The January 22, 2008, press release of the Federal Open Market Committee (FOMC) states that the FOMC decided to lower its target for the federal

The January 22, 2008, press release of the Federal Open Market Committee (FOMC) states that the FOMC "decided to lower its target for the federal funds rate by 75 basis points to 3½ percent." The press release goes on to say that "In a related action the Board of Governors approved a 75-basis point decrease in the discount rate to 4 percent."

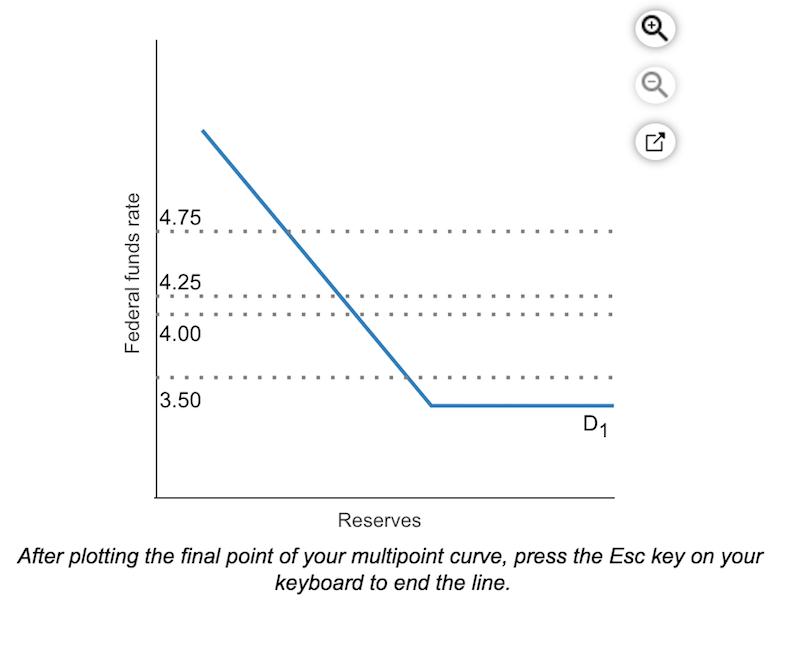

Using a demand and supply graph for the federal funds market, show the equilibrium federal funds rate and the discount rate before the policy action of January 22, 2008, when the federal funds rate was 4¼ percent and the discount rate 4¾ percent.Then, use your graph to explain how the Fed would lower the federal funds rate by 75 basis points (0.25%). Also show in your graph the 75-basis point decrease in the discount rate.

1.) Using the multipoint curve drawing tool, draw a supply curve that illustrates equilibrium in the federal funds market before the policy

action. Label this curve'Upper S 1S1'.

2.) Using the multipoint curve drawingtool, illustrate what would happen in the federal funds market when the Fed lowers the federal funds rate by 75 basis points. Properly label your curve. Carefully follow the instructions above, and only draw the required objects.

4.75 4.25 4.00 3.50 D1 Reserves After plotting the final point of your multipoint curve, press the Esc key on your keyboard to end the line. Federal funds rate

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started