Question: The large computer company you work for just purchased a leading headphone manufacturer. As part of the merger, you have been put in charge of

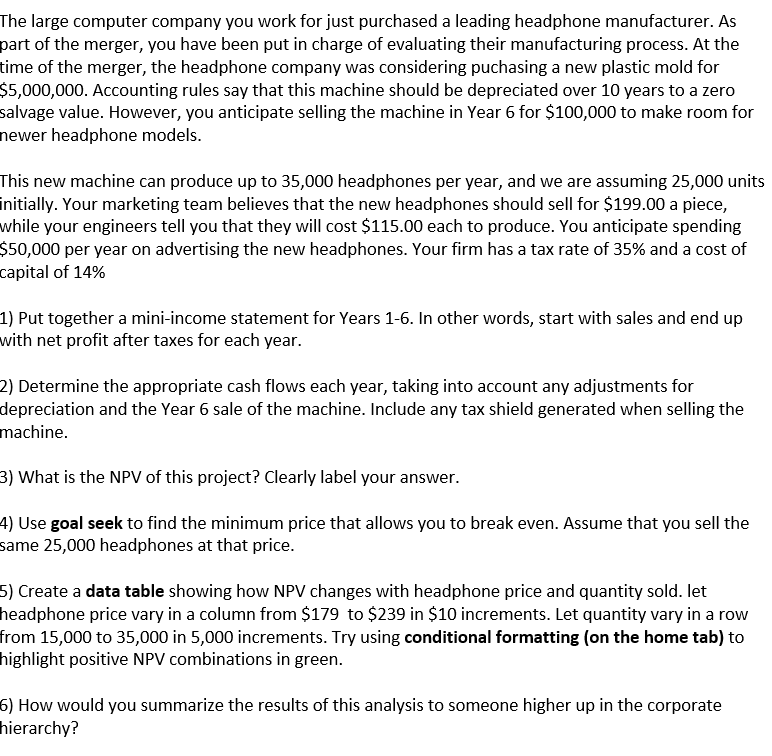

The large computer company you work for just purchased a leading headphone manufacturer. As

part of the merger, you have been put in charge of evaluating their manufacturing process. At the

time of the merger, the headphone company was considering puchasing a new plastic mold for

$ Accounting rules say that this machine should be depreciated over years to a zero

salvage value. However, you anticipate selling the machine in Year for $ to make room for

newer headphone models.

This new machine can produce up to headphones per year, and we are assuming units

initially. Your marketing team believes that the new headphones should sell for $ a piece,

while your engineers tell you that they will cost $ each to produce. You anticipate spending

$ per year on advertising the new headphones. Your firm has a tax rate of and a cost of

capital of

Put together a miniincome statement for Years In other words, start with sales and end up

with net profit after taxes for each year.

Determine the appropriate cash flows each year, taking into account any adjustments for

depreciation and the Year sale of the machine. Include any tax shield generated when selling the

machine.

What is the NPV of this project? Clearly label your answer.

Use goal seek to find the minimum price that allows you to break even. Assume that you sell the

same headphones at that price.

Create a data table showing how NPV changes with headphone price and quantity sold. let

headphone price vary in a column from $ to $ in $ increments. Let quantity vary in a row

from to in increments. Try using conditional formatting on the home tab to

highlight positive NPV combinations in green.

How would you summarize the results of this analysis to someone higher up in the corporate

hierarchy?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock