Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $605,000 for services rendered to its clients

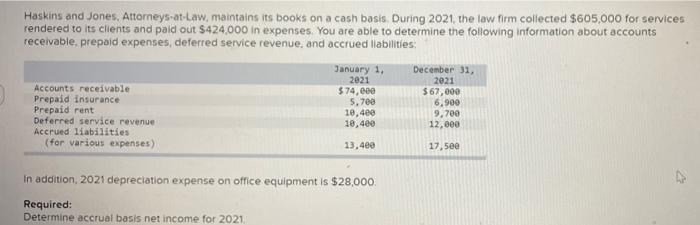

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $605,000 for services rendered to its clients and paid out $424,000 in expenses. You are able to determine the following information about accounts receivable, prepaid expenses, deferred service revenue, and accrued liabilities: Accounts receivable Prepaid insurance Prepaid rent Deferred service revenue Accrued liabilities (for various expenses) January 1, 2021 $74,000 5,700 10,400 10,400 13,400 In addition, 2021 depreciation expense on office equipment is $28,000. Required: Determine accrual basis net income for 2021. December 31, 2021 $67,000 6,900 9,700 12,000 17,500

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

D eter mine acc ru al basis net income for 2021 ANS WER Acc ru al basis net income for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started