Question

The Lobster Field is a small, onshore reservoir. The Field is currently producing 11,800 barrels of oil per day. The Operator is considering whether to

The Lobster Field is a small, onshore reservoir. The Field is currently producing 11,800 barrels of oil per day. The Operator is considering whether to work-over the producing wells in order to improve the performance of the field. The major impact of the work would be to improve productivity in the short term, but at the expense of production in the longer term. Some improvement in overall recovery is also expected.

The work-overs would cost $10 million and could be completed during 2005. As a result of the accelerated production, the field life is expected to be reduced by one year, with a saving of $2 million in fixed Opex in that year. Variable Opex, related to production amounts to about $1 per barrel.

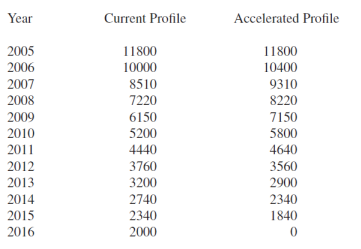

The current planned and accelerated production profiles are presented in following table:

using 2005 as Year 0)

Please advise the Operator whether to proceed with the planned investment. (Current policy of the Company is to assume an oil price of $20 dollars per barrel, constant in real terms over the life of the project. In this case, taxation and inflation effects are to be ignored

Kindly give answer in excel format and explained in word format.

Year Current Profile Accelerated Profile 2005 11800 11800 2006 10000 10400 2007 8510 9310 2008 7220 8220 2009 6150 7150 2010 5200 5800 2011 4440 4640 2012 3760 3560 2013 3200 2900 2014 2740 2340 2015 2340 1840 2016 2000 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started