Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Less is More company manufactures swimsuits. The company is considering expanding to the bathrobe market. The project will last 6 years. The proposed

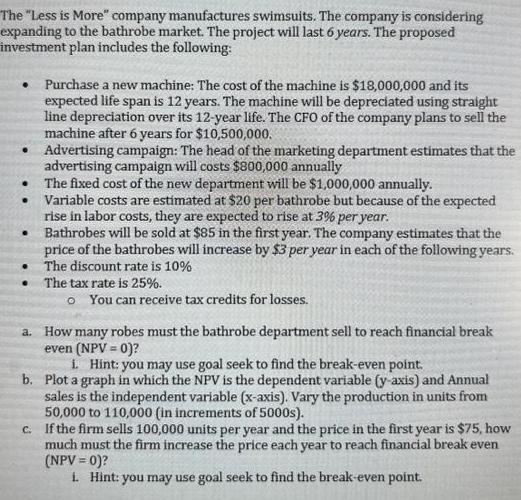

The "Less is More" company manufactures swimsuits. The company is considering expanding to the bathrobe market. The project will last 6 years. The proposed investment plan includes the following: Purchase a new machine: The cost of the machine is $18,000,000 and its expected life span is 12 years. The machine will be depreciated using straight line depreciation over its 12-year life. The CFO of the company plans to sell the machine after 6 years for $10,500,000. Advertising campaign: The head of the marketing department estimates that the advertising campaign will costs $800,000 annually The fixed cost of the new department will be $1,000,000 annually. Variable costs are estimated at $20 per bathrobe but because of the expected rise in labor costs, they are expected to rise at 3% per year. Bathrobes will be sold at $85 in the first year. The company estimates that the price of the bathrobes will increase by $3 per year in each of the following years. The discount rate is 10% The tax rate is 25%. o You can receive tax credits for losses. a. How many robes must the bathrobe department sell to reach financial break even (NPV = 0)? i. Hint: you may use goal seek to find the break-even point. b. Plot a graph in which the NPV is the dependent variable (y-axis) and Annual sales is the independent variable (x-axis). Vary the production in units from 50,000 to 110,000 (in increments of 5000s). c. If the firm sells 100,000 units per year and the price in the first year is $75, how much must the firm increase the price each year to reach financial break even (NPV = 0)? 1. Hint: you may use goal seek to find the break-even point.

Step by Step Solution

★★★★★

3.39 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the number of bathrobes the Bathrobe department must sell to reach financial breakeven NPV 0 we need to calculate the net present value NPV of the project and find the point wher...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started