Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The investments of Steelers Inc. Include a single investment: 12,800 shares of Bengals Inc. common stock purchased on September 12, 20Y7, for $13 per

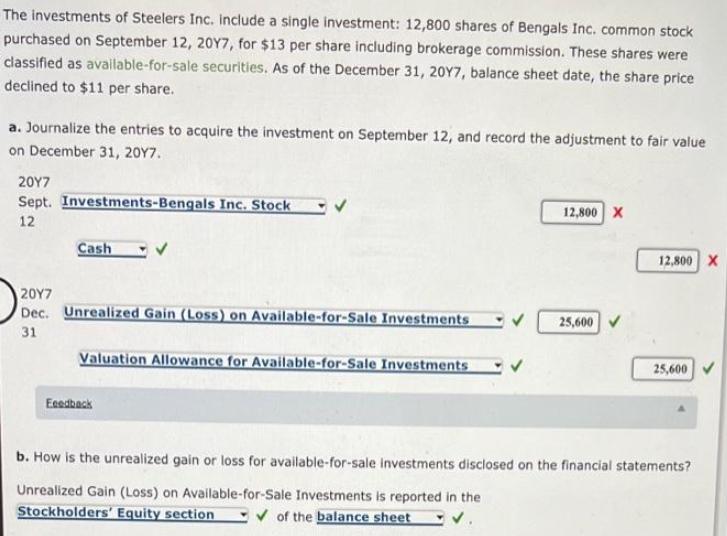

The investments of Steelers Inc. Include a single investment: 12,800 shares of Bengals Inc. common stock purchased on September 12, 20Y7, for $13 per share including brokerage commission. These shares were classified as available-for-sale securities. As of the December 31, 20Y7, balance sheet date, the share price declined to $11 per share. a. Journalize the entries to acquire the investment on September 12, and record the adjustment to fair value on December 31, 20Y7. 207 Sept. Investments-Bengals Inc. Stock 12,800 X 12 Cash 12,800 X 20Y7 Dec. Unrealized Gain (Loss) on Available-for-Sale Investments 25,600 V 31 Valuation Allowance for Available-for-Sale Investments 25,600 Easdback b. How is the unrealized gain or loss for available-for-sale investments disclosed on the financial statements? Unrealized Gain (Loss) on Available-for-Sale Investments is reported in the Stockholders' Equity section V of the balance sheet

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A Journalize the entries to acquire the investment as shown below General Journa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started