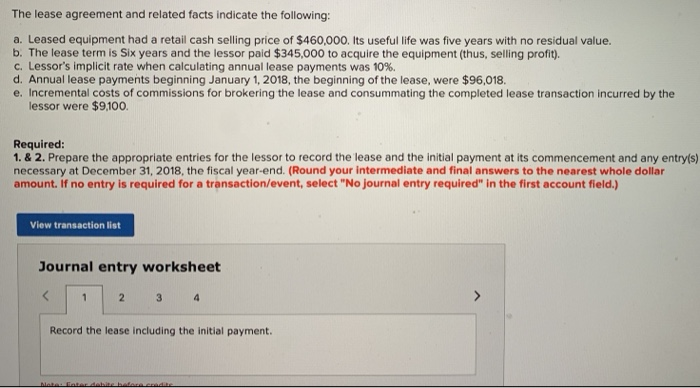

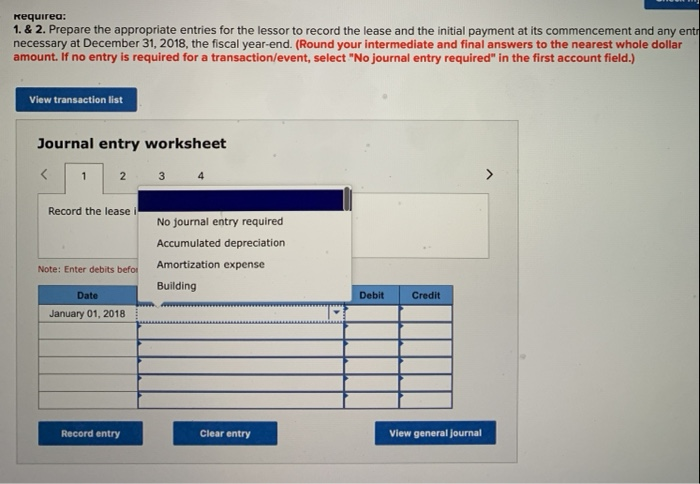

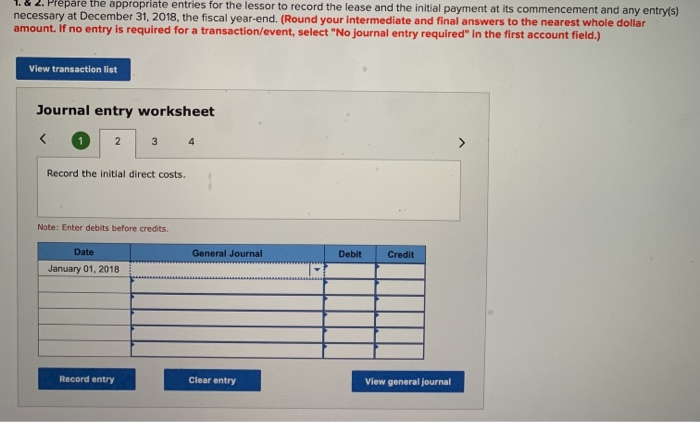

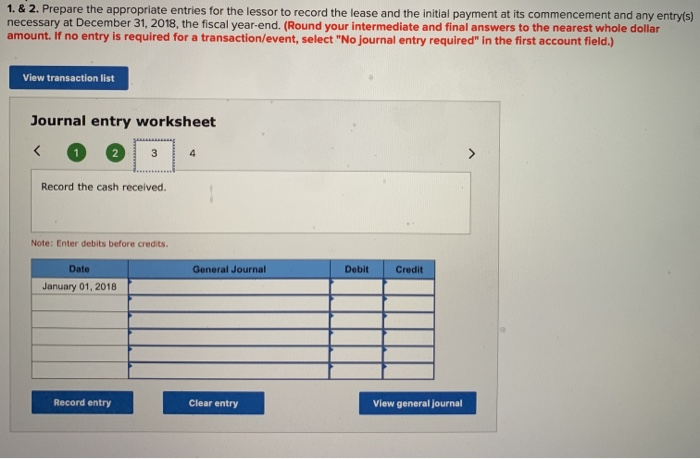

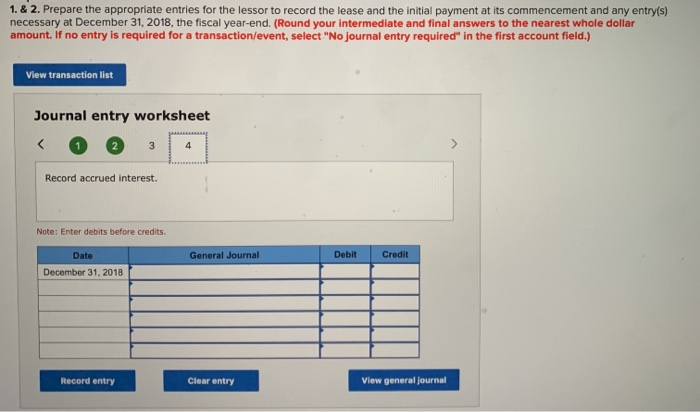

The lease agreement and related facts indicate the following: a. Leased equipment had a retail cash selling price of $460,000. Its useful life was five years with no residual value. b. The lease term is six years and the lessor paid $345,000 to acquire the equipment (thus, selling profit). c. Lessor's implicit rate when calculating annual lease payments was 10%. d. Annual lease payments beginning January 1, 2018, the beginning of the lease, were $96,018. e. Incremental costs of commissions for brokering the lease and consummating the completed lease transaction incurred by the lessor were $9,100. Required: 1. & 2. Prepare the appropriate entries for the lessor to record the lease and the initial payment at its commencement and any entry(s) necessary at December 31, 2018, the fiscal year-end. (Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 3 4 1 2 Record the lease including the initial payment. Made in de bascule Requirea: 1. & 2. Prepare the appropriate entries for the lessor to record the lease and the initial payment at its commencement and any entr necessary at December 31, 2018, the fiscal year-end. (Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 Record the lease No journal entry required Accumulated depreciation Amortization expense Building Note: Enter debits befor Debit Credit Date January 01, 2018 Record entry Clear entry View general journal Prepare the appropriate entries for the lessor to record the lease and the initial payment at its commencement and any entry(s) necessary at December 31, 2018, the fiscal year-end. (Round your intermediate and final answers to the nearest whole dollar amount. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 Record the initial direct costs. Note: Enter debits before credits Date General Journal Debit Credit January 01, 2018 Record entry Clear entry View general Journal 1. & 2. Prepare the appropriate entries for the lessor to record the lease and the initial payment at its commencement and any entry(s) necessary at December 31, 2018, the fiscal year-end. (Round your intermediate and final answers to the nearest whole dollar amount. if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet