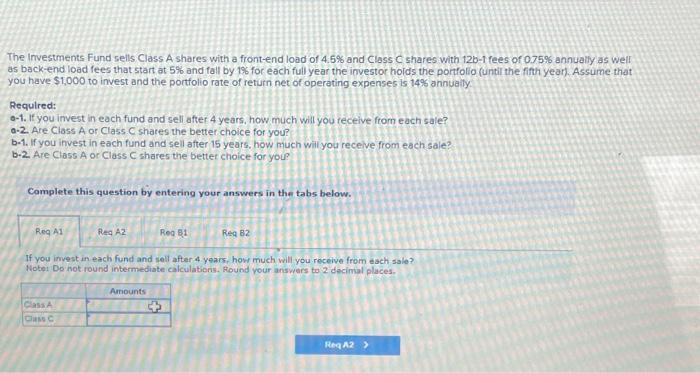

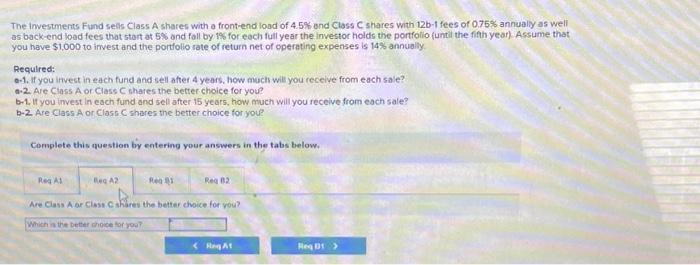

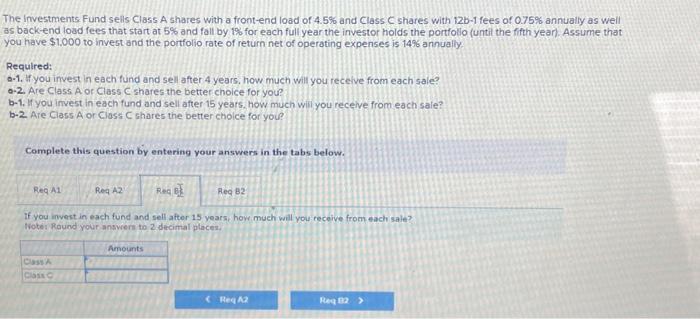

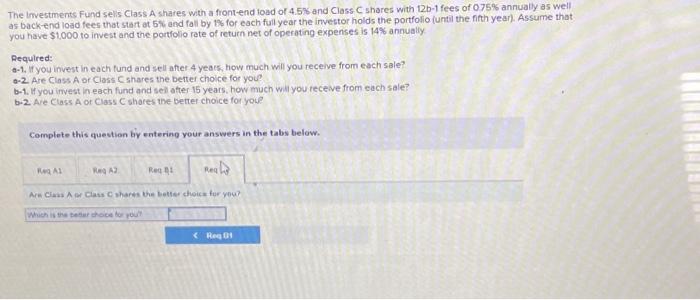

The investments Fund selis Class A shares with a front-end load of 4.5% and Class C shares with 12b1 fees of 0.75% annualiy as well as back-end load fees that stant at 5% and fall by 195 for each full year the investoc holds the portfolio (until the fifh year). Assume that you have $1,000 to imvest and the portiolio rate of return net of operating expenses is 14% annually. Requlred: Q.1. If you invest in each fund and sell after 4 years, how much will you receive from each sale? a.2. Are Class A or Class C shares the better choice for you? b-1. If you invest in each fund and sell after 15 years, how much will you receive from each sale? b-2 Are Class A or Class C shares the better choice for you? Complete this question by entering your answers in the tabs below. Are Class A ar Class C shares the better choice for vow? The imvestments Fund selis Class A shares with a frontend load of 4.5% and Class C shares with 12b1 fees of 075% annually as well as backend load fees that start at 5% and fall by 1% for each full year the investor holds the portfolio (until the finth year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 14% annually. Required: Q-1. If you invest in each fund and sell after 4 yeass, how much will you receive from each sale? 0-2. Are Class A or Class C shares the better choice for you b-1. If you invest in each fund and sell atter 15 years, how much will you receive from each sale? b.2. Are Class A or Class C shares the better choice for you? Complete this question by entering your answers in the tabs below. Ars Ciess A or Class C sharks be better choisa fue you? The Investments Fund sells Class A shares with a frontend load of 4.5% and Class C shares with 12b1 fees of 0.75% annually as well as back-end load fees that start at 5% and fall by 19 for each full year the investor holds the porfolio (until the finh year). Assume that you have $1,000 to invest and the portfolio rate of return net of operating expenses is 149% annualiy. Required: Q-1. If you invest in each fund and sell after 4 years, how much will you teceive from each sale? 0.2. Are Class A or Class C shares the better choice for you? b-1. If you invest in each fund and sell after 15 years. how much will you recelve from each sale? b-2. Are Class A or Class C shares the better choice for you? Complete this question by entering your answers in the tabs below. If you imvest in each fund and sell after 4 years, how much will you receive from each sale? Notei Do not round intermediate calculations, Round vour answars to 2 decimal places. The investments. Fund sells Class A shares with a front-end load of 4.5% and Class C shares with 12b1 fees of 0.75% annually as well as backend load fees that start at 5% and fall by 1% for each full year the investor holds the portfotlo (until the fifth year). Assume that you have $1.000 to invest and the portfolio rate of return net of operating expenses is 14% annually. Required: Q-1. If you invest in each fund and sell after 4 years, how much will you recelve from each sale? 0-2. Are Class A or Class C shares the better choice for you? b-1. If you invest in each fund and sell after 15 years, how much will you recelve from each sale? b-2. Are Class A or Class C shares the better cholce for you? Complete this question by entering your answers in the tabs below. If you invest in each fund and sell after 15 years, how much will you receive from each sale? froter Round your answern to 2 decimal places