Answered step by step

Verified Expert Solution

Question

1 Approved Answer

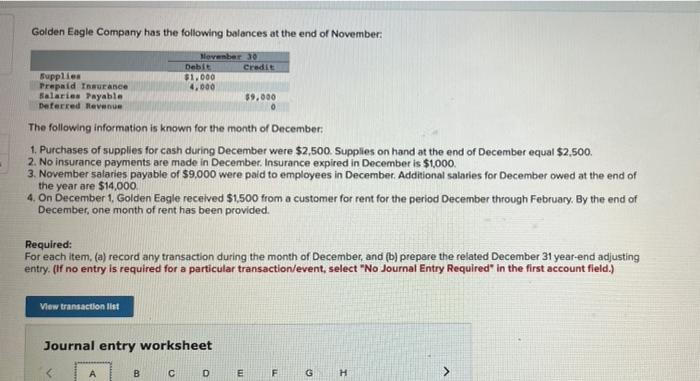

the last two are two different questions Golden Eagle Company has the following balances at the end of November Supplies Prepaid Terance Salaries Payable Deferred

the last two are two different questions

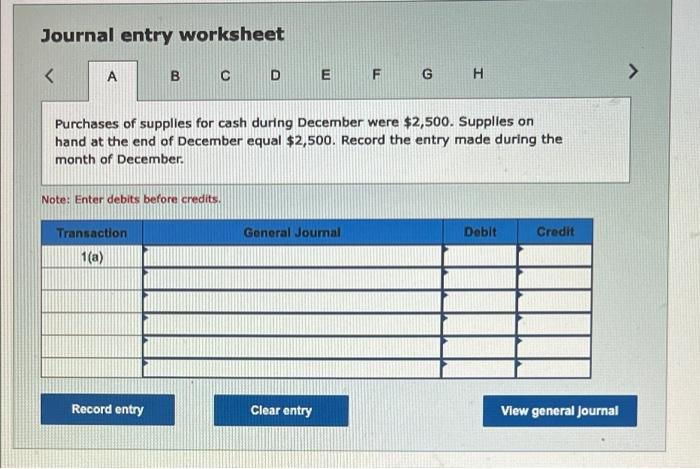

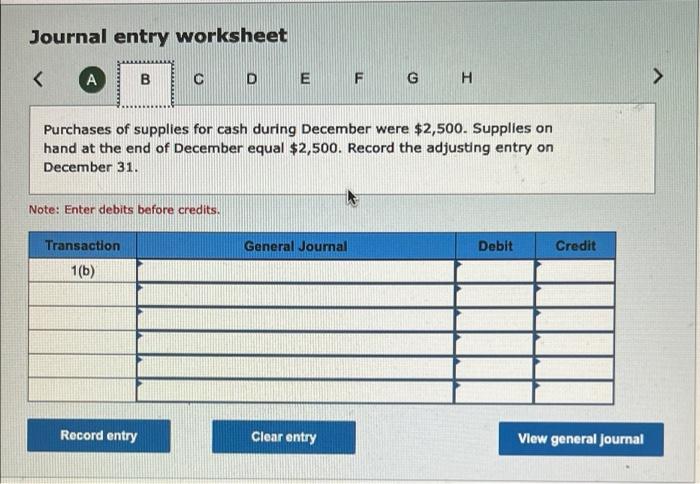

Golden Eagle Company has the following balances at the end of November Supplies Prepaid Terance Salaries Payable Deferred Revenue November 30 Debit Credit $1.000 4.000 $9.000 The following information is known for the month of December: 1. Purchases of supplies for cash during December were $2,500. Supplies on hand at the end of December equal $2,500. 2. No insurance payments are made in December. Insurance expired in December is $1000. 3. November salaries payable of $9,000 were paid to employees in December, Additional salaries for December owed at the end of the year are $14,000 4. On December 1, Golden Eagle received $1.500 from a customer for rent for the period December through February. By the end of December, one month of rent has been provided. Required: For each item, (a) record any transaction during the month of December, and (b) prepare the related December 31 year-end adjusting entry. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet B C D E F G G H Journal entry worksheet No Insurance payments are made in December. Insurance expired in December is $1,000. Record the entry made during the month of December. Note: Enter debits before credits. Transaction General Journal Debit Credit 2(a) Record entry Clear entry View general Journal Journal entry worksheet No insurance payments are made in December. Insurance expired in December Is $1,000. Record the adjusting entry on December 31. Note: Enter debits before credits. Transaction General Journal Debit Credit 2(b) Record entry Clear entry View general Journal Journal entry worksheet On December 1, Golden Eagle received $1,500 from a customer for rent for the period December through February. By the end of December, one month of rent has been provided. Record the adjusting entry on December 31. Note: Enter debits before credits. General Journal Debit Credit Transaction 4(b) Record entry Clear entry View general Journal Below are the restated amounts of net income and retained earnings for Volunteers Incorporated and Raiders incorporated for the period 2015 to 2024, Volunteers began operations in 2016, while Raiders began several years earlier Required: Calculate the balance of retained earnings each year for each company. Neither company paid dividends during this time (Enter your answers in millions (ie., 10,000,000 should be entered as 10). Amounts to be deducted should be indicated by a minus sign.) Year 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 VOLUNTEERS INCORPORATED RAIDERS INCORPORATED (5 in millions) (in millions) Net Income Retained Net Income Retained (Loss) Earnings (LOS) Earnings $ 0 $ 0 $ 29 $ 11 24 24 (49) (7) 55 35 57 129 96 24 129 (137) 48) 571 353 104 354 156 888&9& Consider the following situations for Shocker: 1. On November 28, 2024. Shocker received a $1,500 payment from a customer for services to be rendered evenly over the next three months. Deferred Revenue was credited on November 28. 2. On December 1, 2024, the company paid a local radio station $2,100 for 30 radio ads that were to be aired, 10 per month throughout December, January, and February. Prepaid Advertising was debited on December 1. 3. Employee salaries for the month of December totaling $6,000 will be paid on January 7, 2025. 4. On August 31, 2024, Shocker borrowed $50,000 from a local bank. A note was signed with principal and 6% interest to be paid on August 31, 2025 Required: Indicate by how much the assets, liabilities, and stockholders' equity in the December 31, 2024, balance sheet is higher or lower if the adjusting entry is not recorded. (If none of the categories apply for a particular item, leave the cell blank.) Assets Liabilities Stockholders' Equity 1. 2. 3. 4. Total Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started