Answered step by step

Verified Expert Solution

Question

1 Approved Answer

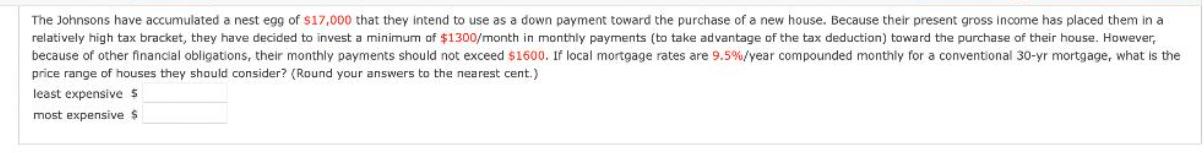

The Johnsons have accumulated a nest egg of $17,000 that they intend to use as a down payment toward the purchase of a new

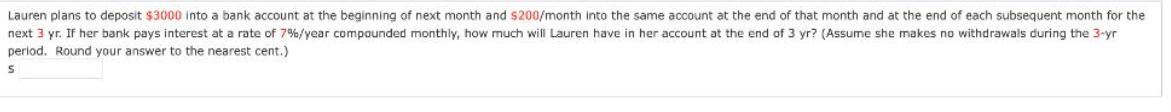

The Johnsons have accumulated a nest egg of $17,000 that they intend to use as a down payment toward the purchase of a new house. Because their present gross income has placed them in a relatively high tax bracket, they have decided to invest a minimum of $1300/month in monthly payments (to take advantage of the tax deduction) toward the purchase of their house. However, because of other financial obligations, their monthly payments should not exceed $1600. If local mortgage rates are 9.5%/year compounded monthly for a conventional 30-yr mortgage, what is the price range of houses they should consider? (Round your answers to the nearest cent.) least expensive s most expensive $ Lauren plans to deposit $3000 into a bank account at the beginning of next month and $200/month into the same account at the end of that month and at the end of each subsequent month for the next 3 yr. If her bank pays interest at a rate of 7 %/year compounded monthly, how much will Lauren have in her account at the end of 3 yr? (Assume she makes no withdrawals during the 3-yr period. Round your answer to the nearest cent.) S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started