Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The landlord is responsible for paying property taxes for Westwood Plaza. However, each lease requires the tenants to pay their CAM share of property taxes

The landlord is responsible for paying property taxes for Westwood Plaza. However, each lease requires the tenants to pay their CAM share of property taxes above the level that existed when they signed the lease. Last year the property tax rate was reassessed at $1.375 per square foot. This was an increase of 10%.

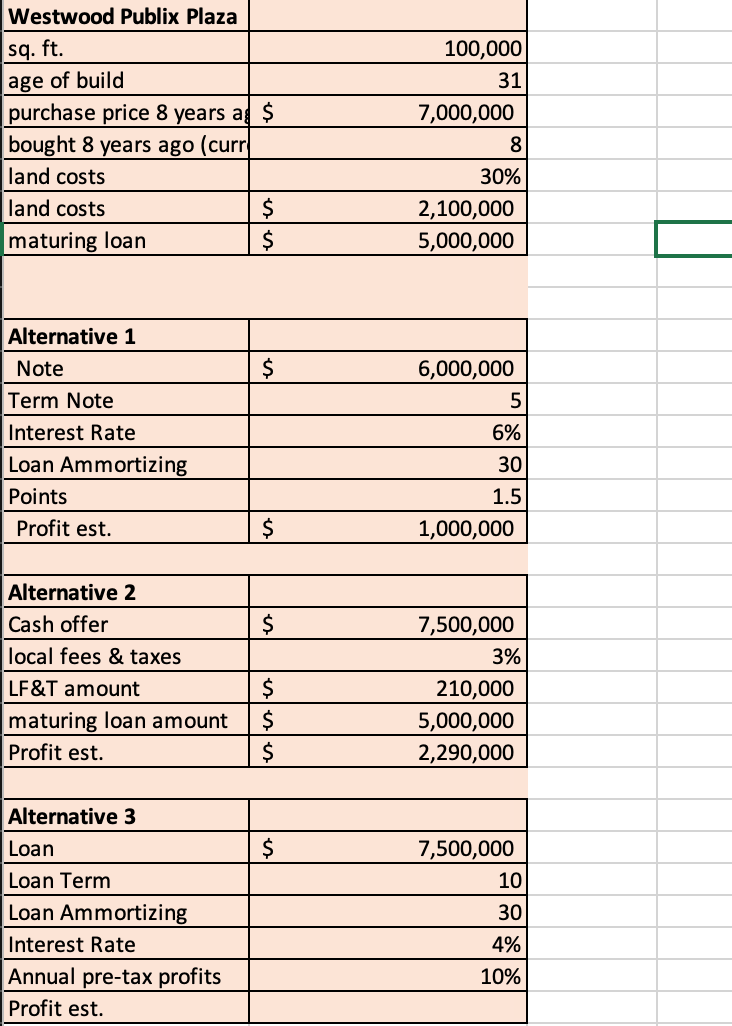

Westwood Publix Plaza sq. ft. age of build 100,000 31 purchase price 8 years as $ 7,000,000 bought 8 years ago (curr 8 land costs 30% land costs $ 2,100,000 maturing loan $ 5,000,000 Alternative 1 Note $ 6,000,000 Term Note 5 Interest Rate 6% Loan Ammortizing 30 Points Profit est. 1.5 $ 1,000,000 Alternative 2 Cash offer $ 7,500,000 local fees & taxes 3% LF&T amount $ 210,000 maturing loan amount $ 5,000,000 Profit est. $ 2,290,000 Alternative 3 Loan $ 7,500,000 Loan Term 10 Loan Ammortizing 30 Interest Rate 4% Annual pre-tax profits 10% Profit est. Westwood Publix Plaza sq. ft. age of build 100,000 31 purchase price 8 years as $ 7,000,000 bought 8 years ago (curr 8 land costs 30% land costs $ 2,100,000 maturing loan $ 5,000,000 Alternative 1 Note $ 6,000,000 Term Note 5 Interest Rate 6% Loan Ammortizing 30 Points Profit est. 1.5 $ 1,000,000 Alternative 2 Cash offer $ 7,500,000 local fees & taxes 3% LF&T amount $ 210,000 maturing loan amount $ 5,000,000 Profit est. $ 2,290,000 Alternative 3 Loan $ 7,500,000 Loan Term 10 Loan Ammortizing 30 Interest Rate 4% Annual pre-tax profits 10% Profit est.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating Tenant CAM Charges for Increased Property Taxes Based on the information provided we can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started