The Le Beau Footwear Case is based on actual events. The names, dates, and circumstances have been altered to maintain confidentiality. Le Beau Footwear was

The Le Beau Footwear Case is based on actual events. The names, dates, and circumstances have been altered to maintain confidentiality. Le Beau Footwear was founded in Montreal in 1985 by the Le Beau brothers, Artie and Denis, who had worked in footwear retailing for a number of years. During its first five years, the company built a strong reputation as a high-end retailer of Italian shoes and boots. The company had no debt with the exception of a capital lease agreement for its premises.

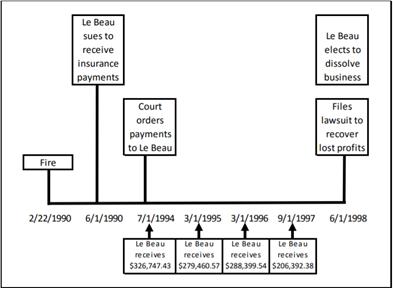

On February 22, 1990, a fire completely destroyed the leased premises and its contents. The entire footwear inventory, furniture, supplies, and most business records were lost. Fortunately, Le Beau was able to substantiate the cost of the insured assets using its own partial records and documents provided by its suppliers. However, Le Beau’s insurer, Kolman Insurance, delayed paying the settlement, citing its suspicion of arson. Le Beau sought legal remedy against Kolman in June of 1990. Finally, on June 29, 1994, the Honorable Mr. Justice M. Kelley ordered the insurer to pay Le Beau $1,059,607.50 in compensation for its insurable losses. Kolman countersued, seeking to have the judgment paid out over several years while it hoped to uncover further evidence of arson. The court was persuaded and ordered the settlement be paid in four installments: $326,747.43 on July 7, 1994; $279,460.57 on March 1, 1995; $288,399.54 on March 1, 1996; and $206,392.38 on September 1, 1997. These payments included the legal rate of interest from June 29, 1994, the date of the judgement. After more than seven years, Kolman could not prove the arson charges and dropped its litigation.

Delays, legal fees, limited access to capital markets, and Kolman’s action against the company prevented Le Beau from re-opening at any time during the payout period. By the time 3 Kolman dropped its lawsuit against Le Beau in June, 1998, the company had decided to permanently close the business. Le Beau filed a second lawsuit against Kolman Insurance to recover the profits lost between June 1994 (when the judgment was ordered) and June, 1998 (when the business was dissolved). Le Beau argued that Kolman’s delays prevented the company from resuming business in an orderly and prompt manner and caused the eventual shut down. A timeline of these events is provided in Exhibit 1 Timeline of Events in the picture below:

In conjunction with this lawsuit, Le Beau hired a financial expert, Able Forensics (Able), to estimate the monetary loss resulting from the inability to operate during the period from June, 1994 to June, 1998. Able had extensive experience in business valuation and estimating the cost of capital in various rate-of-return regulatory proceedings. With its staff of accounting and finance experts, Able planned to estimate Le Beau’s lost profits using both an accounting and a market-based perspective. Estimates of the return on investment (ROI) and opportunity cost of capital (OCC) were obtained and then adjusted to reflect Le Beau’s small size and private ownership differences. Able then inferred the monetary value of the losses to Le Beau, net of the cumulative value of the settlements received, using each of the adjusted estimates.

Able used two well-established valuation methods regularly utilized by the courts in regulatory hearings: the comparable earnings approach to estimate ROI and the market approach to estimate OCC. Both the comparable earnings and the market approaches require an understanding of the economic forces in play. To begin its assessment of the two alternatives, the team at Able first studied the economic environment in Canada during the period of Le Beau’s operations, the insurance payments, and the subsequent lawsuit to recover lost profits.

Economic Environment of the Footwear Industry

The 1990’s were characterized by increased globalization, rapid technological innovation, and deregulation. Like other North American and European industrialized countries, Canada underwent a comprehensive transformation to bring both focus and diversification to its industrial base. During the second half of the 1990s, the Canadian economy thrived. Inflation was held below 2%, while GDP growth averaged a robust 3%. Securities markets anticipated the upcoming economic performance, posting record high rates of return in all sectors of the market. The value of the Toronto Stock Exchange composite index of 300 actively traded Canadian securities (TSE 300) appreciated at an average annual rate of 18.5% and 19.28% during the periods 1993-1997 and 1995-1997, respectively.

The Canadian footwear industry was affected by similar economic and competitive forces 5 that faced the economy as a whole. Globalization and approval of the North American Free Trade Agreement (NAFTA) opened up the Canadian marketplace to foreign producers and retailers. The ability to disseminate new fashions seamlessly through electronic mass media communication networks significantly increased the diversity and the volatility of new fashions in the industry. Canadian footwear retailers responded through innovative marketing, improved product design and enhanced sourcing.

During the first half of the decade, the Canadian footwear industry achieved modest growth due to foreign competition and low domestic demand. However, as the overall economy flourished in the second half of the decade, so did the footwear industry. The retail and department stores sub-indices' portfolios of the TSE 300 composite index produced annual returns ranging from 12% to 16% during the 1993 -1997 period and from 20% to 24% during 1995-1997. Unfortunately, due to the delay in receiving the insurance payments, Le Beau was unable to resume operations during this thriving growth period.

Comparable earnings approach

The comparable earnings approach relies on finding return on investment data for companies in the same risk class. Due to the overwhelmingly private ownership structure of retail shoe firms, Able had to find a surrogate measure for return on investment for Le Beau. Fortunately in 1993, Statistics Canada began to gather aggregate revenue and expenditure data for the wholesale and retail trade sectors through its Annual Wholesale and Retail Survey. Specifically, the survey reports aggregate sales, cost of goods sold, and operating profits for 3,638 firms in the retail shoe industry. Independent shoe stores (27% of revenues) are aggregated with chain stores, precluding a separate analysis of independent shoe stores. To avoid any computational and interpretational issues inherent in initial survey data, Able chose to rely 6 exclusively on data from the 1994 survey, which are provided in Appendix 1.

Although Statistics Canada limited its data collection to revenues and expenses, the data included an expanded cost of goods sold presentation that reported the amounts of beginning and ending inventory. Thus, the amount of average inventory could be calculated from the data. Able obtained data from the Canadian Shoe Retailers Association showing that inventory comprised between 40% and 75% of total assets of member firms. Extrapolating these percentages, the team estimated the range of total asset values for firms in the industry and used these values to provide upper and lower limits for the return on investment. These upper and low limits were used to estimate the amount that could have been earned by Le Beau during June 1994 through June 1998, had it received the insurance settlement ($1,059, 607.50) on June 1, 1994, the date of the judgement. Able then subtracted the future value of the payments awarded by the Court from the foregoing estimate to arrive at the net profit loss to Le Beau.

Market Approach

Able was aware that establishing a private firm’s opportunity cost of capital is more subtle than simply applying the market model approach based on the Capital Asset Pricing Model (CAPM) to publicly traded firms. Had Le Beau been a publicly-traded company, its own stock price information would have been used to implement the market model approach. However, Le Beau was a privately-held firm. Thus, the key to using the market approach was to identify comparable risk alternatives for Le Beau. Able Forensics found two broad sub-indices of the TSE 300 Composite Index that were appropriate. The first sub-index portfolio, Merchandising, included 24 wholesale distribution firms (food stores, department stores, specialty stores, and hospitality stores). The second sub-index portfolio, Department Stores, is itself a component of the Merchandising index. The Department Stores index is comprised of 7 two companies, Sears Canada and Hudson Bay. Able judged that the Department Stores index was a closer substitute to an independent shoe store like Le Beau due to its retail nature and its inclusion of shoe sales in its overall sales.

It is widely expected that leverage positively influences the cost of equity capital. Both companies in the Department Stores index maintained an average debt to asset ratio of approximately 27% during the period 1994-1998. Although Le Beau had no debt, its capital lease agreement for its premises may render the same leverage effect on its cost of equity capital as debt financing does for the firms in the Department Stores index. Hence, Able chose to make no further leverage adjustments.

To operationalize the market model to estimate the beta for the Department Stores index, Able needed to approximate the market risk premium and the risk-free rate of interest relevant for the period, 1994-1998. For the market risk premium, Able calculated the difference between the average monthly rate of return on the TSE 300 index and that of 90-day Treasury Bills (TBills) issued by the government of Canada using data for 1948 - 1998 (the longest period for which data were available). Able calculated the average market risk premium to be 7%. The corresponding average annualized yield on T-Bills for this period was approximately 6%, which was used as the estimate of the risk-free rate of interest.

Possible Adjustments to the ROI and OCC Estimates

In general, investors require a higher risk premium on stocks with a smaller market capitalization (small cap stocks) than stocks with a larger market capitalization. The additional risk premium reflects smaller firms’ lack of diversification and their limited access to capital markets. Able sought data to quantify this differential by looking to Nesbitt Burns, an investment firm that tracks a portfolio of small cap Canadian stocks. From 1970 through 1994, the Nesbitt 8 Burns Small Cap Portfolio’s risk premium averaged 294 basis points above the market risk premium for the same period, implying a small cap risk premium of approximately 2.94%.

Able was also aware of the reduced and asymmetric nature of the available information about privately-held firms. This is evidenced in the marketplace as venture capital financing and initial public offerings (IPOs) commonly experience a significant degree of underpricing (a discount) to reflect this lack of information by the market. The lack of information makes an investment in privately-held firms riskier, and consequently, investors are unwilling to pay as much for ownership shares. Ritter (2013) documents an average degree of underpricing of 16.8% for U.S. firms which went public between 1960 through 2010. Canadian IPOs launched after 1984 experienced an average underpricing of 4.3%. Note that the Canadian IPO information covers the same time period during which Le Beau was founded and began operations. Able Forensics argued that the Canadian IPO underpricing experience was generally relevant to adjusting Le Beau’s estimated returns, but recognized the need to show reasonability to the Court. Thus, Able recommended a conservative premium of 150 to 250 basis points to account for the private financing nature of the company.

Case Requirements

Assume you are a second-year associate at Able Forensics. You have participated in the planning sessions and are familiar with the information discussed above. Prepare a report that addresses the following:

- Briefly discuss and compare (advantages/disadvantages) the Opportunity Cost of Capital (OCC) and the Rate of Return on Investment (ROI) methodologies used to estimate the rate of return lost at Le Beau Footwear due to its inability to operate during the period June 1994 through June 1998.

- Explain why Able Forensic focused on the impact of the economic environment in Canada during the 1990s on the footwear industry.

- Discuss the justification for the adjustments made to address Le Beau’s capital structure, its small size, and the privately held nature of its operation.

- In estimating the value of the accumulated net loss to Le Beau, the lawsuit installments, and the original insurance claim of $1,059,607.50, are compounded by different rates of return. Why did Abel recommend two different rates?

- What are some of the possible limitations (conceptually and (or) analytical) in the case? What is your recommendations for improvements?

Fire Le Beau sues to receive insurance payments. Court orders payments to Le Beau Le Beau elects to dissolve business Files lawsuit to recover lost profits 2/22/1990 6/1/1990 7/1/1994 3/1/1995 3/1/1996 9/1/1997 6/1/1998 Le Beau Le Beau Le Beau Le Beau receives receives receives receives $326,747.43 $279,460.57 $288,399.54 $206,392.38

Step by Step Solution

3.49 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

1 Opportunity Cost of Capital OCC and Rate of Return on Investment ROI Methodologies Opportunity Cost of Capital OCC The opportunity cost of capital OCC is the return that an investor could have earne...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started