Question

The management of Kunkel Company is considering the purchase of a $30,000 machine that would reduce operating costs by $6,500 per year. At the end

The management of Kunkel Company is considering the purchase of a $30,000 machine that would reduce operating costs by $6,500 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 12%.

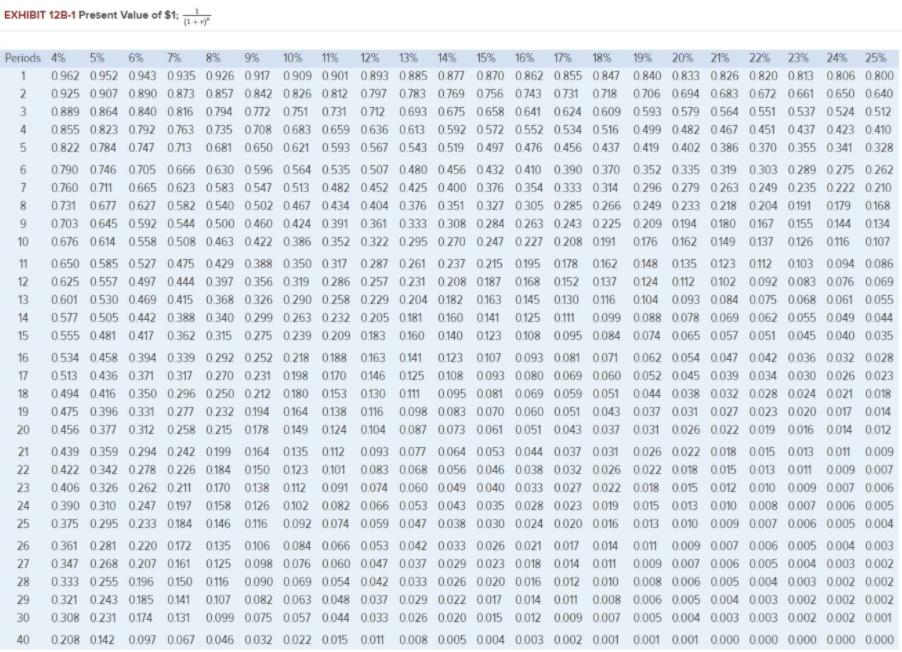

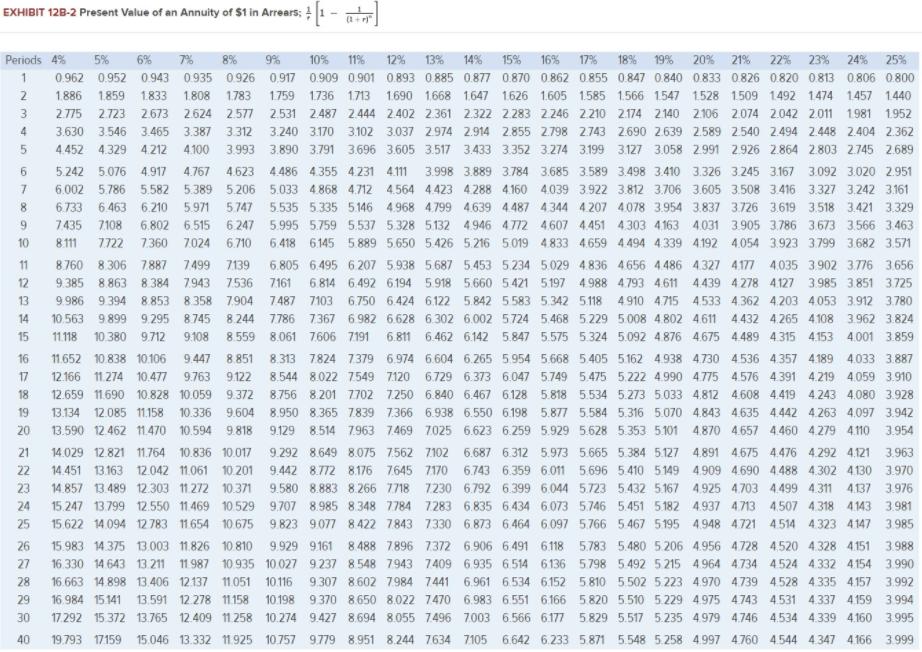

View Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the table.

1. Determine the net present value of the investment in the machine.

2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?

EXHIBIT 128-1 Present Value of $1: (1+ Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0926 0917 0909 0901 0.893 0885 0.877 0870 0862 0.855 0.847 0.840 0.833 0826 0820 0.813 0806 0.800 0.925 0.907 0890 0873 0857 0.842 0826 0812 0797 0783 0769 0756 0743 0731 0718 0.706 0.694 0.683 0.672 0.661 0650 0640 3. 0 889 0864 0 840 0816 0794 0772 0.751 0731 0712 0693 0675 0658 0641 0624 0609 0593 0.579 0.564 0551 0537 0524 0512 0855 0823 0792 0.763 0735 0.708 0683 0659 0636 0613 0.592 0572 0552 0.534 0516 0.499 0.482 0 467 0451 0437 0423 0410 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0476 0.456 0437 0.419 0.402 0.386 0.370 0.355 0341 0.328 0790 0.746 0 705 0666 0630 0.596 0564 0535 0507 0480 0456 0432 0410 0390 0370 0352 0.335 0.319 0303 0.289 0275 0.262 7. 0760 0.711 0.665 0623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0376 0.354 0333 0314 0.296 0.279 0.263 0249 0.235 0222 0210 8. 0.731 0.677 0627 0.582 0540 0.502 0467 0434 0404 0376 0351 0327 0305 0.285 0.266 0.249 0.233 0.218 0204 0191 0179 0168 6. 0.703 0645 0.592 0544 0500 0.460 0424 0391 0.361 0333 0.308 0 284 0.263 0.243 0225 0.209 0.194 0180 0167 0155 0144 0134 10 0.676 0614 0.558 0.508 0.463 0.422 0386 0.352 0.322 0295 0270 0247 0227 0.208 0191 0176 0.162 0149 0137 0.126 0116 0107 11 0650 0585 0527 0.475 0429 0.388 0350 0317 0287 0261 0237 0215 0195 0178 0162 0148 0135 0123 012 0103 0.094 0.086 12 0625 0557 0497 0444 0.397 0.356 0319 0.286 0257 0231 0.208 0187 0168 0152 0137 0124 012 0102 0092 0.083 0076 0069 13 0.601 0530 0469 0.415 0.368 0326 0290 0.258 0229 0204 0182 0.163 0145 0130 0116 0104 0.093 0084 0.075 0.068 0.061 0055 14 0577 0.505 0442 0.388 0340 0.299 0263 0.232 0205 0181 0160 0141 0125 0.111 0099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 15 0.555 0481 0417 0.362 0315 0275 0239 0.209 0183 0160 0140 0123 0108 0095 0.084 0074 0.065 0.057 0.051 0.045 0.040 0035 16 0534 0458 0.394 0.339 0 292 0 252 0 218 0188 0163 0141 0123 0.107 0093 0.081 0071 0.062 0.054 0.047 0.042 0036 0032 0.028 17 0.513 0436 0371 0.317 0270 0231 0198 0170 0146 0125 0108 0.093 0080 0069 0060 0.052 0.045 0.039 0034 0.030 0026 0023 18 0.494 0416 0.350 0296 0250 0.212 0180 0.153 0130 0111 0.095 0.081 0069 0.059 0.051 0.044 0.038 0.032 0028 0.024 0021 0.018 19 0.475 0396 0.331 0277 0.232 0.194 0164 0138 0116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 20 0456 0.377 0.312 0258 0215 0178 0149 0124 0104 0.087 0073 0.061 0051 0.043 0.037 0031 0.026 0.022 0019 0.016 0.014 0,012 21 0439 0359 0.294 0242 0.199 0.164 0135 0112 0093 0077 0064 0.053 0.044 0037 0031 0.026 0.022 0018 0.015 0.013 0.011 0.009 22 0422 0.342 0.278 0226 0184 0150 0123 0101 0.083 0068 0.056 0.046 0038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 007 23 0.406 0326 0.262 0.211 0170 0138 0112 0091 0.074 0060 0049 0.040 0033 0027 0022 0018 0.015 0.012 0.010 0.009 0.007 0.006 24 0390 0310 0247 0197 0158 0126 0102 0.082 0066 0053 0043 0.035 0028 0.023 0.019 0015 0.013 0.010 0.008 0.007 0006 0.005 25 0375 0295 0.233 0184 0146 0116 0.092 0074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 26 0 361 0281 0220 0172 0135 0106 0084 0.066 0.053 0042 0033 0.026 0021 0017 0014 0.011 0.009 0.007 0006 0.005 0.004 0.003 27 0347 0268 0.207 0161 0125 0.098 0076 0060 0.047 0037 0029 0.023 0018 0014 0.01 0.009 0.007 0.006 0.005 0.004 0.003 0.002 28 0.333 0255 0196 0150 0116 0.090 0069 0.054 0.042 0033 0026 0.020 0016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0,002 29 0.321 0.243 0185 0141 0107 0.082 0.063 0048 0.037 0029 0022 0.017 0.014 0011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 30 0308 0231 0.174 0.131 0.099 0.075 0.057 0.044 0033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 40 0 208 0142 0.097 0067 0.046 0.032 0022 0.015 0.011 0008 0005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 000

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Initial investment 30000 Annual net cash flow 65...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

604724e2abc90_74473.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started