Answered step by step

Verified Expert Solution

Question

1 Approved Answer

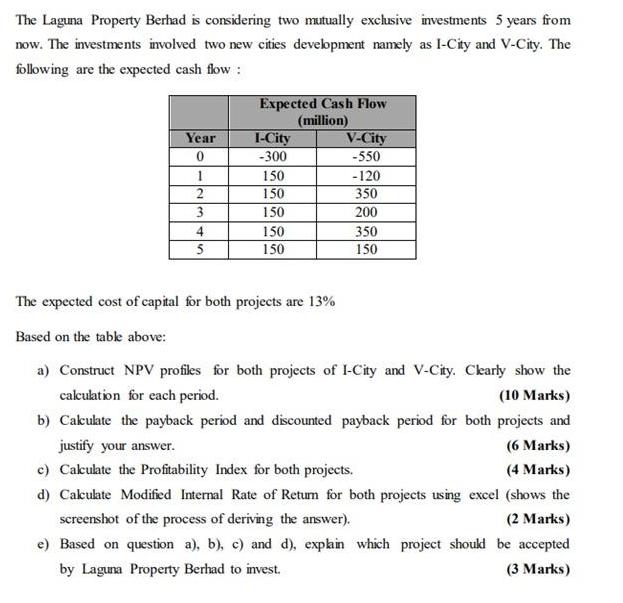

The Laguna Property Berhad is considering two mutually exchsive investments 5 years from now. The investments involved two new cities development namely as I-City

The Laguna Property Berhad is considering two mutually exchsive investments 5 years from now. The investments involved two new cities development namely as I-City and V-City. The following are the expected cash flow : Expected Cash Flow (million) T-City Year V-City -300 -550 1 150 -120 150 350 3 150 200 4 150 350 5 150 150 The expected cost of capital for both projects are 13% Based on the table above: a) Construct NPV profiles for both projects of I-City and V-City. Ckearly show the cakulation for each period. (10 Marks) b) Cakuate the payback period and discounted payback period for both projects and justify your answer. (6 Marks) c) Cakulate the Profitability Index for both projects. (4 Marks) d) Cakulate Modified Internal Rate of Retum for both projects using excel (shows the screenshot of the process of deriving the answer). (2 Marks) e) Based on question a), b), c) and d), explin which project shoukl be accepted by Laguna Property Berhad to invest. (3 Marks)

Step by Step Solution

★★★★★

3.62 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a b According to the payback period and discounted payback period ICity pays faster than VCity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started