Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. The following transactions occurred during July:Jul

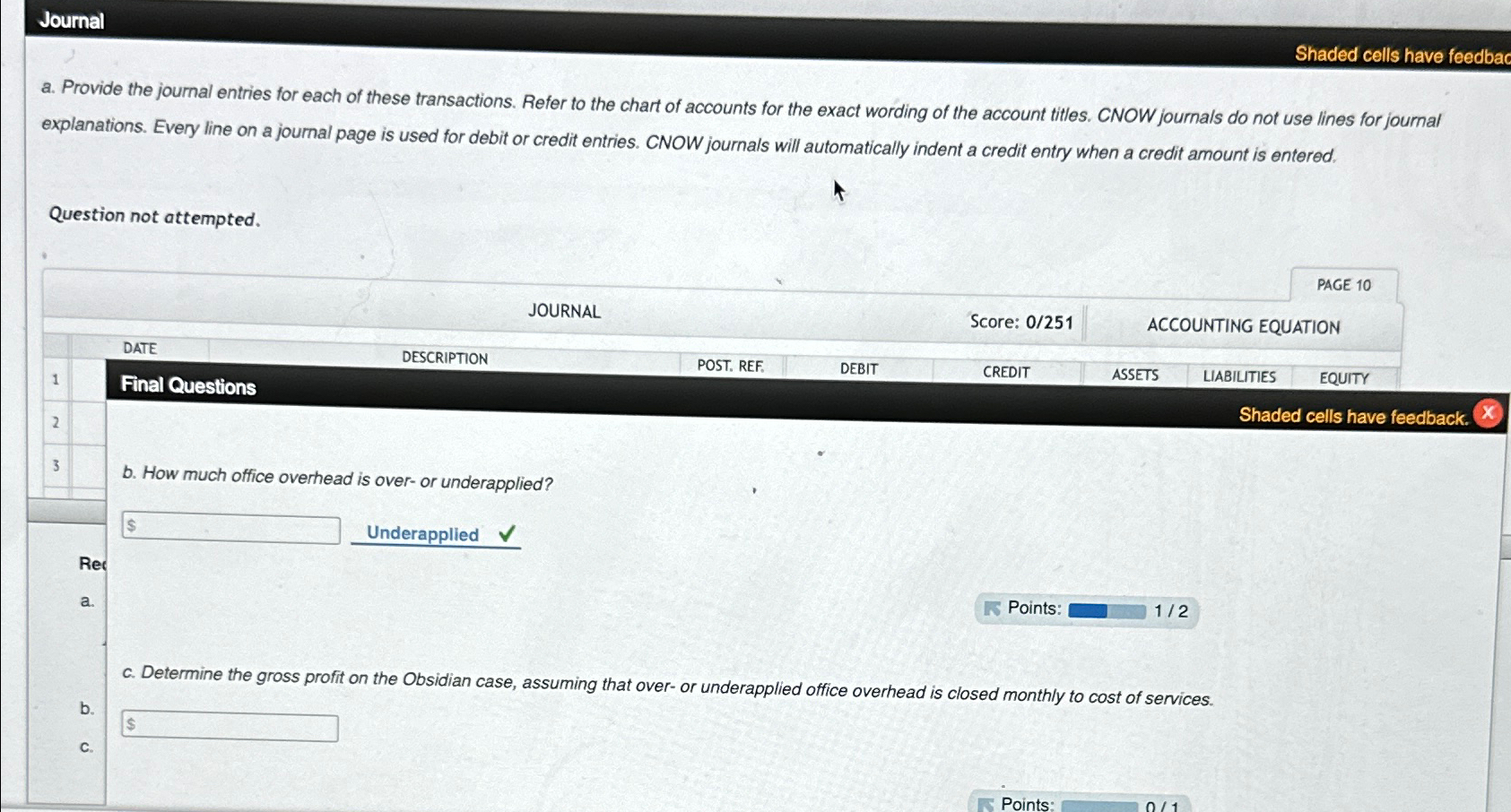

The law firm of Furlan and Benson accumulates costs associated with individual cases, using a job order cost system. The following transactions occurred during July:JulCharged hours of professional lawyer time at a rate of $ per hour to the Obsidian Co breech of contract suit to prepare for the trialReimbursed travel costs to employees for depositions related to the Obsidian case, $Charged hours of professional time for the Obsidian trial at a rate of $ per hourReceived invoice from consultants Wadsley and Harden for $ for expert testimony related to the Obsidian trialApplied office overhead at a rate of $ per professional hour charged to the Obsidian casePaid administrative and support salaries of $ for the monthUsed office supplies for the month, $Paid professional salaries of $ for the monthBilled Obsidian $ for successful defense of the caseRequired:a Provide the journal entries for each of these transactions. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.b How much office overhead is over or underapplied?c Determine the gross profit on the Obsidian case, assuming that over or underapplied office overhead is closed monthly to cost of services.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started