Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Johnny Pickles Brewing Company has been successful as a small craft microbrewery with a focus on distributing its products to bars and restaurants.

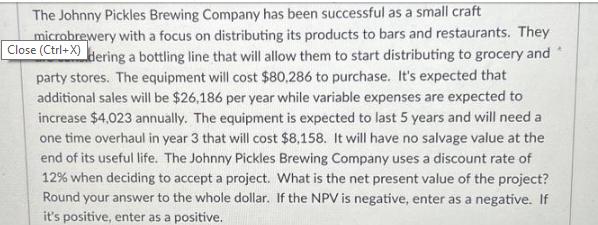

The Johnny Pickles Brewing Company has been successful as a small craft microbrewery with a focus on distributing its products to bars and restaurants. They Close (Ctrl+X) dering a bottling line that will allow them to start distributing to grocery and party stores. The equipment will cost $80,286 to purchase. It's expected that additional sales will be $26,186 per year while variable expenses are expected to increase $4,023 annually. The equipment is expected to last 5 years and will need a one time overhaul in year 3 that will cost $8,158. It will have no salvage value at the end of its useful life. The Johnny Pickles Brewing Company uses a discount rate of 12% when deciding to accept a project. What is the net present value of the project? Round your answer to the whole dollar. If the NPV is negative, enter as a negative. If it's positive, enter as a positive.

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project we need to determine the present value of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started