Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Kerry Company and it's 85% owned subsidiary (Edwards Corporation) uses the DIRECT METHOD to prepare its statement of cash flows. Consolidated TRIAL BALANCE totals

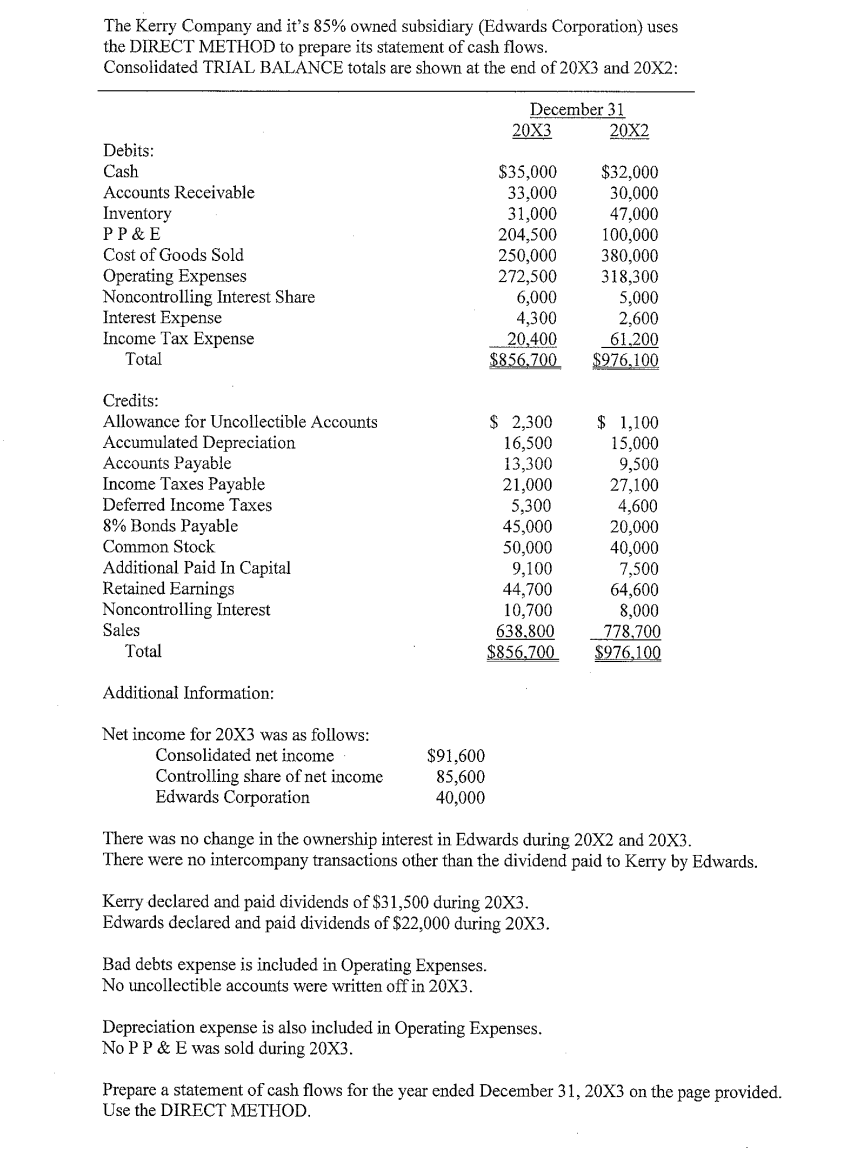

The Kerry Company and it's 85% owned subsidiary (Edwards Corporation) uses the DIRECT METHOD to prepare its statement of cash flows. Consolidated TRIAL BALANCE totals are shown at the end of 20X3 and 20X2: Ne There was no change in the ownership interest in Edwards during 20X2 and 20X3. There were no intercompany transactions other than the dividend paid to Kerry by Edwards. Kerry declared and paid dividends of $31,500 during 20X3. Edwards declared and paid dividends of $22,000 during 203. Bad debts expense is included in Operating Expenses. No uncollectible accounts were written off in 20X3. Depreciation expense is also included in Operating Expenses. No P P \& E was sold during 20X3. Prepare a statement of cash flows for the year ended December 31, 20X3 on the page provided. Use the DIRECT METHOD

The Kerry Company and it's 85% owned subsidiary (Edwards Corporation) uses the DIRECT METHOD to prepare its statement of cash flows. Consolidated TRIAL BALANCE totals are shown at the end of 20X3 and 20X2: Ne There was no change in the ownership interest in Edwards during 20X2 and 20X3. There were no intercompany transactions other than the dividend paid to Kerry by Edwards. Kerry declared and paid dividends of $31,500 during 20X3. Edwards declared and paid dividends of $22,000 during 203. Bad debts expense is included in Operating Expenses. No uncollectible accounts were written off in 20X3. Depreciation expense is also included in Operating Expenses. No P P \& E was sold during 20X3. Prepare a statement of cash flows for the year ended December 31, 20X3 on the page provided. Use the DIRECT METHOD Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started