Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The LMN partnership is owned by three equal (1/3) partners. Each partner has owned their respective interests since formation of the partnership. Each partner's

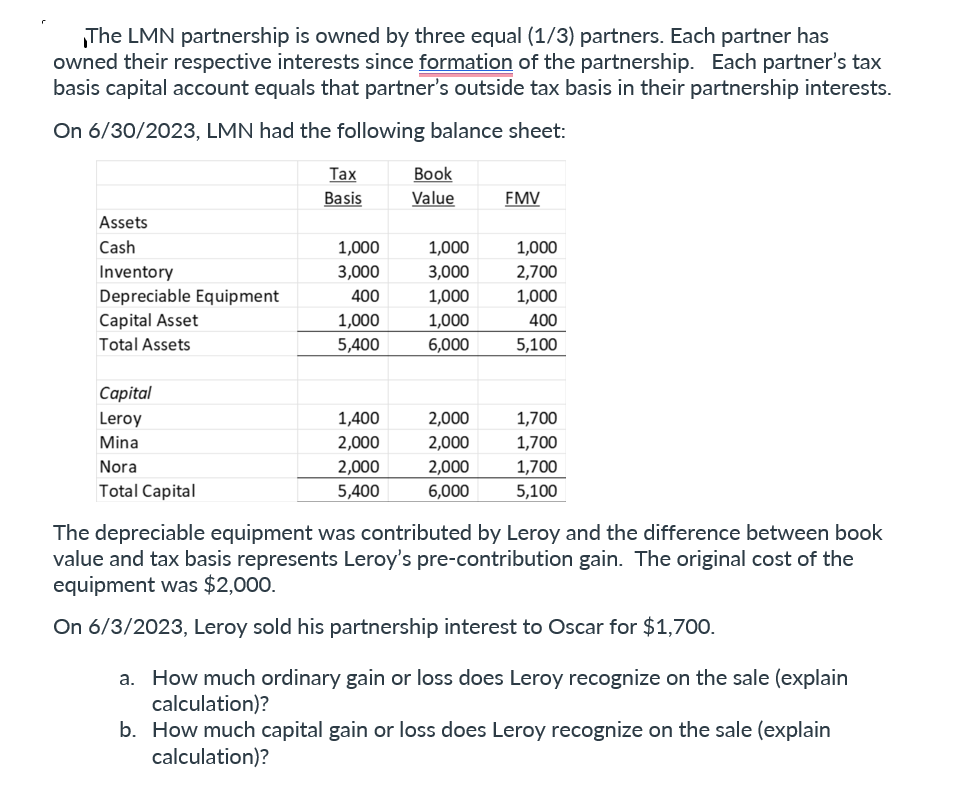

The LMN partnership is owned by three equal (1/3) partners. Each partner has owned their respective interests since formation of the partnership. Each partner's tax basis capital account equals that partner's outside tax basis in their partnership interests. On 6/30/2023, LMN had the following balance sheet: Tax Book Basis Value FMV Assets Cash 1,000 1,000 1,000 Inventory 3,000 3,000 2,700 Depreciable Equipment 400 1,000 1,000 Capital Asset 1,000 1,000 400 Total Assets 5,400 6,000 5,100 Capital Leroy Mina Nora Total Capital 1,400 2,000 1,700 2,000 2,000 1,700 2,000 2,000 1,700 5,400 6,000 5,100 The depreciable equipment was contributed by Leroy and the difference between book value and tax basis represents Leroy's pre-contribution gain. The original cost of the equipment was $2,000. On 6/3/2023, Leroy sold his partnership interest to Oscar for $1,700. a. How much ordinary gain or loss does Leroy recognize on the sale (explain calculation)? b. How much capital gain or loss does Leroy recognize on the sale (explain calculation)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing Leroys Gain on Partnership Interest Sale Understanding the Problem Leroya partner in the LMN partnershipsold his interest to OscarWe need to determine the amount of ordinary and capital gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started