Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Fiona Co is considering the closure of one of its operations, department 3, and the financial accountant has submitted the following

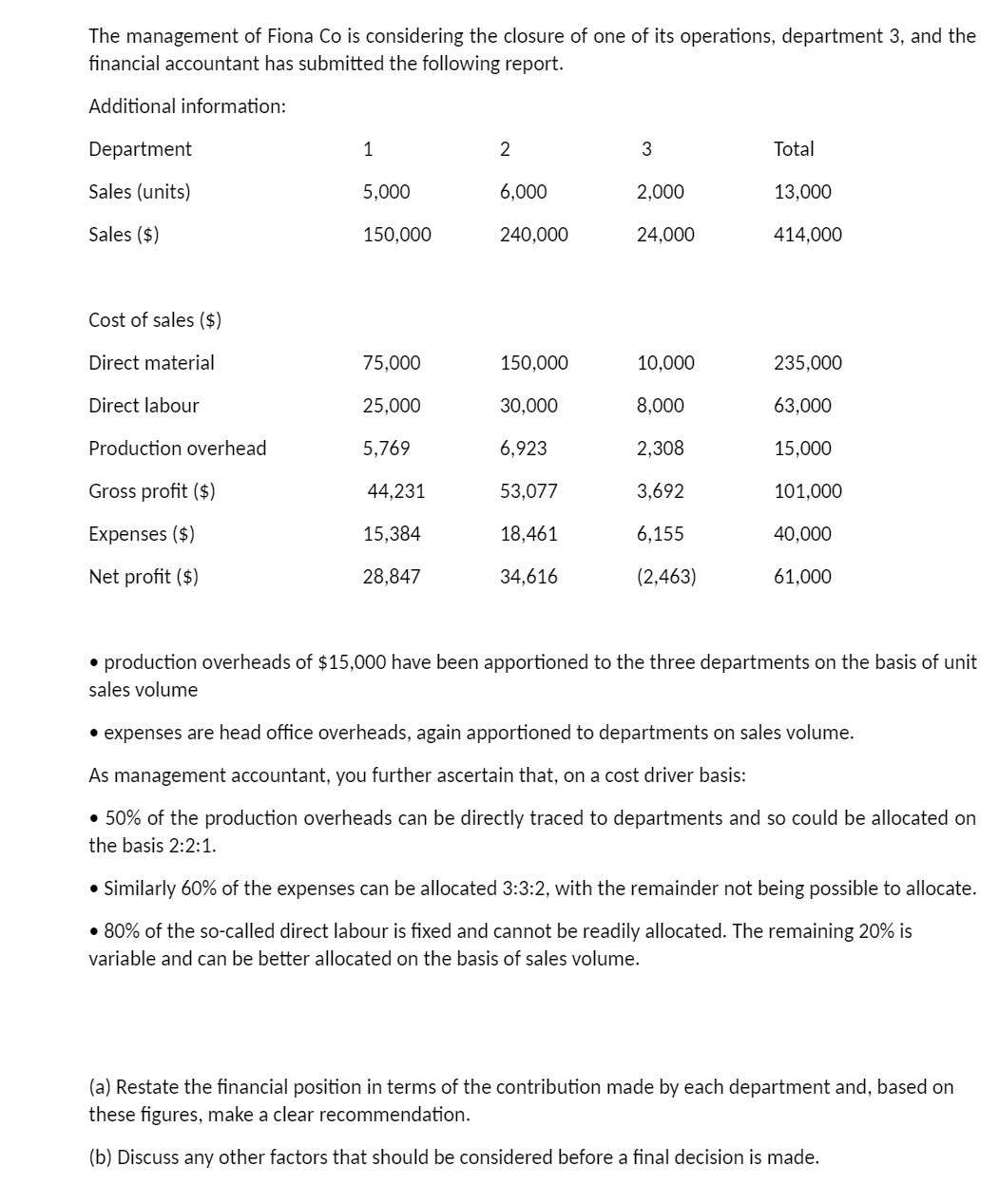

The management of Fiona Co is considering the closure of one of its operations, department 3, and the financial accountant has submitted the following report. Additional information: Department Sales (units) Sales ($) 1 2 3 Total 5,000 6,000 2.000 13,000 150,000 240,000 24,000 414,000 Cost of sales ($) Direct material 75,000 150,000 10,000 235,000 Direct labour 25,000 30,000 8,000 63,000 Production overhead 5,769 6,923 2,308 15,000 Gross profit ($) 44,231 53,077 3,692 101,000 Expenses ($) 15,384 18,461 6,155 40,000 Net profit ($) 28,847 34,616 (2,463) 61,000 production overheads of $15,000 have been apportioned to the three departments on the basis of unit sales volume expenses are head office overheads, again apportioned to departments on sales volume. As management accountant, you further ascertain that, on a cost driver basis: 50% of the production overheads can be directly traced to departments and so could be allocated on the basis 2:2:1. Similarly 60% of the expenses can be allocated 3:3:2, with the remainder not being possible to allocate. 80% of the so-called direct labour is fixed and cannot be readily allocated. The remaining 20% is variable and can be better allocated on the basis of sales volume. (a) Restate the financial position in terms of the contribution made by each department and, based on these figures, make a clear recommendation. (b) Discuss any other factors that should be considered before a final decision is made.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Restate the Financial Position To restate the financial position well need to separate fixed and variable costs and reallocate them based on the given cost drivers Heres the detailed breakdown Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started