Answered step by step

Verified Expert Solution

Question

1 Approved Answer

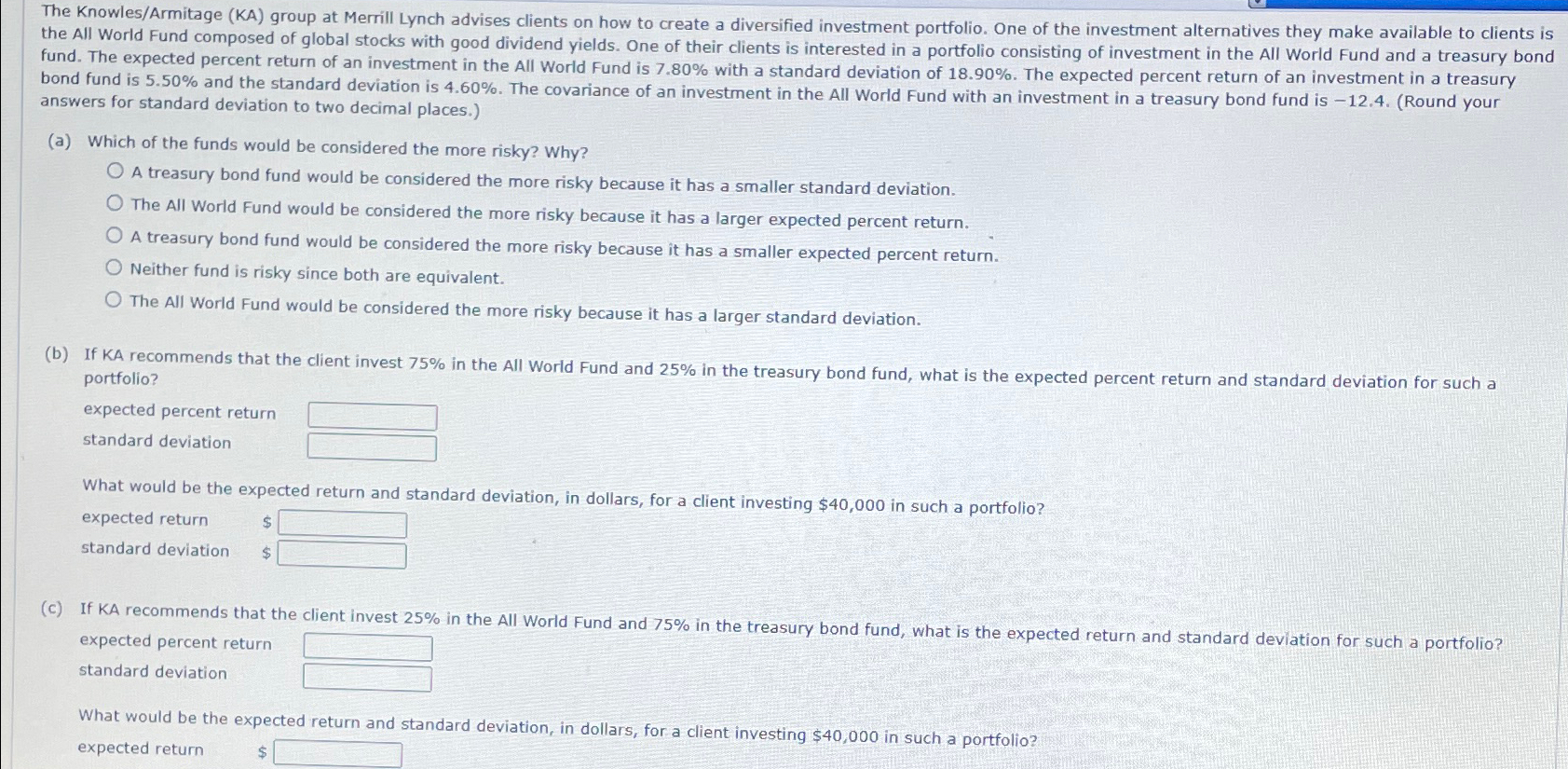

The Knowles / Armitage ( KA ) group at Merrill Lynch advises clients on how to create a diversified investment portfolio. One of the investment

The KnowlesArmitage KA group at Merrill Lynch advises clients on how to create a diversified investment portfolio. One of the investment alternatives they make available to clients is the All World Fund composed of global stocks with good dividend yields. One of their clients is interested in a portfolio consisting of investment in the All World Fund and a treasury bond fund. The expected percent return of an investment in the All World Fund is with a standard deviation of The expected percent return of an investment in a treasury bond fund is and the standard deviation is The covariance of an investment in the All World Fund with an investment in a treasury bond fund is Round your answers for standard deviation to two decimal places.

a Which of the funds would be considered the more risky? Why?

A treasury bond fund would be considered the more risky because it has a smaller standard deviation.

The All World Fund would be considered the more risky because it has a larger expected percent return.

A treasury bond fund would be considered the more risky because it has a smaller expected percent return.

Neither fund is risky since both are equivalent.

The All World Fund would be considered the more risky because it has a larger standard deviation.

b If KA recommends that the client invest in the All World Fund and in the treasury bond fund, what is the expected percent return and standard deviation for such a portfolio?

expected percent return

standard deviation

What would be the expected return and standard deviation, in dollars, for a client investing $ in such a portfolio?

tableexpected return,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started