Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Johnson & Johnson Company need a new machine to keep up with technological changes The machine has an estimated useful life of four

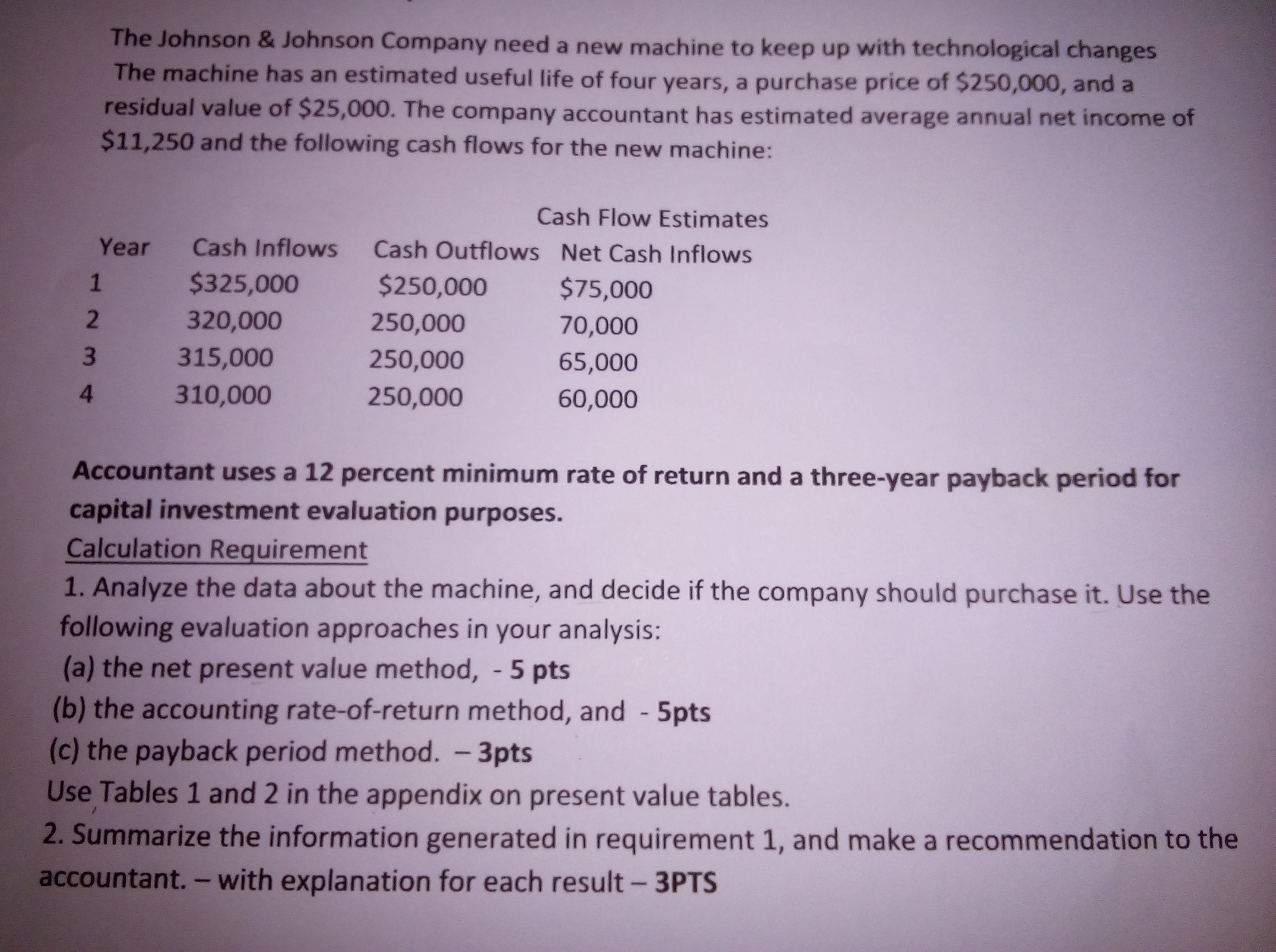

The Johnson & Johnson Company need a new machine to keep up with technological changes The machine has an estimated useful life of four years, a purchase price of $250,000, and a residual value of $25,000. The company accountant has estimated average annual net income of $11,250 and the following cash flows for the new machine: Cash Flow Estimates Year Cash Inflows Cash Outflows Net Cash Inflows $325,000 1 $250,000 $75,000 2 320,000 250,000 70,000 3 315,000 250,000 65,000 4 310,000 250,000 60,000 Accountant uses a 12 percent minimum rate of return and a three-year payback period for capital investment evaluation purposes. Calculation Requirement 1. Analyze the data about the machine, and decide if the company should purchase it. Use the following evaluation approaches in your analysis: (a) the net present value method, - 5 pts (b) the accounting rate-of-return method, and - 5pts (c) the payback period method. - 3pts Use Tables 1 and 2 in the appendix on present value tables. 2. Summarize the information generated in requirement 1, and make a recommendation to the accountant. - with explanation for each result - 3PTS

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

a The net percent value method Year 0 1 2 3 4 Cash inflows 325000 320000 315000 310000 Cash outflows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started