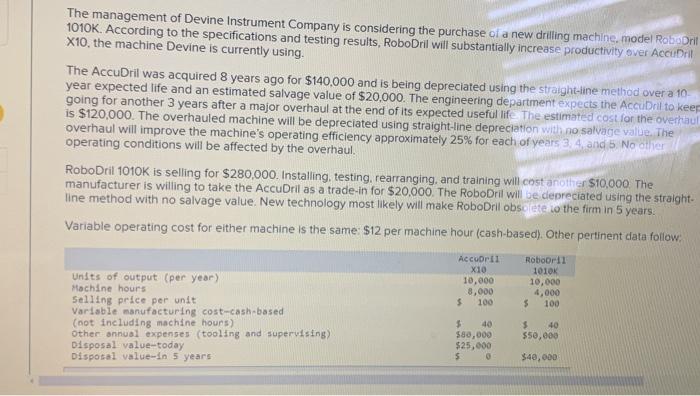

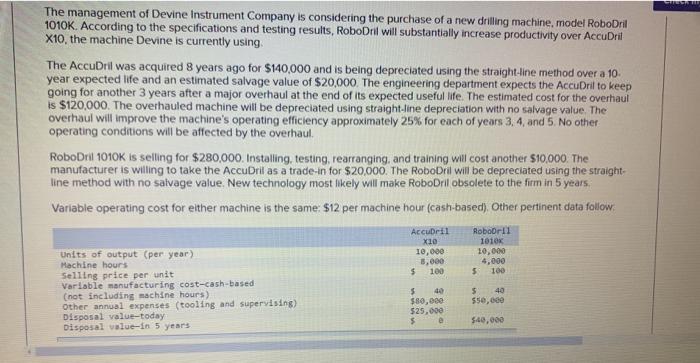

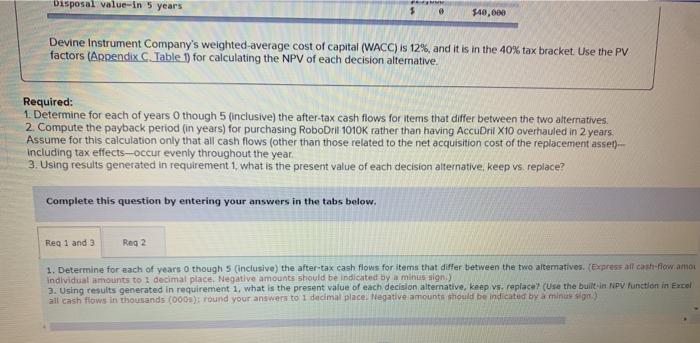

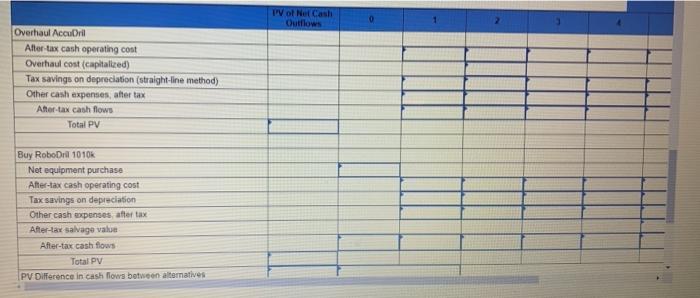

The management of Devine Instrument Company is considering the purchase of a new drilling machine, model Robodril 1010K. According to the specifications and testing results, RoboDrill will substantially increase productivity over Accu Drill X10, the machine Devine is currently using. The AccuDril was acquired 8 years ago for $140,000 and is being depreciated using the straight-line method over a 10 year expected life and an estimated salvage value of $20,000. The engineering department expects the Accuril to keep going for another 3 years after a major overhaul at the end of its expected useful life. The estimated cost for the overhaul is $120,000. The overhauled machine will be depreciated using straight-line depreciation with no salvage value. The overhaul will improve the machine's operating efficiency approximately 25% for each of years and b. No other operating conditions will be affected by the overhaul. RoboDril 1010K is selling for $280,000. Installing, testing, rearranging, and training will cost another $10,000 The manufacturer is willing to take the Accuril as a trade-in for $20,000. The RoboDrill will be depreciated using the straight- line method with no salvage value. New technology most likely will make RoboDrilobsoldte co the firm in 5 years. Variable operating cost for either machine is the same: $12 per machine hour (cash-based). Other pertinent data follow, AccoDril X10 10,000 8,000 $ Roboor 1010K 10,000 4,000 $ 100 100 Units of output (per year) Machine hours Selling price per unit Variable manufacturing cost-cash-based (not including machine hours) Other annual expenses (tooling and supervising) Disposal value-today Disposal value in 5 years $ 40 $80,000 $25,000 5 $ 40 $50,000 $40,000 The management of Devine Instrument Company is considering the purchase of a new drilling machine, model RoboDril 1010K. According to the specifications and testing results, RoboDrill will substantially increase productivity over Accu Drit X10, the machine Devine is currently using The Accutril was acquired 8 years ago for $140,000 and is being depreciated using the straight-line method over a 10 year expected life and an estimated salvage value of $20,000. The engineering department expects the AccuBril to keep going for another 3 years after a major overhaul at the end of its expected useful life. The estimated cost for the overhaul is $120,000. The overhauled machine will be depreciated using straight line depreciation with no salvage value. The overhaul will improve the machine's operating efficiency approximately 25% for each of years 3.4 and 5. No other operating conditions will be affected by the overhaul. RoboDril 1010K is selling for $280,000. Installing, testing, rearranging, and training will cost another $10,000. The manufacturer is willing to take the AccuDril as a trade-in for $20,000. The RoboDrill will be depreciated using the straight- line method with no salvage value. New technology most likely will make RoboDril obsolete to the firm in 5 years. Variable operating cost for elther machine is the same $12 per machine hour (cash-based), Other pertinent data follow Roboort Accur X10 10,000 3,000 $ 100 1010 10,000 4.000 5 100 Units of output (per year) Machine hours Selling price per unit Variable manufacturing cost-cash-based (not including machine hours) Other annual expenses (tooling and supervising) Disposal value-today Disposal value-in 5 years 5 40 $50,000 5 $80,000 $25,000 5 e $40,000 Disposal value in 5 years 5 $40,000 Devine Instrument Company's weighted-average cost of capital (WACC) is 12%, and it is in the 40% tax bracket. Use the PV factors (Appendix C Table 1) for calculating the NPV of each decision alternative. Required: 1. Determine for each of years though 5 (inclusive) the after-tax cash flows for items that differ between the two alternatives. 2. Compute the payback period (in years) for purchasing RoboDrill 1010K rather than having Accu Drie X10 overhauled in 2 years Assume for this calculation only that all cash flows (other than those related to the net acquisition cost of the replacement asset)- including tax effects-occur evenly throughout the year 3. Using results generated in requirement 1, what is the present value of each decision alternative, keep vs replace? Complete this question by entering your answers in the tabs below. Reg 1 and 3 Reg 2 1. Determine for each of years 0 though 5 (inclusive) the after-tax cash flows for items that differ between the two alternatives. Express all cash flow amou individual amounts to I decimal place. Negative amounts should be indicated by a minus sign) 3. Using results generated in requirement 1, what is the present value of each decision alternative, keep ve replace(Use the built-in NPV Munction in Excel all cash flows in thousands (0001): round your answers to 1 decimal place. Negative amounts should be indicated by a minu sign) IV of Net Cash Outflows Overhaul Accuri After-tax cash operating cost Overhaul cost capitalized) Tax savings on depreciation (straight-line method) Other cash expenses after tax After-tax cash flows Total PV Buy RoboDril 1010 Net equipment purchase After-tax cash operating cost Tax savings on depreciation Other cash expenses after tax After-tax salvage value After-tax cash flows Total PV PV Difference in cash flows between alternatives Req 1 and 3 Reg 2 Compute the payback period (in years) for purchasing RoboDril 1010K rather than having Accu Drill X10 overhauled in 2 years Assume for this calculation only that all cash flows (other than those related to the net acquisition cost of the replacement asset)-including tax effects-occur evenly throughout the year. (Round your answer to 1 decimal place.) Show less Payback period years