Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The law firm of Matadin and Howe relies heavily on a colour laser printer to process the paperwork. Recently the printer has not functioned

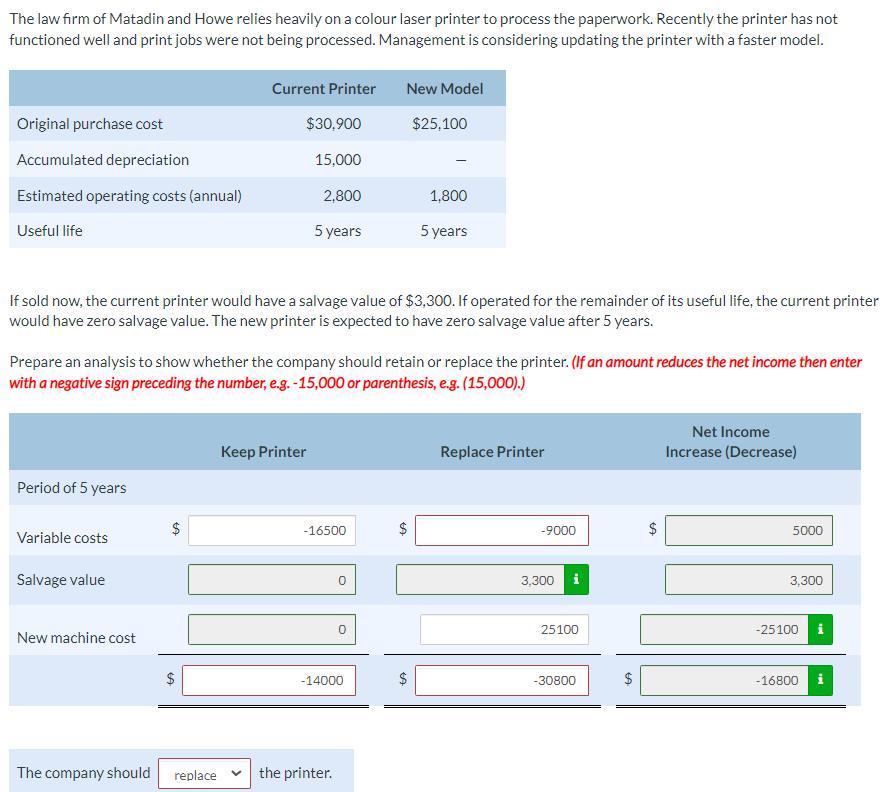

The law firm of Matadin and Howe relies heavily on a colour laser printer to process the paperwork. Recently the printer has not functioned well and print jobs were not being processed. Management is considering updating the printer with a faster model. Original purchase cost Accumulated depreciation Estimated operating costs (annual) Useful life Period of 5 years Variable costs Salvage value Current Printer New machine cost $30,900 15,000 If sold now, the current printer would have a salvage value of $3,300. If operated for the remainder of its useful life, the current printer would have zero salvage value. The new printer is expected to have zero salvage value after 5 years. The company should replace Prepare an analysis to show whether the company should retain or replace the printer. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) 2,800 5 years Keep Printer -16500 0 the printer. 0 -14000 New Model LA $25,100 GA 1,800 5 years $ Replace Printer -9000 3,300 i 25100 -30800 GA Net Income Increase (Decrease) 5000 3,300 -25100 -16800 i The law firm of Matadin and Howe relies heavily on a colour laser printer to process the paperwork. Recently the printer has not functioned well and print jobs were not being processed. Management is considering updating the printer with a faster model. Original purchase cost Accumulated depreciation Estimated operating costs (annual) Useful life Period of 5 years Variable costs Salvage value Current Printer New machine cost $30,900 15,000 If sold now, the current printer would have a salvage value of $3,300. If operated for the remainder of its useful life, the current printer would have zero salvage value. The new printer is expected to have zero salvage value after 5 years. The company should replace Prepare an analysis to show whether the company should retain or replace the printer. (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) 2,800 5 years Keep Printer -16500 0 the printer. 0 -14000 New Model LA $25,100 GA 1,800 5 years $ Replace Printer -9000 3,300 i 25100 -30800 GA Net Income Increase (Decrease) 5000 3,300 -25100 -16800 i

Step by Step Solution

★★★★★

3.39 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

The analysis for whether the company should keep or replace the printer needs to consider the various financial costs and benefits associated with eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started