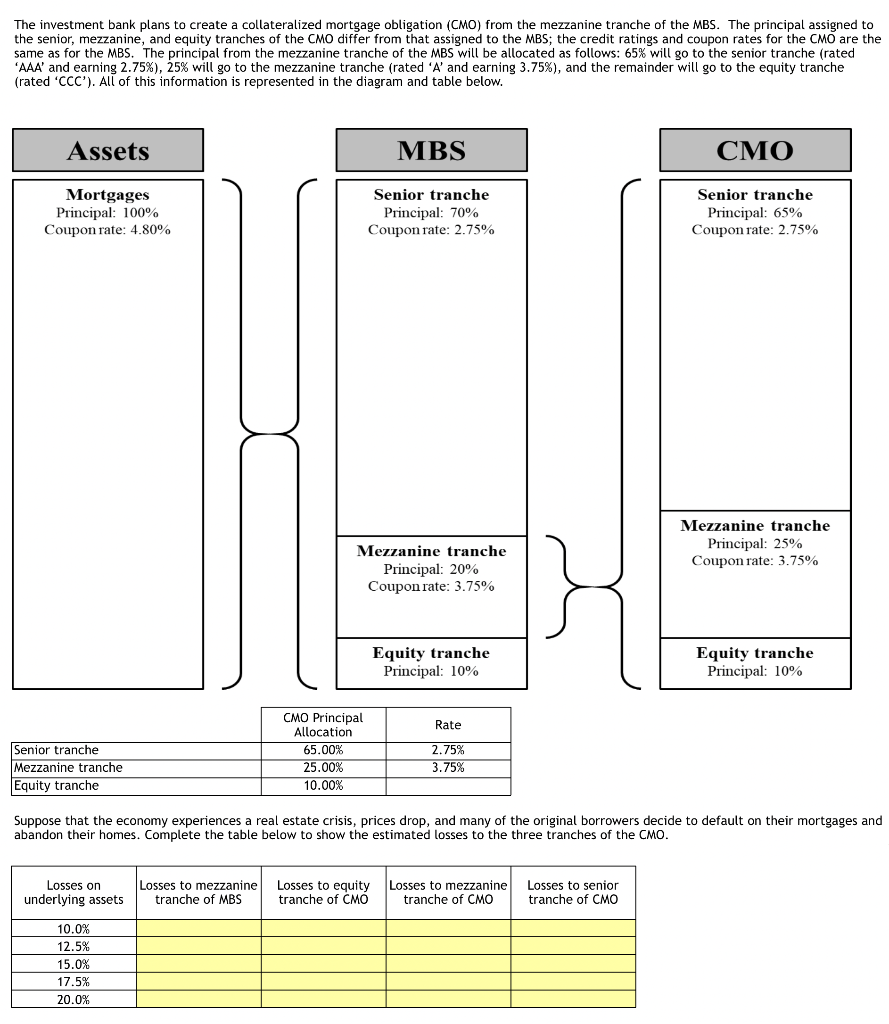

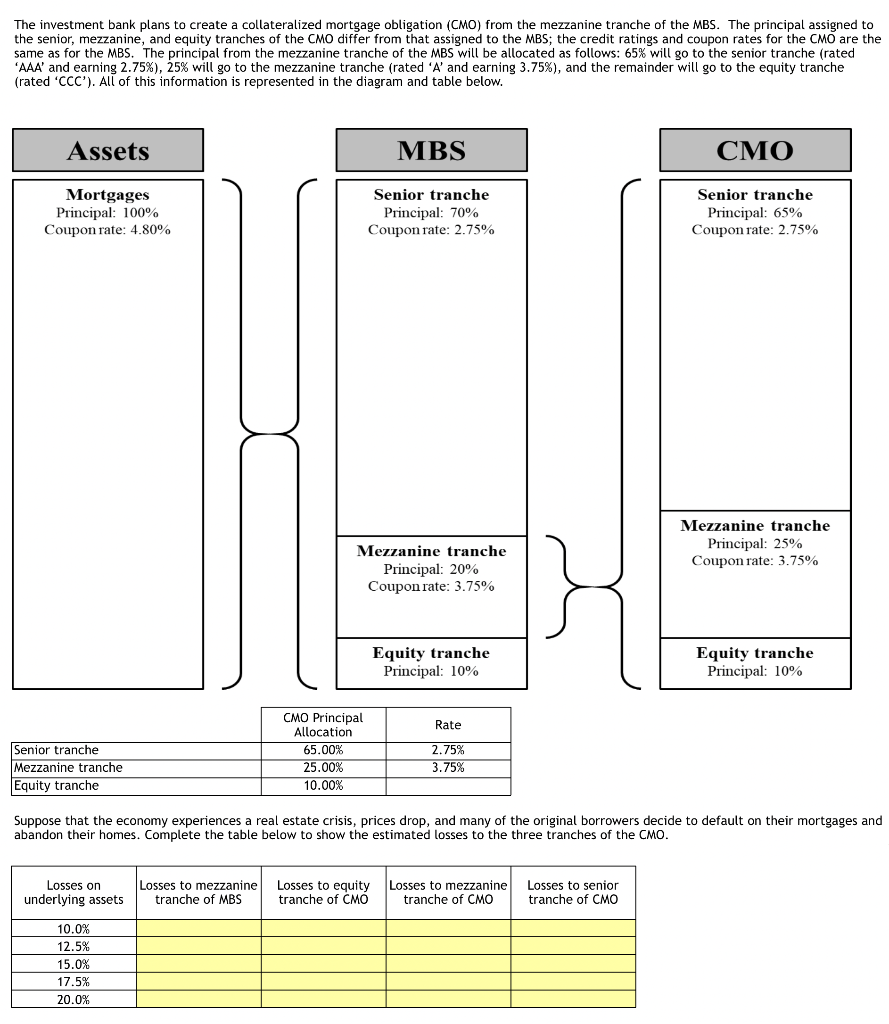

The investment bank plans to create a collateralized mortgage obligation (CMO) from the mezzanine tranche of the MBS. The principal assigned to the senior, mezzanine, and equity tranches of the CMO differ from that assigned to the MBS; the credit ratings and coupon rates for the CMO are the same as for the MBS. The principal from the mezzanine tranche of the MBS will be allocated as follows: 65% will go to the senior tranche (rated 'AAA' and earning 2.75%), 25% will go to the mezzanine tranche (rated 'A' and earning 3.75%), and the remainder will go to the equity tranche (rated 'CCC'). All of this information is represented in the diagram and table below. Assets MBS CMO Mortgages Principal: 100% Coupon rate: 4.80% Senior tranche Principal: 70% Coupon rate: 2.75% Senior tranche Principal: 65% Coupon rate: 2.75% Mezzanine tranche Principal: 25% Coupon rate: 3.75% Mezzanine tranche Principal: 20% Coupon rate: 3.75% Equity tranche Principal: 10% Equity tranche Principal: 10% Rate Senior tranche Mezzanine tranche Equity tranche CMO Principal Allocation 65.00% 25.00% 10.00% 2.75% 3.75% Suppose that the economy experiences a real estate crisis, prices drop, and many of the original borrowers decide to default on their mortgages and abandon their homes. Complete the table below to show the estimated losses to the three tranches of the CMO. Losses on underlying assets Losses to mezzanine tranche of MBS Losses to equity tranche of CMO Losses to mezzanine tranche of CMO Losses to senior tranche of CMO 10.0% 12.5% 15.0% 17.5% 20.0% The investment bank plans to create a collateralized mortgage obligation (CMO) from the mezzanine tranche of the MBS. The principal assigned to the senior, mezzanine, and equity tranches of the CMO differ from that assigned to the MBS; the credit ratings and coupon rates for the CMO are the same as for the MBS. The principal from the mezzanine tranche of the MBS will be allocated as follows: 65% will go to the senior tranche (rated 'AAA' and earning 2.75%), 25% will go to the mezzanine tranche (rated 'A' and earning 3.75%), and the remainder will go to the equity tranche (rated 'CCC'). All of this information is represented in the diagram and table below. Assets MBS CMO Mortgages Principal: 100% Coupon rate: 4.80% Senior tranche Principal: 70% Coupon rate: 2.75% Senior tranche Principal: 65% Coupon rate: 2.75% Mezzanine tranche Principal: 25% Coupon rate: 3.75% Mezzanine tranche Principal: 20% Coupon rate: 3.75% Equity tranche Principal: 10% Equity tranche Principal: 10% Rate Senior tranche Mezzanine tranche Equity tranche CMO Principal Allocation 65.00% 25.00% 10.00% 2.75% 3.75% Suppose that the economy experiences a real estate crisis, prices drop, and many of the original borrowers decide to default on their mortgages and abandon their homes. Complete the table below to show the estimated losses to the three tranches of the CMO. Losses on underlying assets Losses to mezzanine tranche of MBS Losses to equity tranche of CMO Losses to mezzanine tranche of CMO Losses to senior tranche of CMO 10.0% 12.5% 15.0% 17.5% 20.0%