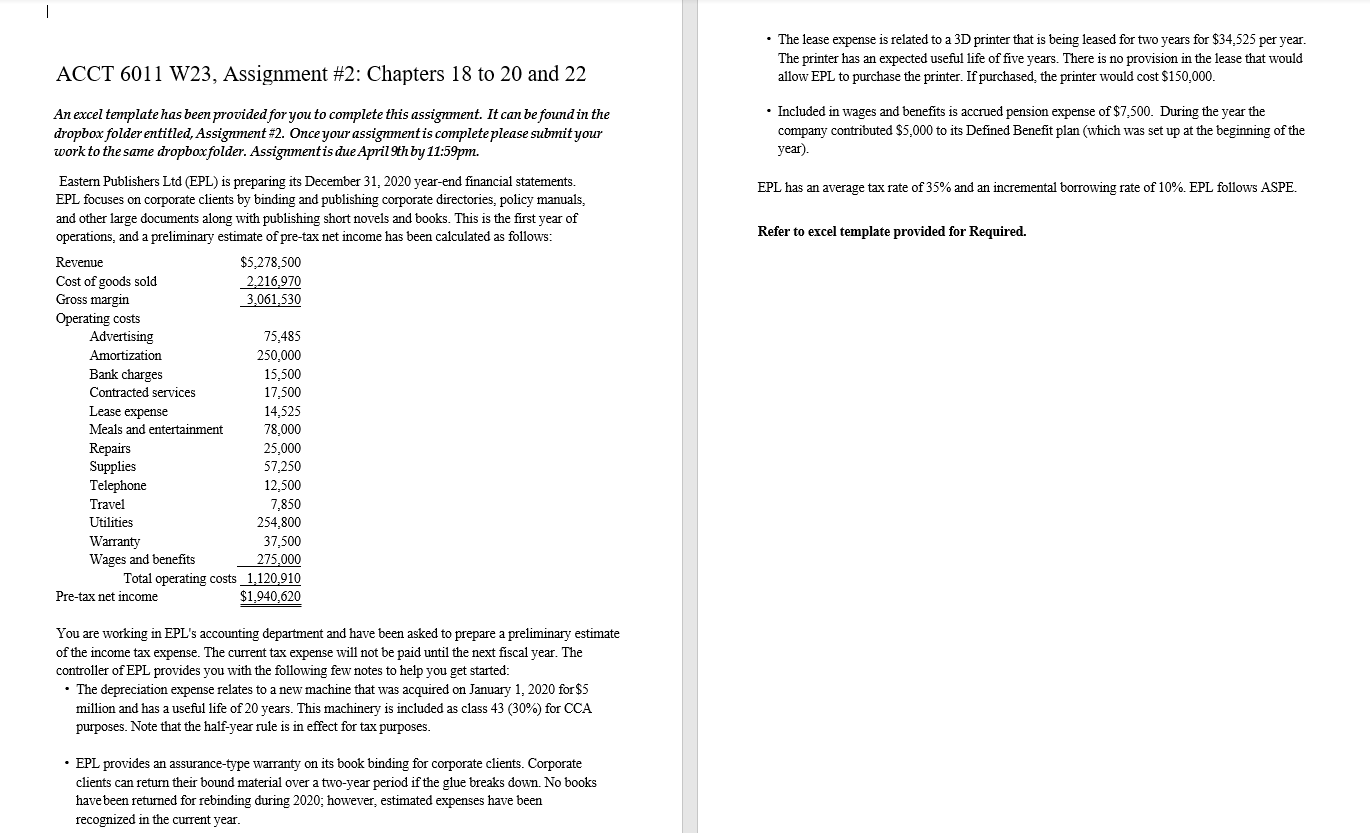

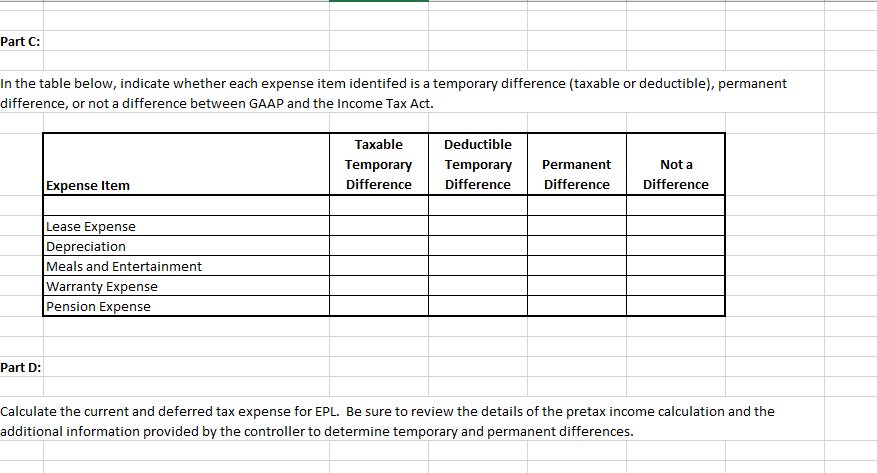

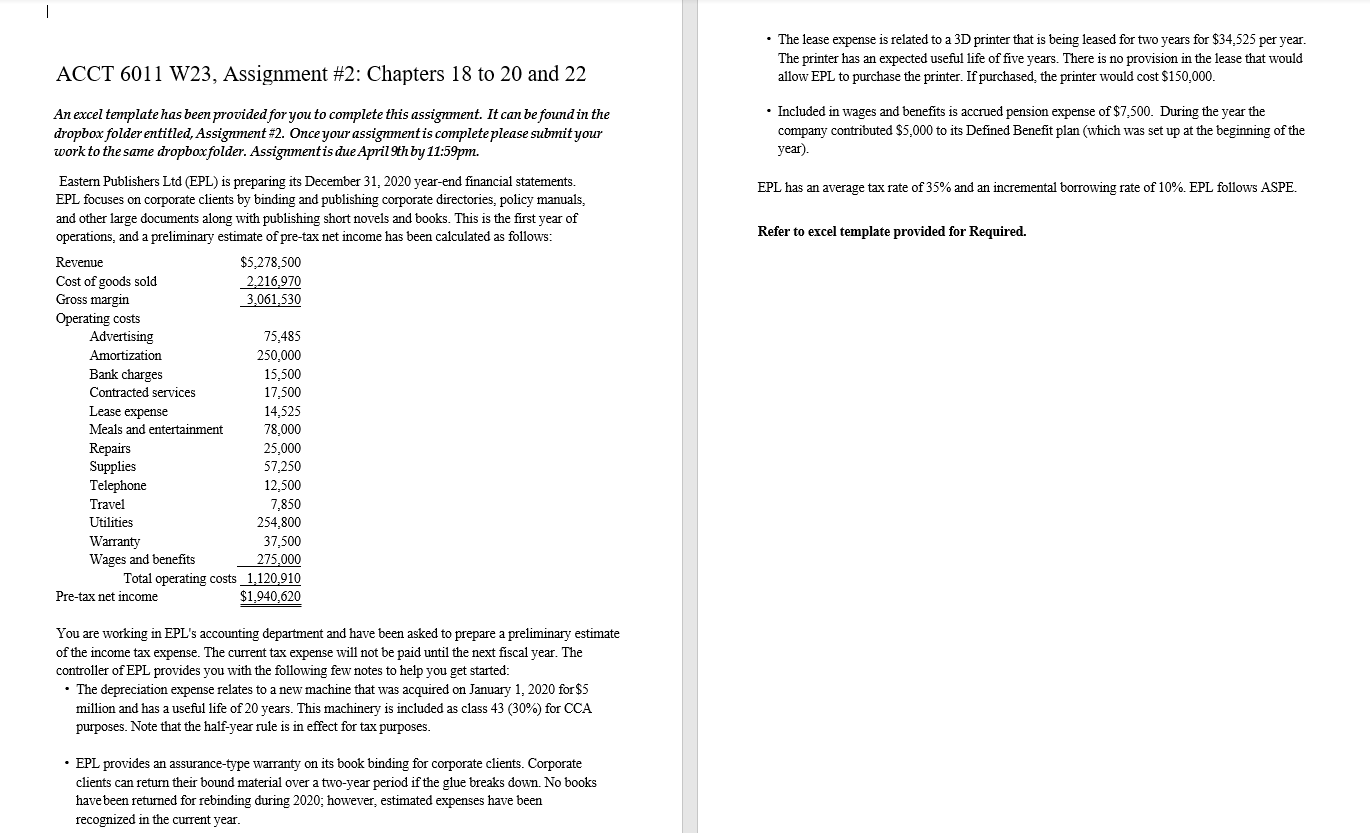

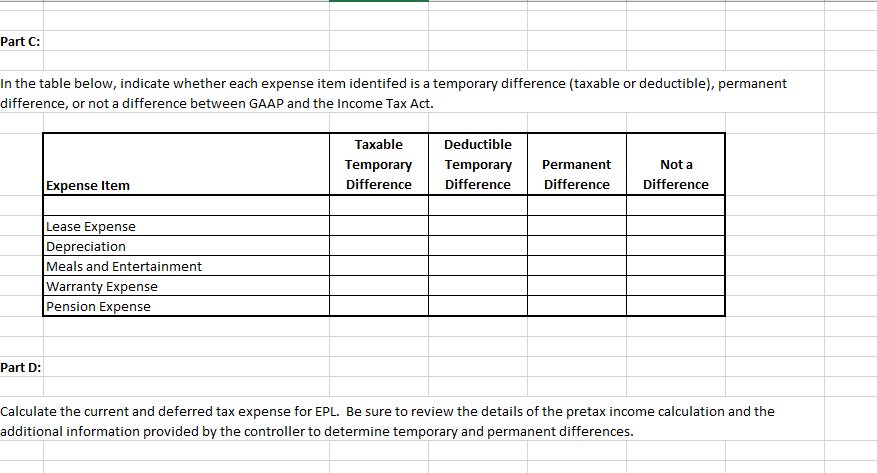

- The lease expense is related to a 3D printer that is being leased for two years for $34,525 per year. The printer has an expected useful life of five years. There is no provision in the lease that would ACCT 6011 W23, Assignment \#2: Chapters 18 to 20 and 22 allow EPL to purchase the printer. If purchased, the printer would cost $150,000. An excel template has been provided for you to complete this assignment. It can be found in the - Included in wages and benefits is accrued pension expense of $7,500. During the year the dropbox folder entitled, Assignment \#2. Once your assignment is complete please submit your company contributed $5,000 to its Defined Benefit plan (which was set up at the beginning of the work to the same dropbox folder. Assignment is due April 9th by 11:59pm. year). Eastern Publishers Ltd (EPL) is preparing its December 31, 2020 year-end financial statements. EPL has an average tax rate of 35% and an incremental borrowing rate of 10%. EPL follows ASPE. EPL focuses on corporate clients by binding and publishing corporate directories, policy manuals, and other large documents along with publishing short novels and books. This is the first year of operations, and a preliminary estimate of pre-tax net income has been calculated as follows: Refer to excel template provided for Required. You are working in EPL's accounting department and have been asked to prepare a preliminary estimate of the income tax expense. The current tax expense will not be paid until the next fiscal year. The controller of EPL provides you with the following few notes to help you get started: - The depreciation expense relates to a new machine that was acquired on January 1, 2020 for $5 million and has a useful life of 20 years. This machinery is included as class 43(30%) for CCA purposes. Note that the half-year rule is in effect for tax purposes. - EPL provides an assurance-type warranty on its book binding for corporate clients. Corporate clients can return their bound material over a two-year period if the glue breaks down. No books have been returned for rebinding during 2020; however, estimated expenses have been recognized in the current year. n the table below, indicate whether each expense item identifed is a temporary difference (taxable or deductible), permanent difference, or not a difference between GAAP and the Income Tax Act. - The lease expense is related to a 3D printer that is being leased for two years for $34,525 per year. The printer has an expected useful life of five years. There is no provision in the lease that would ACCT 6011 W23, Assignment \#2: Chapters 18 to 20 and 22 allow EPL to purchase the printer. If purchased, the printer would cost $150,000. An excel template has been provided for you to complete this assignment. It can be found in the - Included in wages and benefits is accrued pension expense of $7,500. During the year the dropbox folder entitled, Assignment \#2. Once your assignment is complete please submit your company contributed $5,000 to its Defined Benefit plan (which was set up at the beginning of the work to the same dropbox folder. Assignment is due April 9th by 11:59pm. year). Eastern Publishers Ltd (EPL) is preparing its December 31, 2020 year-end financial statements. EPL has an average tax rate of 35% and an incremental borrowing rate of 10%. EPL follows ASPE. EPL focuses on corporate clients by binding and publishing corporate directories, policy manuals, and other large documents along with publishing short novels and books. This is the first year of operations, and a preliminary estimate of pre-tax net income has been calculated as follows: Refer to excel template provided for Required. You are working in EPL's accounting department and have been asked to prepare a preliminary estimate of the income tax expense. The current tax expense will not be paid until the next fiscal year. The controller of EPL provides you with the following few notes to help you get started: - The depreciation expense relates to a new machine that was acquired on January 1, 2020 for $5 million and has a useful life of 20 years. This machinery is included as class 43(30%) for CCA purposes. Note that the half-year rule is in effect for tax purposes. - EPL provides an assurance-type warranty on its book binding for corporate clients. Corporate clients can return their bound material over a two-year period if the glue breaks down. No books have been returned for rebinding during 2020; however, estimated expenses have been recognized in the current year. n the table below, indicate whether each expense item identifed is a temporary difference (taxable or deductible), permanent difference, or not a difference between GAAP and the Income Tax Act