Answered step by step

Verified Expert Solution

Question

1 Approved Answer

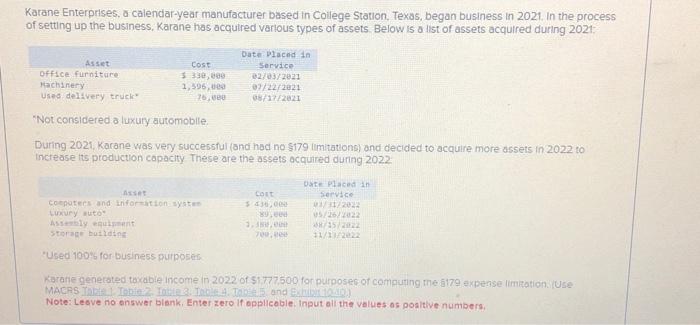

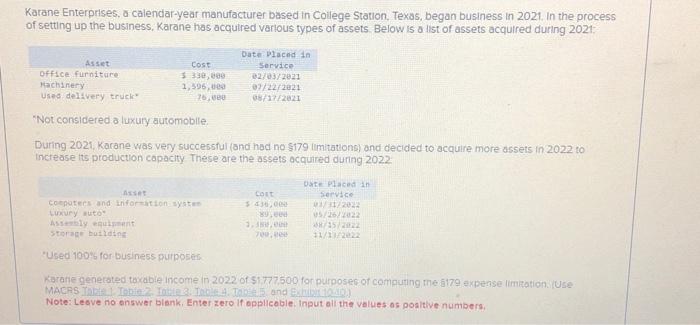

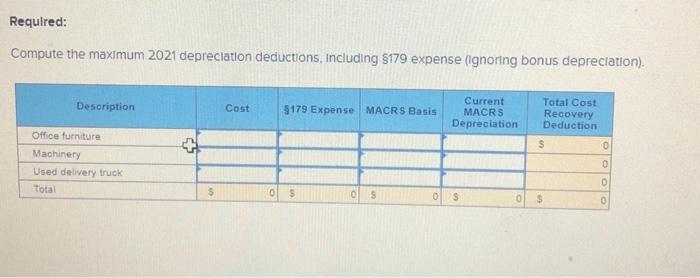

The last 5 photos are charts that will help with answering the questions. the first two photos are the problems that I need help with

The last 5 photos are charts that will help with answering the questions.

the first two photos are the problems that I need help with

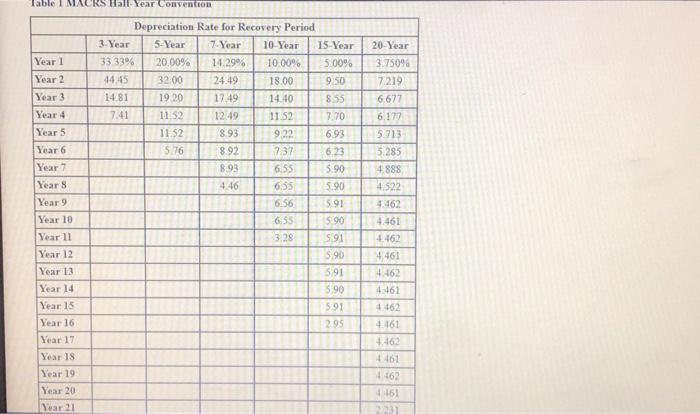

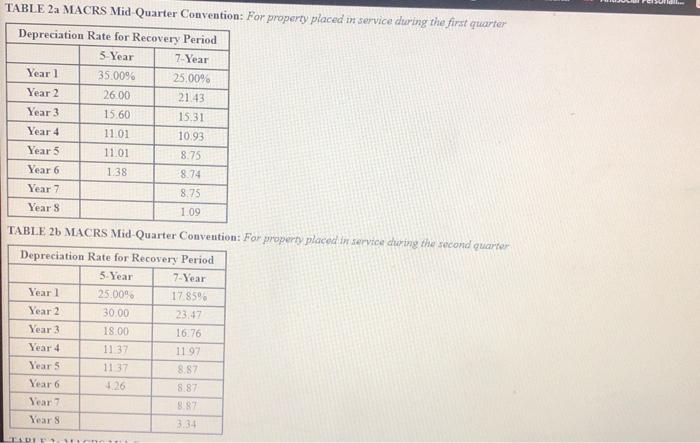

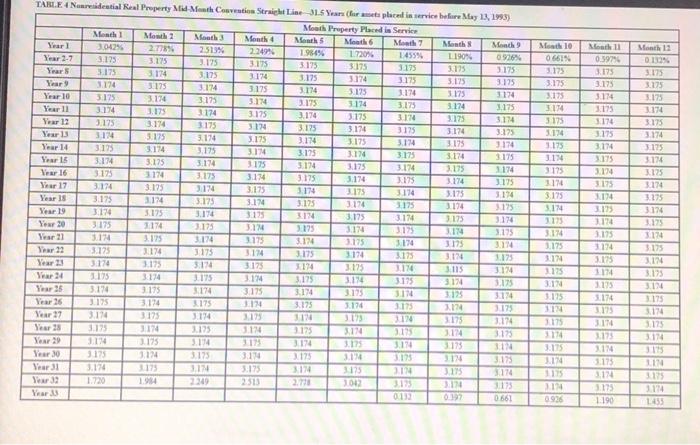

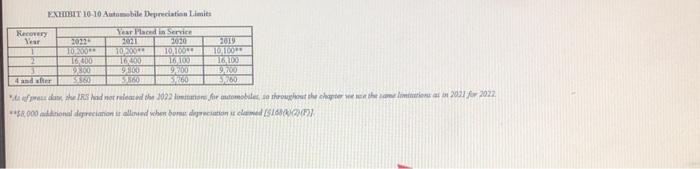

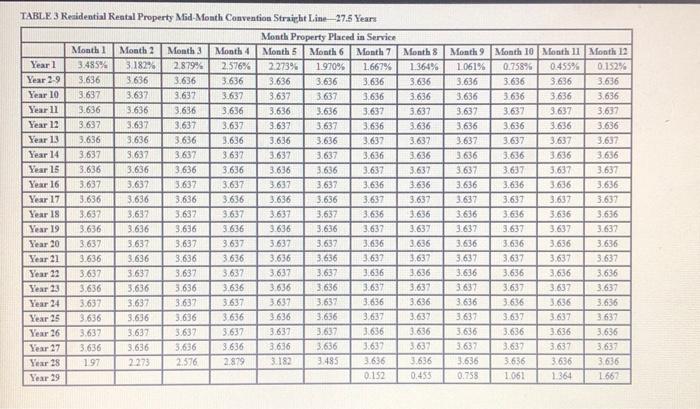

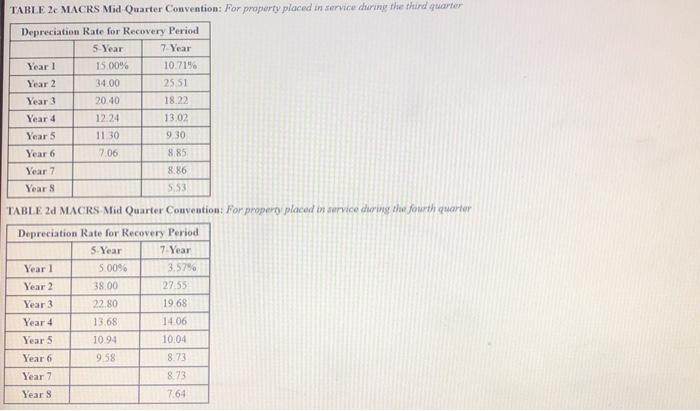

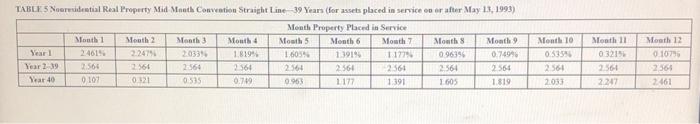

Karane Enterprises, a calendar-year manufacturer based in College Station. Texas, began business in 2021. In the process of setting up the business, Karane has acquired vartous types of assets. Below is a list of assets acquired during 2021 ; "Not considered a luxury automobile. During 2021, Karane was very successful (and had no $179 limitations) and decided to acquire more assets in 2022 io increase tis production capacity These are the ossets acquired duning 2022 "Used 1004 for business purposerr Karahe generoted toxable income in 2022 of 51,77,500 for nurbosec of computng the il79 expense limitotion. IUse Note: Leove no onswer blank. Enter zero if opplicoble. Input all the values os poaltive numbers. Compute the maximum 2021 depreciation deductions, Including $179 expense (Ignoring bonus depreciation). \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3.Year & 5-Year & 7 Year & 10 -Year & I5-Year & 20-Year \\ \hline Year 1 & 3333% & 20.00% & 14.29% & 10.00% & 5.00% & 3.7509 \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 855 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 693 & 5.713 \\ \hline Year 6 & & 5.76 & 892 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 591 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 591 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2321 \\ \hline \end{tabular} TABLE 2a MACRS Mid-Quarter Convention: For property placed in service dwoing the first quarter TABLE 2b MLCRS Mid-Quarter Convention: Far property placed in service dwring the second guarter RMHIRHT 10-10 Autassbile Depreciation Limit: TABL. 3 Reaidential Reatal Property Mid-Moath Convention Straipbt L.ine-27.5 Year TABLE 2d MACRS-Mid Quarter Couvention: Forpropero placed in aervice choring the fourth euarter TBBE 5 Noerevilential Real Rroperty Mid Mandh Conveation Straight Line-39 Years (for assets placed in service eo or after May 13, 1993) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started