Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Kingbird Inc., a small private company that uses the cost recovery impairment model, was discussing whether certain equipment should be written

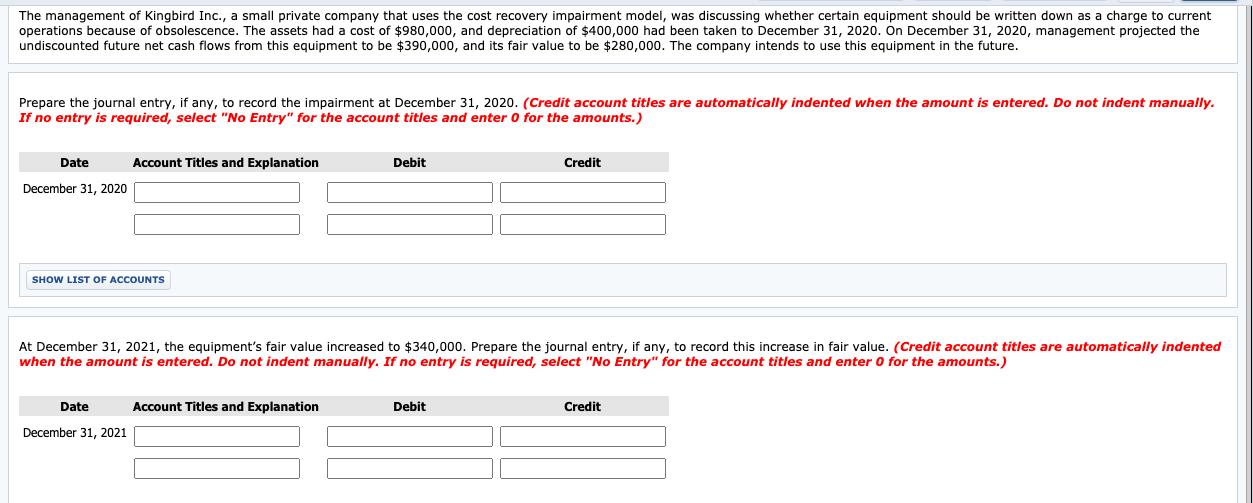

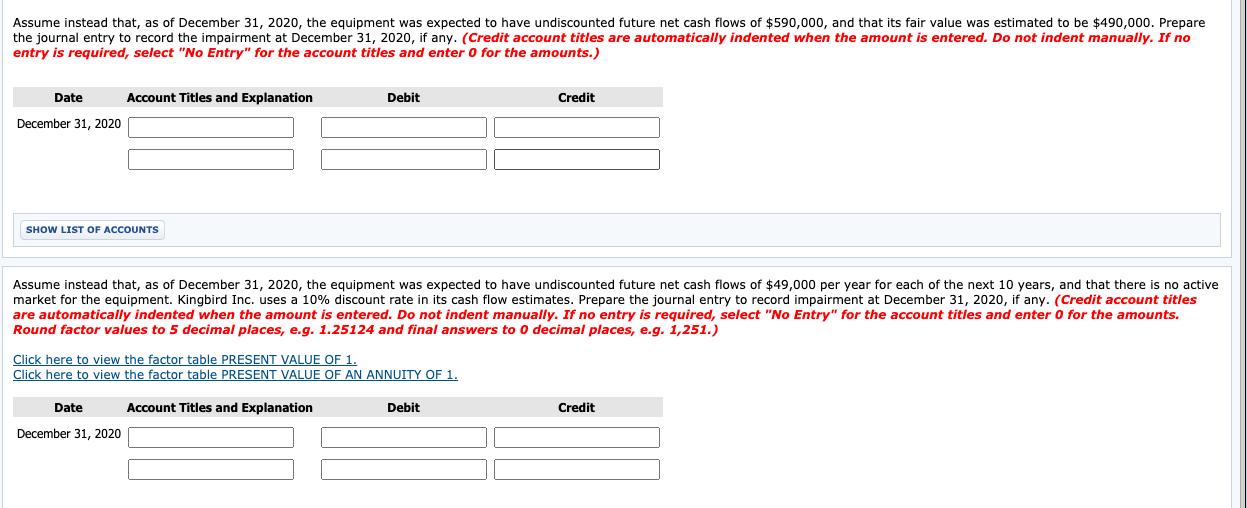

The management of Kingbird Inc., a small private company that uses the cost recovery impairment model, was discussing whether certain equipment should be written down as a charge to current operations because of obsolescence. The assets had a cost of $980,000, and depreciation of $400,000 had been taken to December 31, 2020. On December 31, 2020, management projected the undiscounted future net cash flows from this equipment to be $390,000, and its fair value to be $280,000. The company intends to use this equipment in the future. Prepare the journal entry, if any, to record the impairment at December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date December 31, 2020 SHOW LIST OF ACCOUNTS Account Titles and Explanation Date December 31, 2021 At December 31, 2021, the equipment's fair value increased to $340,000. Prepare the journal entry, if any, to record this increase in fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Debit Account Titles and Explanation Credit Debit Credit Assume instead that, as of December 31, 2020, the equipment was expected to have undiscounted future net cash flows of $590,000, and that its fair value was estimated to be $490,000. Prepare the journal entry to record the impairment at December 31, 2020, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date December 31, 2020 Account Titles and Explanation SHOW LIST OF ACCOUNTS Date December 31, 2020 Debit Assume instead that, as of December 31, 2020, the equipment was expected to have undiscounted future net cash flows of $49,000 per year for each of the next 10 years, and that there is no active market for the equipment. Kingbird Inc. uses a 10% discount rate in its cash flow estimates. Prepare the journal entry to record impairment at December 31, 2020, if any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round factor values to 5 decimal places, e.g. 1.25124 and final answers to 0 decimal places, e.g. 1,251.) Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Account Titles and Explanation Credit Debit Credit

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Question a December 31 2020 Loss on Impairment 300000 Accumulated Impairment LossesEquipment Equipme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started