Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the last few pictures are the clear ones and should be more easy to read. the first two are a bit blurry but its all

the last few pictures are the clear ones and should be more easy to read. the first two are a bit blurry but its all the same 2 pages.

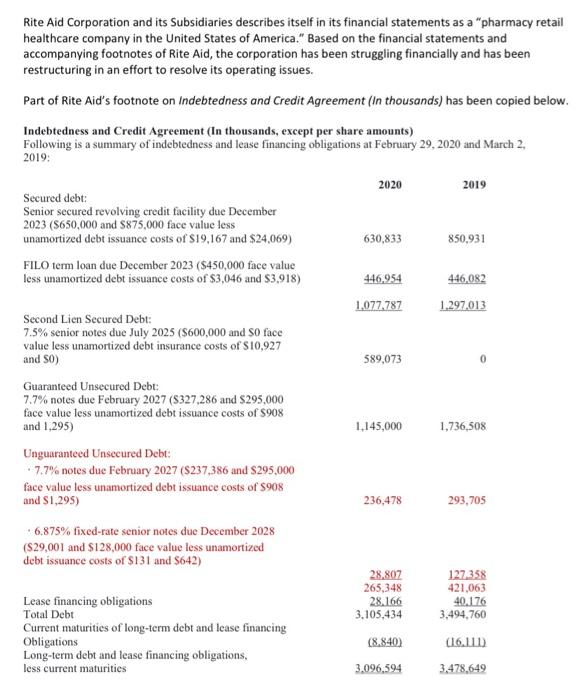

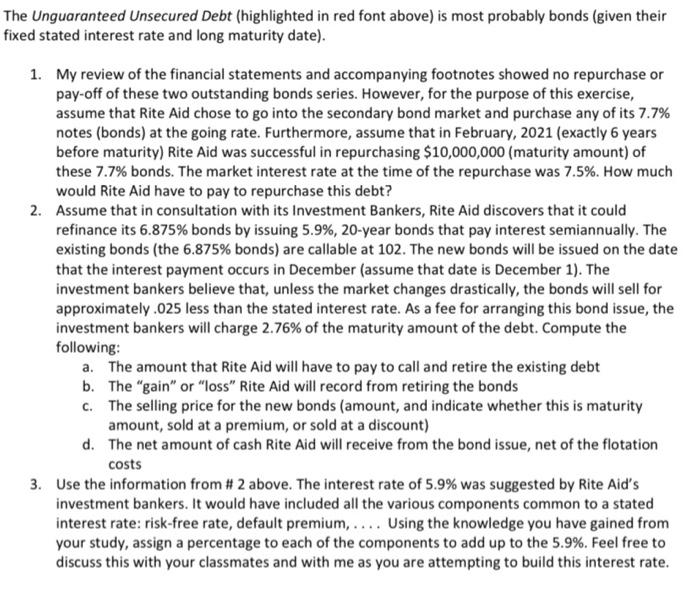

Bite Ad Corporation and its Suecidanes destinacial statements as may utal Healthcare company in the United States of America Based on the financial statements and companying Fotos of the All the creation has been call and last structuring in an effort to save Part of Rite Aidsfotnote en indebtedness and Credit Agreement in thousands has been copied below Indeeds and Credit Agreem deeper Follow any reden odcing F2 Secret Sede 250.00 FILOLcome se I want me Second Low y and tes w www.tw 151212 Facebook 7. 522.00 12. W 1 Tiede Care Women information from The agreed Uendret highlighted in front seven most probably bord the fwedste interested for at del L. My review of the financial Statements and accompanying Fontes showed no repurchase or pay off of these two standing bonds series. However, for the purpose of this eerde ne dut hite Aid there to go to the secondary bond market and purchase any of 77 2. that the interestement cours in December acone that date is December 13. The The pain or "os" te Aid will record from retring the bonds The seling price for the new bonde amount and indicate whether the mounty mount, said sta primer dat die The ratanout of cathod will tron bonde, et af Rotation 3. Use the formation om above. The rated by Red went banks. It would have included with various components.com to stated interest rates free dati premium, Using the role you have gained from your stay,assigna percentato al the components to add up to the 5.0 File 10 diss this with your email interest Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America." Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2. 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (5650,000 and $875,000 face value less unamortized debt issuance costs of S19,167 and $24,069) 630,833 850,931 FILO term loan due December 2023 ($450,000 face value less unamortized debt issuance costs of $3,046 and $3,918) 446,954 446,082 1.077,787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and So face value less unamortized debt insurance costs of S10,927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327,286 and $295,000 face value less unamortized debt issuance costs of S908 and 1,295) 1.145,000 1,736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (S237,386 and S295.000 face value less unamortized debt issuance costs of 908 and $1,295) 236,478 293,705 6,875% fixed-rate senior notes due December 2028 (S29,001 and 128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.802 265,348 28.166 3.105.434 127.358 421,063 40.176 3,494,760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8.840) (16.11) 3.096,594 3,478,649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately.025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from # 2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate. Part II: Bonds Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America. Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (5650,000 and $875,000 face value less unamortized debt issuance costs of $19.167 and 24,069) 630,833 850,931 FILO term loan due December 2023 (S450,000 face value less unamortized debt issuance costs of S3.046 and 83,918) 446.954 446,082 1,077.787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and So face value less unamortized debt insurance costs of $10,927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327.286 and S295.000 face value less unamortized debt issuance costs of 908 and 1.295) 1,145,000 1.736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (S237,386 and S295,000 face value less unamortized debt issuance costs of S908 and $1.295) 236,478 293.705 6.875% fixed-rate senior notes due December 2028 (S29,001 and 128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.807 265,348 28,166 3.105,434 127.358 421,063 40.176 3.494,760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8,840) (16.111 3.096,594 3.478,649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately .025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from #2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate. Part II: Bonds Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America. Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2, 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (S650,000 and $875,000 face value less unamortized debt issuance costs of $19,167 and $24,069) 630.833 850,931 FILO term loan due December 2023 ($450,000 face value lessunamortized debt issuance costs of $3,046 and $3,918) 446.954 446,082 1,077.787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and $0 face value less unamortized debt insurance costs of $10.927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327.286 and $295.000 face value less unamortized debt issuance costs of S908 and 1,295) 1.145,000 1.736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (5237,386 and 8295,000 face value less unamortized debt issuance costs of S908 and $1.295) 236,478 293,705 - 6.875% fixed-rate senior notes due December 2028 (529,001 and S128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.807 265,348 28.166 3,105,434 127.358 421,063 40,176 3.494.760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8.840) (16.011) 3.096,594 3.478.649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately.025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from # 2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate. Bite Ad Corporation and its Suecidanes destinacial statements as may utal Healthcare company in the United States of America Based on the financial statements and companying Fotos of the All the creation has been call and last structuring in an effort to save Part of Rite Aidsfotnote en indebtedness and Credit Agreement in thousands has been copied below Indeeds and Credit Agreem deeper Follow any reden odcing F2 Secret Sede 250.00 FILOLcome se I want me Second Low y and tes w www.tw 151212 Facebook 7. 522.00 12. W 1 Tiede Care Women information from The agreed Uendret highlighted in front seven most probably bord the fwedste interested for at del L. My review of the financial Statements and accompanying Fontes showed no repurchase or pay off of these two standing bonds series. However, for the purpose of this eerde ne dut hite Aid there to go to the secondary bond market and purchase any of 77 2. that the interestement cours in December acone that date is December 13. The The pain or "os" te Aid will record from retring the bonds The seling price for the new bonde amount and indicate whether the mounty mount, said sta primer dat die The ratanout of cathod will tron bonde, et af Rotation 3. Use the formation om above. The rated by Red went banks. It would have included with various components.com to stated interest rates free dati premium, Using the role you have gained from your stay,assigna percentato al the components to add up to the 5.0 File 10 diss this with your email interest Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America." Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2. 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (5650,000 and $875,000 face value less unamortized debt issuance costs of S19,167 and $24,069) 630,833 850,931 FILO term loan due December 2023 ($450,000 face value less unamortized debt issuance costs of $3,046 and $3,918) 446,954 446,082 1.077,787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and So face value less unamortized debt insurance costs of S10,927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327,286 and $295,000 face value less unamortized debt issuance costs of S908 and 1,295) 1.145,000 1,736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (S237,386 and S295.000 face value less unamortized debt issuance costs of 908 and $1,295) 236,478 293,705 6,875% fixed-rate senior notes due December 2028 (S29,001 and 128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.802 265,348 28.166 3.105.434 127.358 421,063 40.176 3,494,760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8.840) (16.11) 3.096,594 3,478,649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately.025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from # 2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate. Part II: Bonds Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America. Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (5650,000 and $875,000 face value less unamortized debt issuance costs of $19.167 and 24,069) 630,833 850,931 FILO term loan due December 2023 (S450,000 face value less unamortized debt issuance costs of S3.046 and 83,918) 446.954 446,082 1,077.787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and So face value less unamortized debt insurance costs of $10,927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327.286 and S295.000 face value less unamortized debt issuance costs of 908 and 1.295) 1,145,000 1.736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (S237,386 and S295,000 face value less unamortized debt issuance costs of S908 and $1.295) 236,478 293.705 6.875% fixed-rate senior notes due December 2028 (S29,001 and 128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.807 265,348 28,166 3.105,434 127.358 421,063 40.176 3.494,760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8,840) (16.111 3.096,594 3.478,649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately .025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from #2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate. Part II: Bonds Rite Aid Corporation and its subsidiaries describes itself in its financial statements as a "pharmacy retail healthcare company in the United States of America. Based on the financial statements and accompanying footnotes of Rite Aid, the corporation has been struggling financially and has been restructuring in an effort to resolve its operating issues. Part of Rite Aid's footnote on Indebtedness and Credit Agreement (In thousands) has been copied below. Indebtedness and Credit Agreement (In thousands, except per share amounts) Following is a summary of indebtedness and lease financing obligations at February 29, 2020 and March 2, 2019: 2020 2019 Secured debt: Senior secured revolving credit facility due December 2023 (S650,000 and $875,000 face value less unamortized debt issuance costs of $19,167 and $24,069) 630.833 850,931 FILO term loan due December 2023 ($450,000 face value lessunamortized debt issuance costs of $3,046 and $3,918) 446.954 446,082 1,077.787 1.297,013 Second Lien Secured Debt: 7.5% senior notes due July 2025 ($600,000 and $0 face value less unamortized debt insurance costs of $10.927 and So) 589,073 Guaranteed Unsecured Debt: 7.7% notes due February 2027 (5327.286 and $295.000 face value less unamortized debt issuance costs of S908 and 1,295) 1.145,000 1.736,508 Unguaranteed Unsecured Debt: 7.7% notes due February 2027 (5237,386 and 8295,000 face value less unamortized debt issuance costs of S908 and $1.295) 236,478 293,705 - 6.875% fixed-rate senior notes due December 2028 (529,001 and S128,000 face value less unamortized debt issuance costs of $131 and 5642) 28.807 265,348 28.166 3,105,434 127.358 421,063 40,176 3.494.760 Lease financing obligations Total Debt Current maturities of long-term debt and lease financing Obligations Long-term debt and lease financing obligations, less current maturities (8.840) (16.011) 3.096,594 3.478.649 The Unguaranteed Unsecured Debt (highlighted in red font above) is most probably bonds (given their fixed stated interest rate and long maturity date). 1. My review of the financial statements and accompanying footnotes showed no repurchase or pay-off of these two outstanding bonds series. However, for the purpose of this exercise, assume that Rite Aid chose to go into the secondary bond market and purchase any of its 7.7% notes (bonds) at the going rate. Furthermore, assume that in February, 2021 (exactly 6 years before maturity) Rite Aid was successful in repurchasing $10,000,000 (maturity amount) of these 7.7% bonds. The market interest rate at the time of the repurchase was 7.5%. How much would Rite Aid have to pay to repurchase this debt? 2. Assume that in consultation with its Investment Bankers, Rite Aid discovers that it could refinance its 6.875% bonds by issuing 5.9%, 20-year bonds that pay interest semiannually. The existing bonds (the 6.875% bonds) are callable at 102. The new bonds will be issued on the date that the interest payment occurs in December (assume that date is December 1). The investment bankers believe that, unless the market changes drastically, the bonds will sell for approximately.025 less than the stated interest rate. As a fee for arranging this bond issue, the investment bankers will charge 2.76% of the maturity amount of the debt. Compute the following: a. The amount that Rite Aid will have to pay to call and retire the existing debt b. The "gain" or "loss" Rite Aid will record from retiring the bonds C. The selling price for the new bonds (amount, and indicate whether this is maturity amount, sold at a premium, or sold at a discount) d. The net amount of cash Rite Aid will receive from the bond issue, net of the flotation costs 3. Use the information from # 2 above. The interest rate of 5.9% was suggested by Rite Aid's investment bankers. It would have included all the various components common to a stated interest rate: risk-free rate, default premium, .... Using the knowledge you have gained from your study, assign a percentage to each of the components to add up to the 5.9%. Feel free to discuss this with your classmates and with me as you are attempting to build this interest rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started