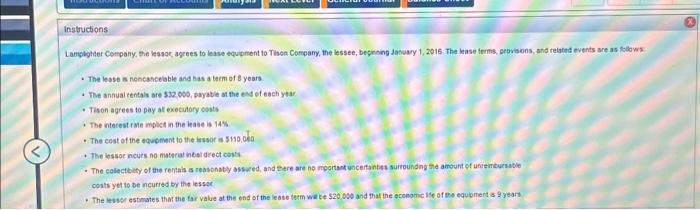

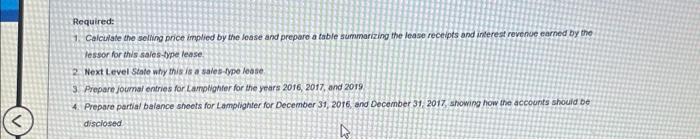

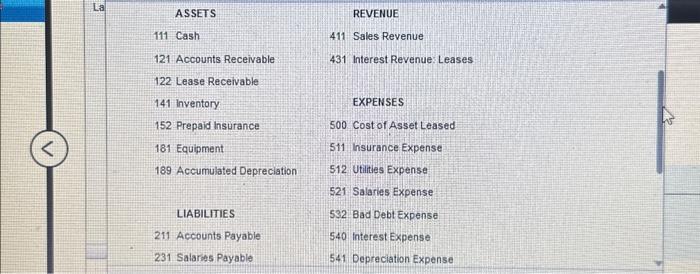

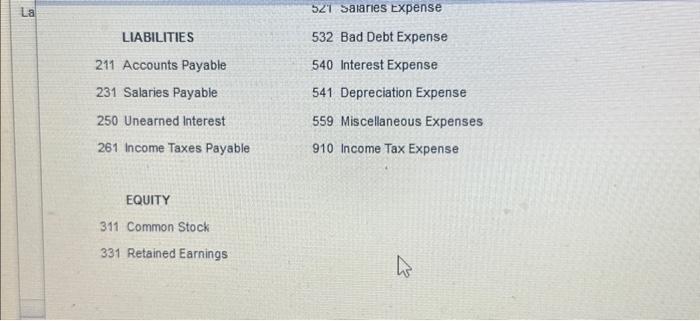

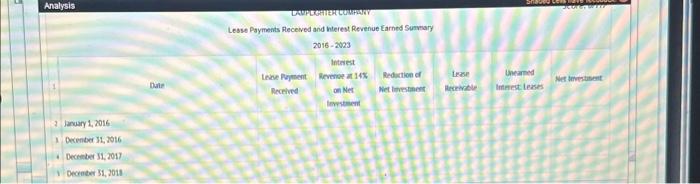

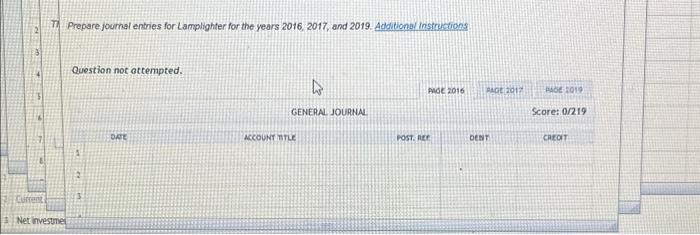

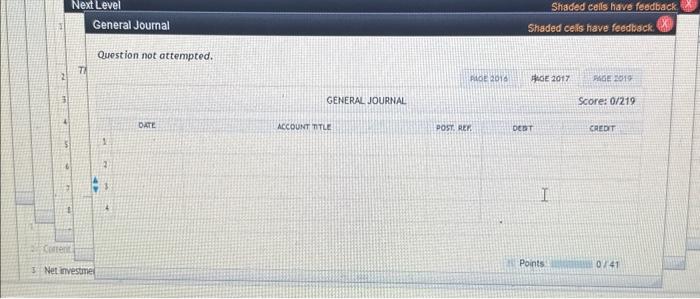

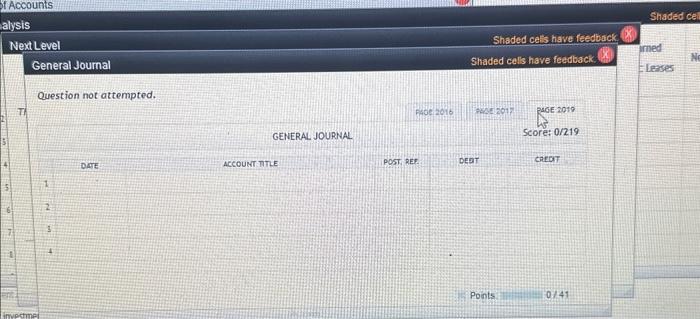

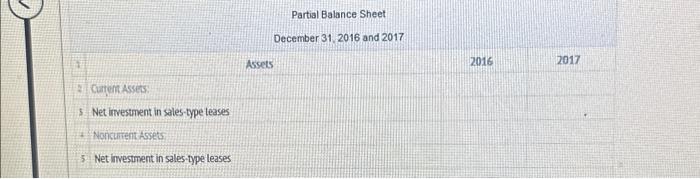

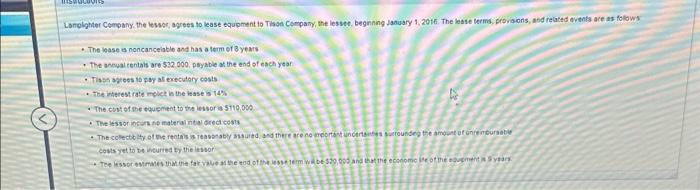

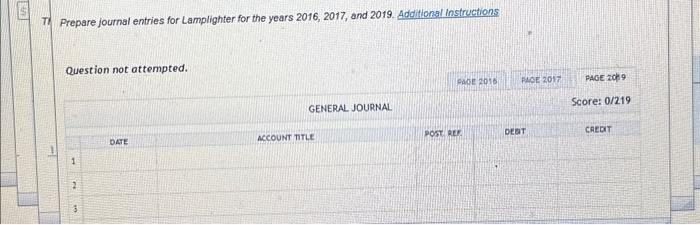

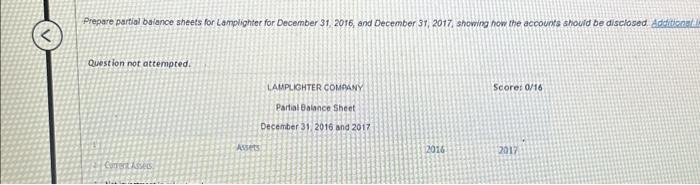

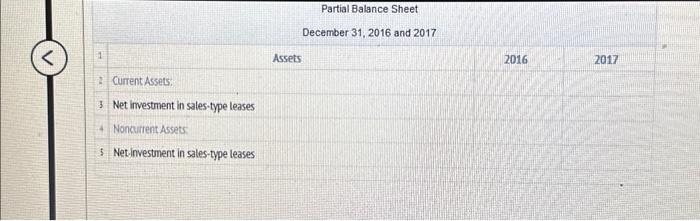

- The lesse a nencancesble and bas a term of 8 years - The annual rentala are 532000 , payatle st the esd of each year - Tison agrees to pay al executory costs - The interest rale mplact in the lease is 14% - The cest of the equement to the inssor a 5110,060 - The iessor ncurs no materat inesi drect covi - The colectelfy of the rentahs a reasphaby assuced, and Eere are np mpgrtant vacertantst surrounding the amourt of unienturatie conts yet to be ncurred by the lessec - The lesuer estinates that the far value at the end of the lease term wa ke $20,080 and that the ecenonic ise of mes equpmert 89 years Required: 1. Calculate the seling pnce inplied by the lease and prepare a table summarizing the lease receipts and inkerest revenue carned by the lessor for this saies-type lease. 2. Next Level state why this is a saies -ype lease 3. Prepare joumsl entries for Lampilghier for the years 2016, 2017, and 2019 4. Prepare partial balance sheets for Lampighter for December 31, 2016, and December 31, 2017, showing how the accounts should be disclosed La 521 Salaries txpense LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Interest 261 income Taxes Payable 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings Calculate the selling price implied by the lease. Analysis Lesse Payments Pleceived and hterest Revenue Earned Summary Date 20162023 2 Janary 1, 2016 1. Deienter 11, 2916 - Decerter 31.204? 1 Decreter 51, 2011 2 January 1,2016 1. December 31, 2016 4 December 31, 2017 5 December 31, 2018 4. Decenber 31, 2019 2. December 31, 2020 1 December 31, 2021 9. Decenber 31, 2022 12 December 31, 2023 Prepare joumsl entries for Lamplighter for the years 2016, 2017, and 2019 . Question not attempted. Quostion not attenpted. Question not attempted. Partial Balance Sheet December 31 . 2016 and 2017 Ascts 2016 2017 * Curtentasses: 5. Net irvectment in sales-type teases 4 Noncurtent Asets 3 Net invesment in sales-type leases Lonolghter Cempany the lesar, agrees to lease equpment io Tisan Cempany, the lesuee, begnnng danuary 1, 20t6. The lease lerms, provicions, asd related avtnts ace as folows The lease a noncanceiable and has a ferm ef 8 years The aneual rentals art $22,000, psyable at the end of each year Tissa sarees to pay al erecilary costs - The interest rate melet in the iease is 14% - The chtiof the equemient to the iessor as 5110.090 . The lessor ickens ne materaintal orect cosst costs yet to te incuried ty the iessor Required: 1. Calculate the selling price implied by the lease and prepare a table summarizing the lease receipts and interest revenue earned by the lessor for this sales-type lease. 2. Next Level State why this is a sales-type lease. 3. Prepare joumal entries for Lamplighter for the years 2016, 2017, and 2019 4. Prepsre partial balance sheets for Lampilghter for December 31, 2016, and December 31, 2017, showing how the accounta should be disciosed Calculate the selling price implied by the lease. Additional Instruction Question not attempted. Prepare journal entries for Lamplighter for the years 2016, 2017, and 2019. Question not attempted. Prepare journal entries for Lamplighter for the years 2016,2017, and 2019. Additional instructions Question not attempted. Prepare partial buiance sheets for Lamplighter for December 31, 2016, and December 31, 2017, showing how the accounts shourd be disciosed. 4 Partial Balance Sheet December 31,2016 and 2017 1 Assets 2016 2017 2. Cument Assets. 3. Net irvestment in sales-type leases Noncurrent Assets 5 Net-investment in sales-type leases - The lesse a nencancesble and bas a term of 8 years - The annual rentala are 532000 , payatle st the esd of each year - Tison agrees to pay al executory costs - The interest rale mplact in the lease is 14% - The cest of the equement to the inssor a 5110,060 - The iessor ncurs no materat inesi drect covi - The colectelfy of the rentahs a reasphaby assuced, and Eere are np mpgrtant vacertantst surrounding the amourt of unienturatie conts yet to be ncurred by the lessec - The lesuer estinates that the far value at the end of the lease term wa ke $20,080 and that the ecenonic ise of mes equpmert 89 years Required: 1. Calculate the seling pnce inplied by the lease and prepare a table summarizing the lease receipts and inkerest revenue carned by the lessor for this saies-type lease. 2. Next Level state why this is a saies -ype lease 3. Prepare joumsl entries for Lampilghier for the years 2016, 2017, and 2019 4. Prepare partial balance sheets for Lampighter for December 31, 2016, and December 31, 2017, showing how the accounts should be disclosed La 521 Salaries txpense LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Interest 261 income Taxes Payable 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings Calculate the selling price implied by the lease. Analysis Lesse Payments Pleceived and hterest Revenue Earned Summary Date 20162023 2 Janary 1, 2016 1. Deienter 11, 2916 - Decerter 31.204? 1 Decreter 51, 2011 2 January 1,2016 1. December 31, 2016 4 December 31, 2017 5 December 31, 2018 4. Decenber 31, 2019 2. December 31, 2020 1 December 31, 2021 9. Decenber 31, 2022 12 December 31, 2023 Prepare joumsl entries for Lamplighter for the years 2016, 2017, and 2019 . Question not attempted. Quostion not attenpted. Question not attempted. Partial Balance Sheet December 31 . 2016 and 2017 Ascts 2016 2017 * Curtentasses: 5. Net irvectment in sales-type teases 4 Noncurtent Asets 3 Net invesment in sales-type leases Lonolghter Cempany the lesar, agrees to lease equpment io Tisan Cempany, the lesuee, begnnng danuary 1, 20t6. The lease lerms, provicions, asd related avtnts ace as folows The lease a noncanceiable and has a ferm ef 8 years The aneual rentals art $22,000, psyable at the end of each year Tissa sarees to pay al erecilary costs - The interest rate melet in the iease is 14% - The chtiof the equemient to the iessor as 5110.090 . The lessor ickens ne materaintal orect cosst costs yet to te incuried ty the iessor Required: 1. Calculate the selling price implied by the lease and prepare a table summarizing the lease receipts and interest revenue earned by the lessor for this sales-type lease. 2. Next Level State why this is a sales-type lease. 3. Prepare joumal entries for Lamplighter for the years 2016, 2017, and 2019 4. Prepsre partial balance sheets for Lampilghter for December 31, 2016, and December 31, 2017, showing how the accounta should be disciosed Calculate the selling price implied by the lease. Additional Instruction Question not attempted. Prepare journal entries for Lamplighter for the years 2016, 2017, and 2019. Question not attempted. Prepare journal entries for Lamplighter for the years 2016,2017, and 2019. Additional instructions Question not attempted. Prepare partial buiance sheets for Lamplighter for December 31, 2016, and December 31, 2017, showing how the accounts shourd be disciosed. 4 Partial Balance Sheet December 31,2016 and 2017 1 Assets 2016 2017 2. Cument Assets. 3. Net irvestment in sales-type leases Noncurrent Assets 5 Net-investment in sales-type leases