Answered step by step

Verified Expert Solution

Question

1 Approved Answer

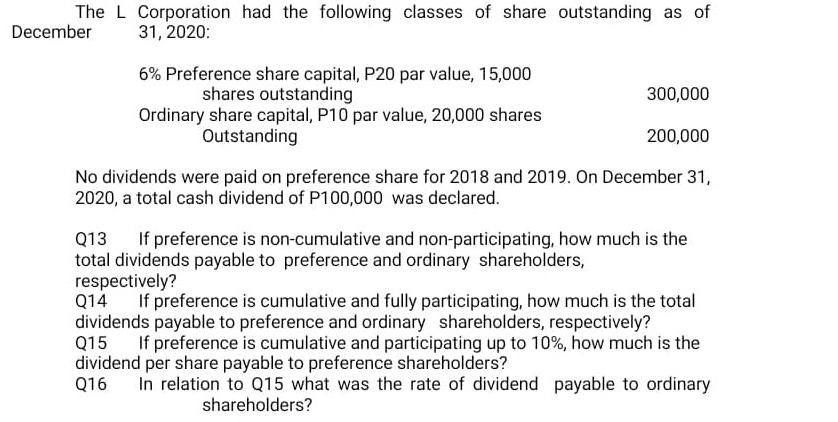

The L Corporation had the following classes of share outstanding as of December 31, 2020: 6% Preference share capital, P20 par value, 15,000 shares

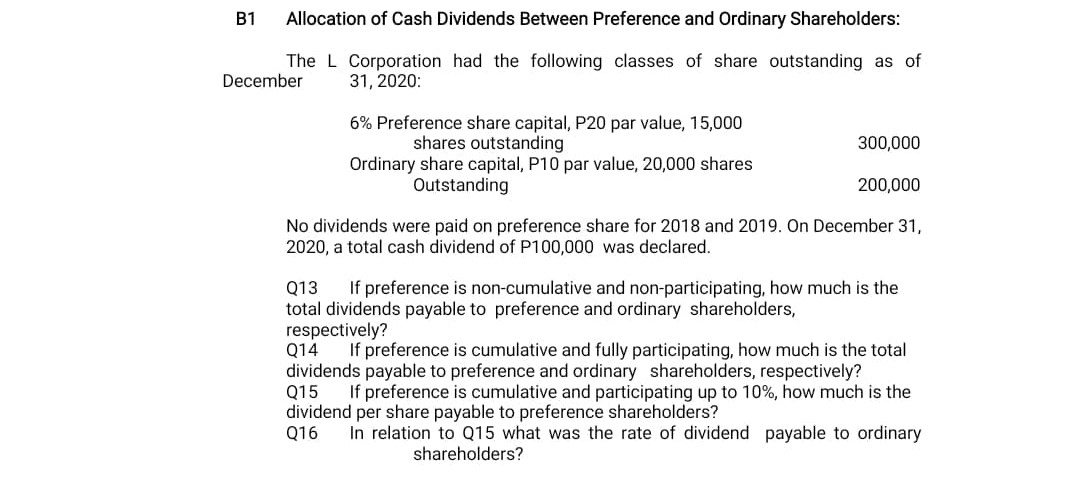

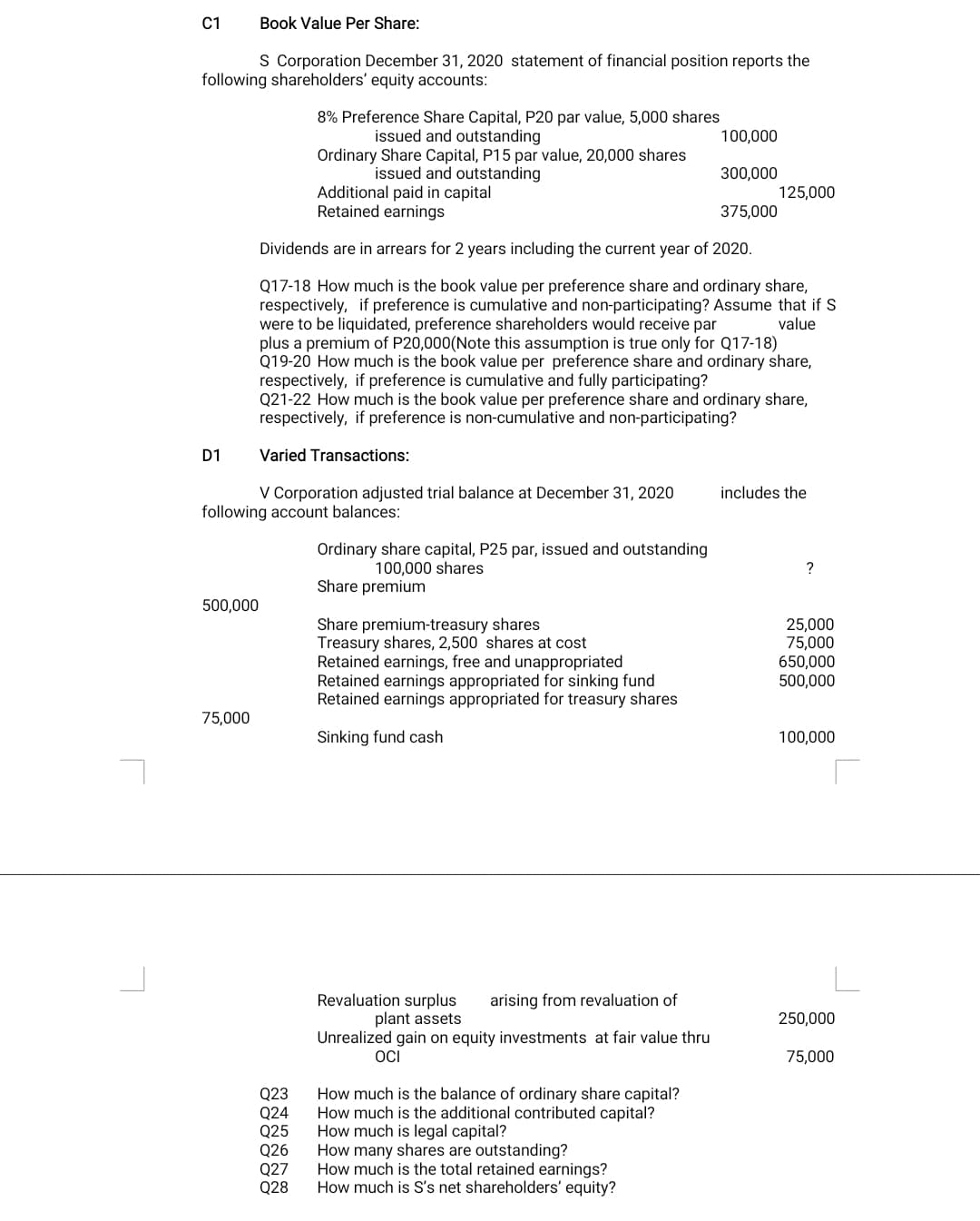

The L Corporation had the following classes of share outstanding as of December 31, 2020: 6% Preference share capital, P20 par value, 15,000 shares outstanding Ordinary share capital, P10 par value, 20,000 shares Outstanding 300,000 200,000 No dividends were paid on preference share for 2018 and 2019. On December 31, 2020, a total cash dividend of P100,000 was declared. Q13 If preference is non-cumulative and non-participating, how much is the total dividends payable to preference and ordinary shareholders, respectively? Q14 If preference is cumulative and fully participating, how much is the total dividends payable to preference and ordinary shareholders, respectively? If preference is cumulative and participating up to 10%, how much is the dividend per share payable to preference shareholders? Q16 In relation to Q15 what was the rate of dividend payable to ordinary shareholders? B1 Allocation of Cash Dividends Between Preference and Ordinary Shareholders: The L Corporation had the following classes of share outstanding as of 31, 2020: December 6% Preference share capital, P20 par value, 15,000 shares outstanding Ordinary share capital, P10 par value, 20,000 shares Outstanding 300,000 200,000 No dividends were paid on preference share for 2018 and 2019. On December 31, 2020, a total cash dividend of P100,000 was declared. Q13 If preference is non-cumulative and non-participating, how much is the total dividends payable to preference and ordinary shareholders, respectively? Q14 If preference is cumulative and fully participating, how much is the total dividends payable to preference and ordinary shareholders, respectively? Q15 If preference is cumulative and participating up to 10%, how much is the dividend per share payable to preference shareholders? Q16 In relation to Q15 what was the rate of dividend payable to ordinary shareholders? C1 Book Value Per Share: S Corporation December 31, 2020 statement of financial position reports the following shareholders' equity accounts: 8% Preference Share Capital, P20 par value, 5,000 shares issued and outstanding 100,000 Ordinary Share Capital, P15 par value, 20,000 shares issued and outstanding 300,000 Additional paid in capital 125,000 Retained earnings 375,000 Dividends are in arrears for 2 years including the current year of 2020. value Q17-18 How much is the book value per preference share and ordinary share, respectively, if preference is cumulative and non-participating? Assume that if S were to be liquidated, preference shareholders would receive par plus a premium of P20,000(Note this assumption is true only for Q17-18) Q19-20 How much is the book value per preference share and ordinary share, respectively, if preference is cumulative and fully participating? Q21-22 How much is the book value per preference share and ordinary share, respectively, if preference is non-cumulative and non-participating? D1 Varied Transactions: V Corporation adjusted trial balance at December 31, 2020 following account balances: includes the 500,000 Ordinary share capital, P25 par, issued and outstanding 100,000 shares Share premium Share premium-treasury shares Treasury shares, 2,500 shares at cost ? 25,000 75,000 Retained earnings, free and unappropriated 650,000 Retained earnings appropriated for sinking fund Retained earnings appropriated for treasury shares 500,000 75,000 Sinking fund cash 100,000 Revaluation surplus arising from revaluation of plant assets 250,000 Unrealized gain on equity investments at fair value thru OCI 75,000 Q23 Q24 Q25 How much is the balance of ordinary share capital? How much is the additional contributed capital? How much is legal capital? Q26 How many shares are outstanding? Q27 Q28 How much is S's net shareholders' equity? How much is the total retained earnings?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started